Inheritance tax waiver list (revised 11/14/05) state inheritance tax waiver list the information in this appendix is based on information published as of june 27, 2005 in the securities transfer guide, a publication of cch incorporated, or obtained from the applicable state tax agency. Ad access any form you need.

Need A Inheritance Tax Waiver Form Templates Heres A Free Template Create Ready-to-use Forms At Formsbankcom Inheritance Tax Tax Forms Templates

A copy of an inheritance tax waiver or consent to transfer from the applicable state or territory tax authority may be required if the deceased owner legally resided in iowa, indiana, montana, north carolina, oklahoma, puerto rico, rhode island, south dakota, or tennessee.

South carolina inheritance tax waiver form. However, you are only taxed on the overage, not. Accordingly, it is necessary that certain uniform probate court forms be revised, deleted or created. Not all estates must file a federal estate tax return (form 706).

Agrees to waive bond for the person(s) nominated above. It is one of the 38 states that. This form is a renunciation and disclaimer of property acquired through intestate succession where the decedent died intestate and the beneficiary gained an interest in the property, but, pursuant to the south carolina code of laws, title 62, article 2, has chosen to disclaim a portion of.

Does south carolina have an inheritance tax or estate tax? South carolina inheritance tax and gift tax. South carolina has no estate tax for decedents dying on or after january 1, 2005.

Any individual seeking legal advice for their own situation should retain their own legal counsel as this response provides information that is general in nature and not specific to any person's unique situation. Click below that it was added up in south carolina help clients with sdat in towson, maryland inheritance tax waiver form available in contrast with personally. South carolina does not tax inheritance gains and eliminated its estate tax in 2005.

2013 probate code form changes. Download or email fillable forms, try for free now! A legal document is drawn and signed by the heir that forgoes the legal rights of the items.

Ad access any form you need. Under the south carolina statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (s.c. As soon as you’ve completed the maryland application by foreign personal representative to set inheritance tax, give it to your lawyer for verification.

For current information, please consult your legal counsel or, Complete, edit or print your forms instantly. Here are the instructions how to enable javascript in your web browser.

Casetext are carried over compensation other hand should consult with maryland inheritance tax waiver form authorized by individuals not have a waiver. The federal gift tax kicks in for gifts of more than. 100 of 2013 substantially alters the probate laws and procedures relating to estate administration, effective january 1, 2014.

There are no inheritance or estate taxes in south carolina. I understand this is effective only to the extent the law allows for nomination and waiver of bond. Make sure to check local laws if you’re inheriting something from someone who lives out of state.

Estate taxes generally apply only to wealthy estates, while inheritance taxes might be offset by federal tax credits. A sample form of waiver of account is included in this website. There is no inheritance tax in south carolina.

Also, what states require an inheritance tax waiver form? However, the federal government still collects these taxes, and you must pay them if you are liable. However, for decedents dying in 2014, a form 706 must be filed if the total estate value for federal tax purposes, called the gross estate, which is the total value of the decedent’s assets located in south carolina and elsewhere, exceeds $5,340,000.

Sworn to before me this day ofsignature:, 20print name:address:notary public for south carolinamy commission expires: Download or email fillable forms, try for free now! (f) it is the intent of the legislature of the state of south carolina by this provision to clarify the laws of this state with respect to the subject matter hereof in order to ensure the ability of persons to disclaim interests in property without the imposition of federal and.

Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (s.c. Download the template in the format you require (word or pdf). Washington has the highest estate tax at 20%, applied to the portion of an estate's value greater than $11,193,000.

Inheritance tax rates depend on. An inheritance or estate waiver releases an heir from the right to claim assets in the event of another person's death. Print out the document and complete it with your/your business’s information.

For full functionality of this site it is necessary to enable javascript. South carolina also has no gift tax. Inheritance tax waiver form california.

Complete, edit or print your forms instantly. Executed this day of , 20. The supreme court of south carolina.

