Remember, though, that the tax exemption only applies to unemployment benefits received in 2020. The tax break is for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during 2020.

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Will there be a tax break for the unemployed in 2022?

When to expect unemployment tax break refund california. If you claimed unemployment last year but filed your taxes before the new $10,200 unemployment tax break was announced, the irs says you can expect an automatic refund starting in may, if you qualify. It’s currently $750 until early september. When to expect a refund for your $10200 unemployment tax break.

So california owes me about 6.00. The irs is expected to continue working through the tax returns backlog for the rest of summer at least, meaning that it. The american rescue plan, which included the tax exclusion on up to $10,200 of unemployment benefits received in 2020 per person, was passed.

Refunds should be hitting mail boxes and bank accounts — however you normally receive tax refunds — within the next couple of weeks. There’s just one problem — those refunds won’t be coming until may, and some may not reach recipients until the summer. Irs unemployment tax refund details still to be determined.

As for how much cash one can expect to receive, current refund estimates are suggesting that for single taxpayers who are eligible for the $10,200 tax break and fit into the 22 percent tax bracket. How to buy tax lien certificates in california. How to calculate your unemployment benefits tax refund.

You don’t need to do anything. While the internal revenue service has already confirmed that the child tax credit will start landing in eligible bank accounts on july 15, the exact timeline of the unemployment tax refunds appears to be still up in the air. Filed or will file your 2020 tax return after march 11, 2021 and:

The irs will begin in may to send tax refunds in two waves to those who benefited from the $10,200 unemployment tax break for claims in 2020. The irs is still in the process of working through a backlog of tax returns, meaning that there will be delays for unemployment benefits recipients waiting for a refund. The tax waiver led to some confusion, given it was.

We’re still unclear as to how to contact the irs. We will make the changes for you. Now, the agency's website informs taxpayers to expect refunds on their unemployment taxes beginning this may for anyone who filed before the waiver was established and therefore overpaid on.