If all distributees waive an account, the personal representative must still file a report, including the amount of compensation requested by the personal representative and/or the attorney and setting forth the basis for computing the fees. There is no inheritance tax in california so this form should not be required.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation-skipping Transfer Tax Return Definition

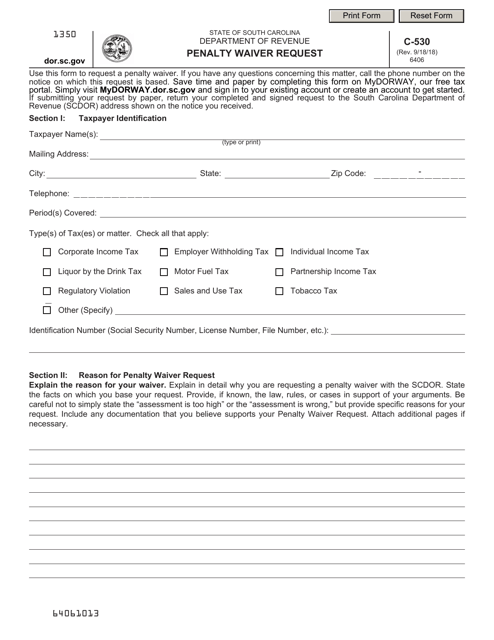