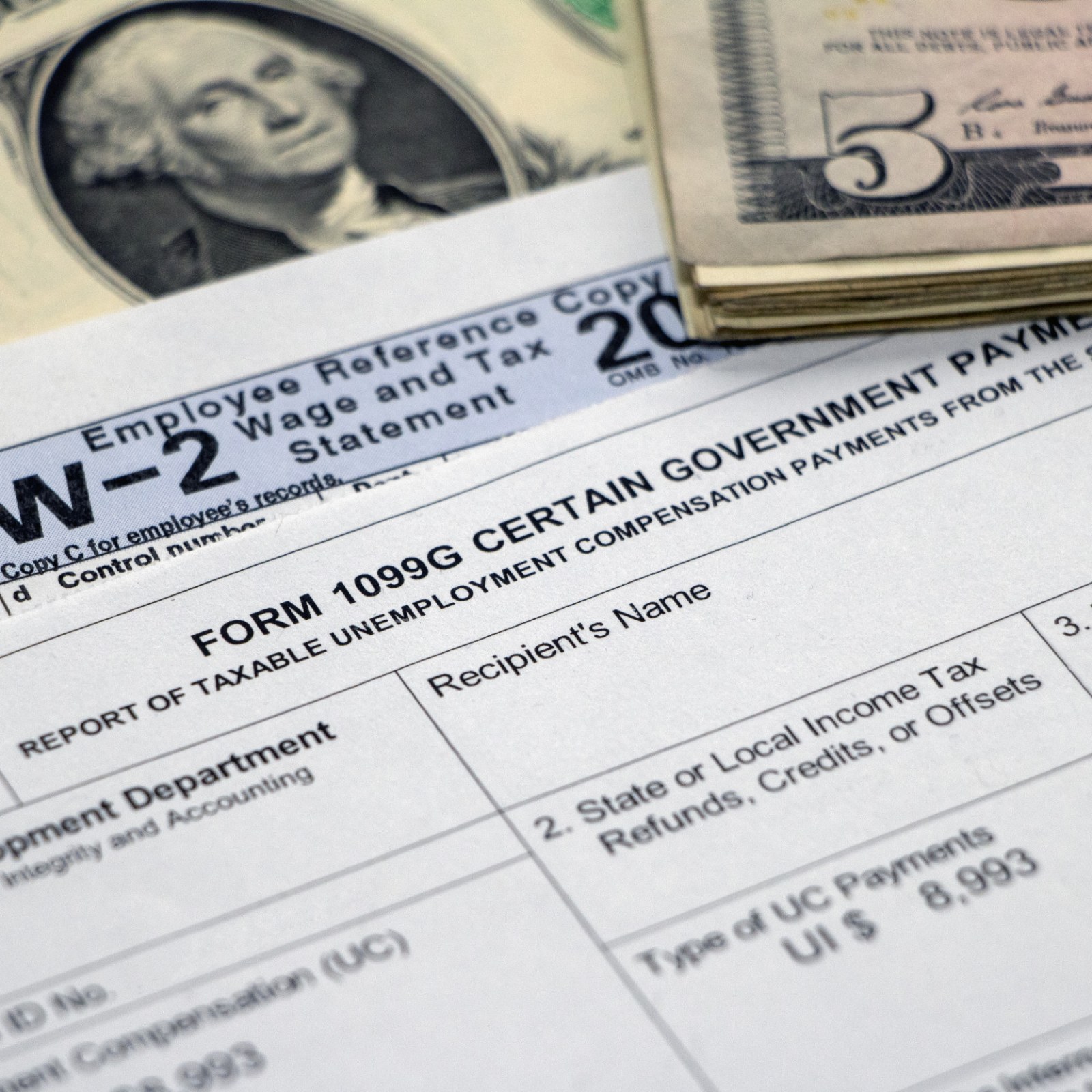

The $10,200 is the amount of income exclusion for single filers, not the amount of the refund. The tax break is only for those who earned less than $150,000 in adjusted gross income and for unemployment insurance received during the pandemic in 2020. Sadly, you can't track the cash in the way you can track other tax refunds.

Who will get it first? Filed your 2020 tax return before march 11, 2021 and: So, if you receive unemployment compensation in 2021.

When to expect unemployment tax break refund: The exemption does not apply to. Unfortunately, another tax break for unemployed people is unlikely to come to fruition in 2022.

The irs is to send tax refunds in two waves to those who benefited from the $10,200 unemployment tax. In california, the maximum weekly amounts varied during 2020. The timings aren't confirmed yet, but the refunds are expected to go out from this month and carry on throughout the summer.

These letters are sent out within 30 days of a correction being made and will tell you if you'll get a refund, or if the cash was used to offset debt. And since many americans need their refunds as soon as possible, that’s just not ideal. The federal portion is green, but state has been processing since this bill passed.

If you claimed unemployment last year but filed your taxes before the new $10,200 unemployment tax break was announced, the irs says you can expect an automatic refund starting in may, if you qualify. Another way is to check your tax. The tax waiver led to some confusion, given it was announced in the middle of tax season, prompting the irs to offer additional guidance on how to claim iteven if filed your 2020 tax.

Tax refund q and a The irs has provided some information on its website about taxes and unemployment compensation. One way to know if a refund has been issued is to wait for the letter that the irs is sending taxpayers whose returns are corrected.

At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. Those letters, issued within 30 days of the adjustment, will. After the unemployment tax break relief bill passed, my federal went up by 3k extra and state went down about 6.00.

If you don’t have that, it likely means the irs hasn’t gotten to your return yet. What you’re looking for is an entry listed as refund issued, and it should have a date in late may or june. Rather, the irs will issue refunds automatically to those who were entitled to that tax break but didn’t account for it.

If you qualify for a bigger tax refund, you’ll receive it beginning august 2021.

Unemployment Tax Refunds Irs Says Millions Will Receive One - Mahoning Matters

Q A The 10200 Unemployment Tax Break Abip

If You Were On Unemployment Last Year Youll Probably Get A Tax Break - Marketplace

When Will Unemployment Tax Refunds Be Issued 9newscom

Irs To Start Sending 10200 Unemployment Benefit Tax Refunds In May

How Many Americans Could Receive An Unemployment Tax Break This Year - Ascom

When To Expect Unemployment Tax Break Refund Who Will Get It First - Ascom

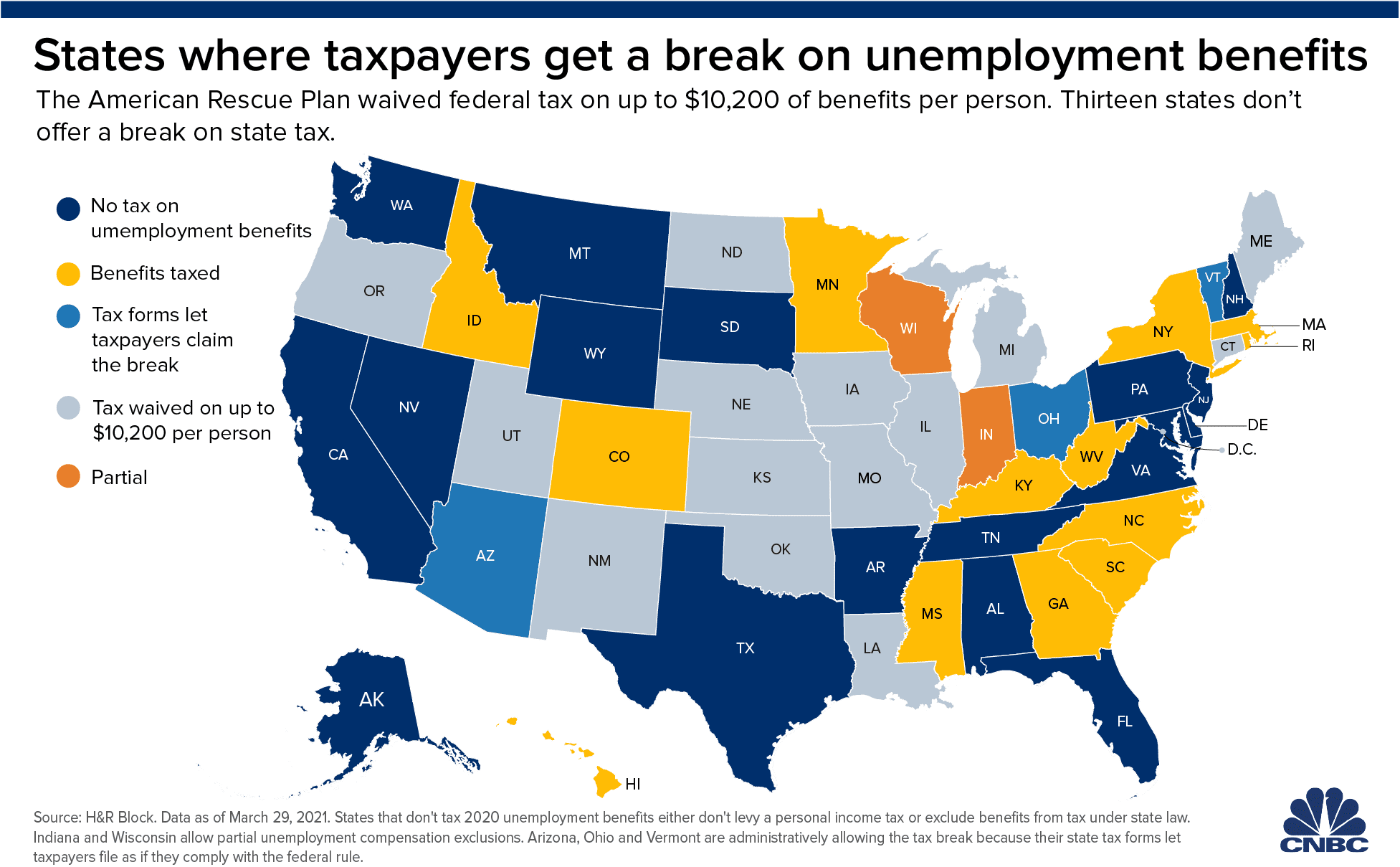

10200 Unemployment Tax Break 13 States Arent Giving The Waiver

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

Irs Refunds Will Start In May For 10200 Unemployment Tax Break

Unemployment Update - How To Get 10200 Unemployment Tax Free Step By Step - Youtube

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs 10200 Unemployment Compensation Tax Break Likely Claimed Without Filing Amended Return

Hr Block - Good News Up To 10200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs - Ascom

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Irs Refunds Will Start In May For 10200 Unemployment Tax Break

No 10200 Unemployment Tax Break In 13 States Could Mean Higher Taxes