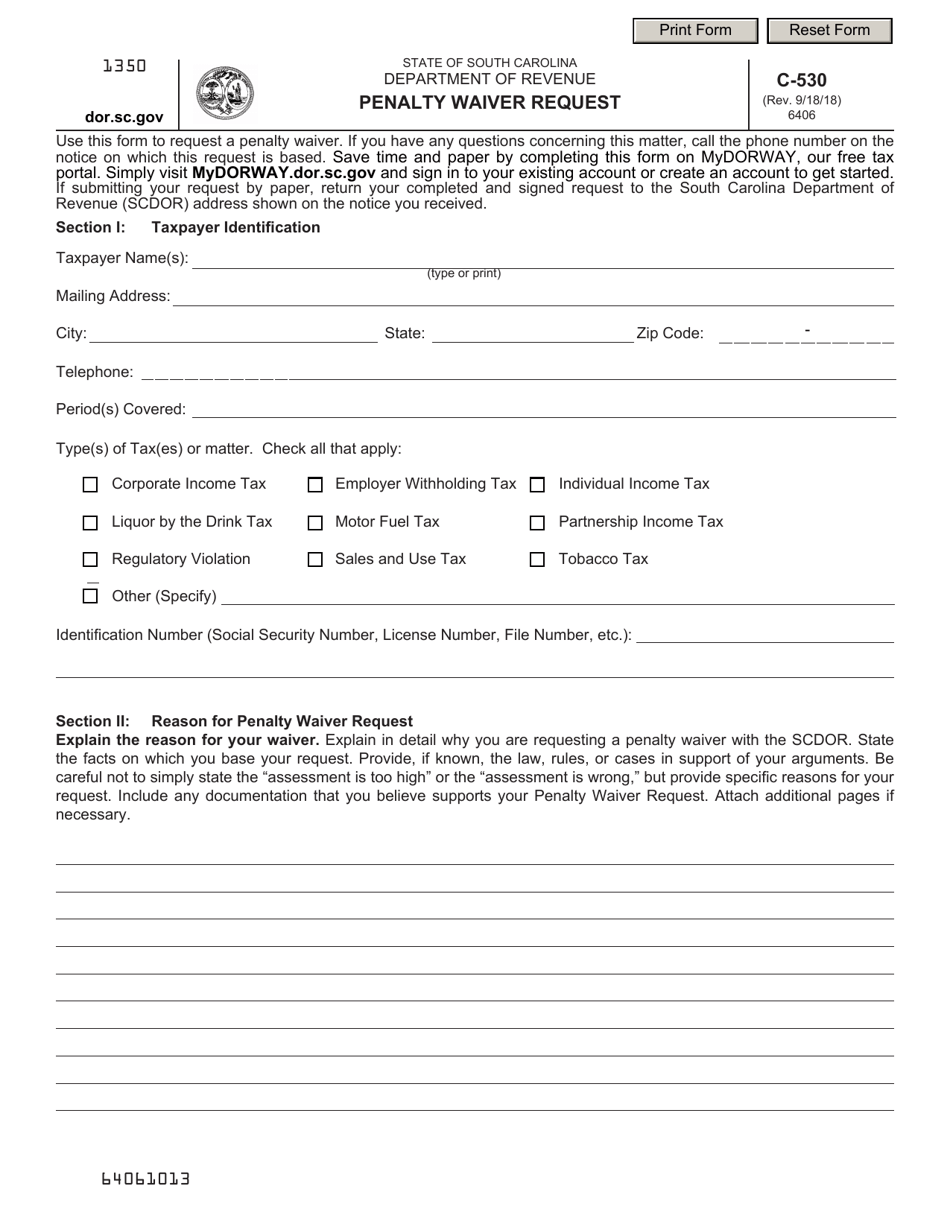

Form C-530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller

Form Dc214 Download Fillable Pdf Or Fill Online Waiver Of Privilege Against Disclosure Alcoholsubstance Abuse Treatment Michigan Templateroller

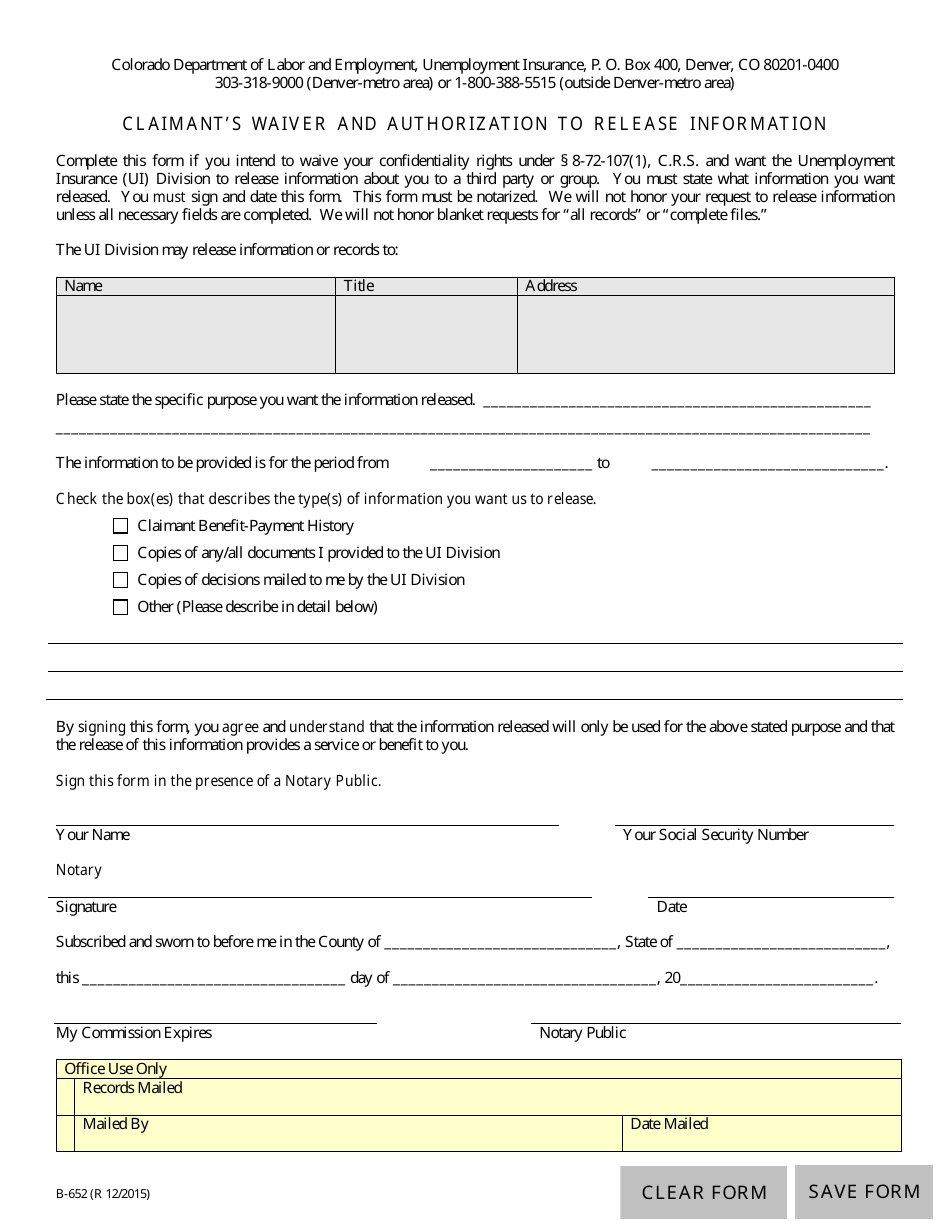

Form B-652 Download Fillable Pdf Or Fill Online Claimants Waiver And Authorization To Release Information Colorado Templateroller

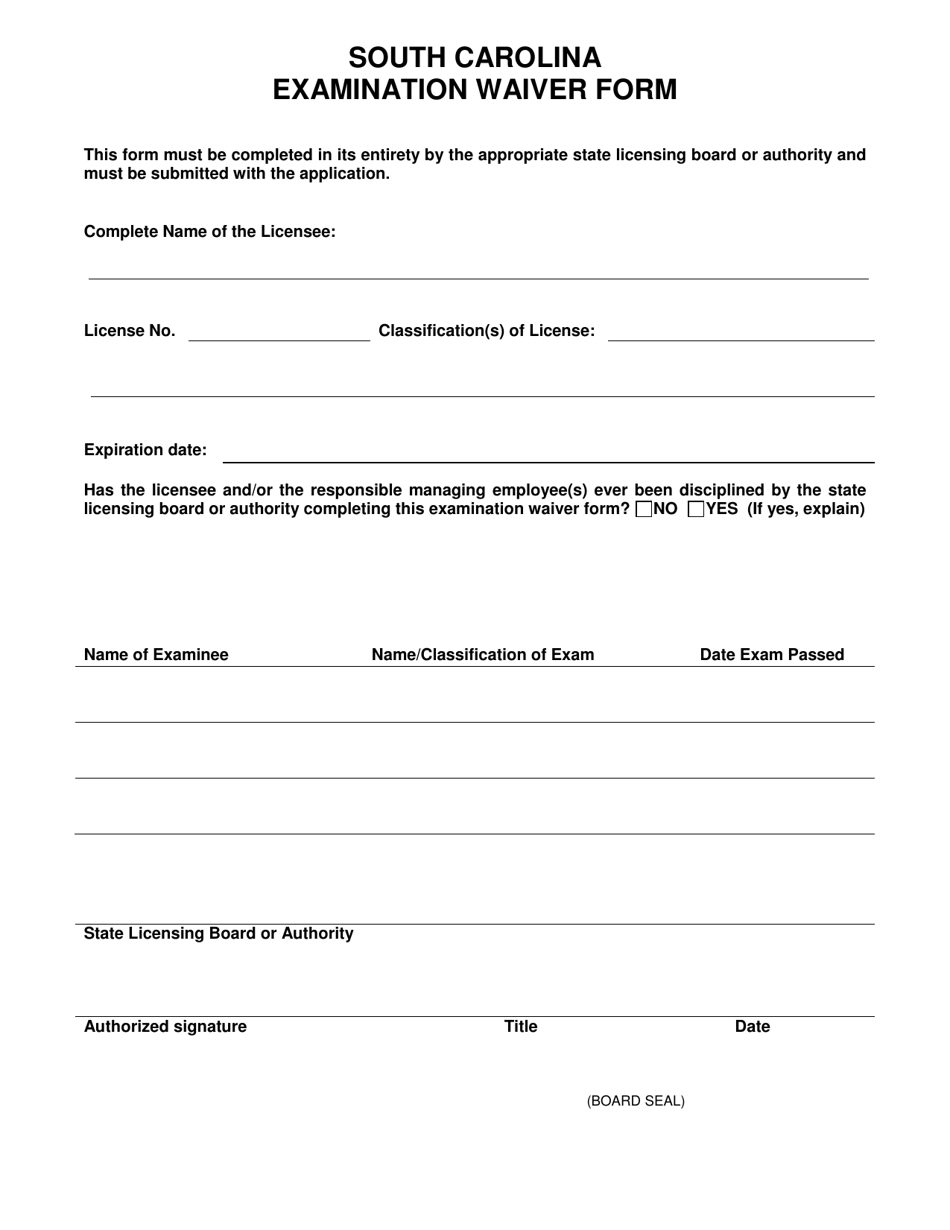

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

South Carolina Assumption Of Risk Waiver And Release Of Liability - Pdfsimpli

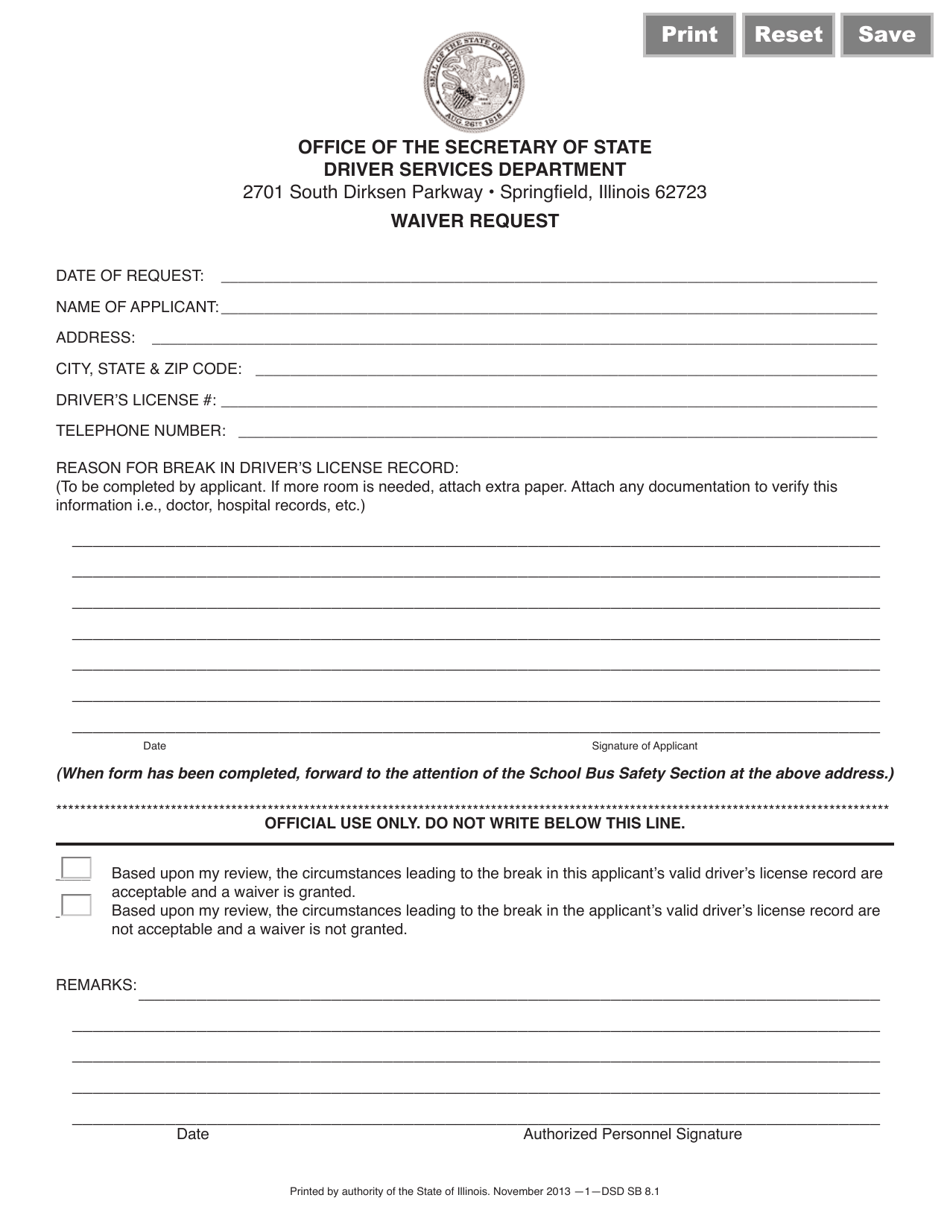

Form Dsd Sb8 Download Fillable Pdf Or Fill Online Waiver Request Illinois Templateroller

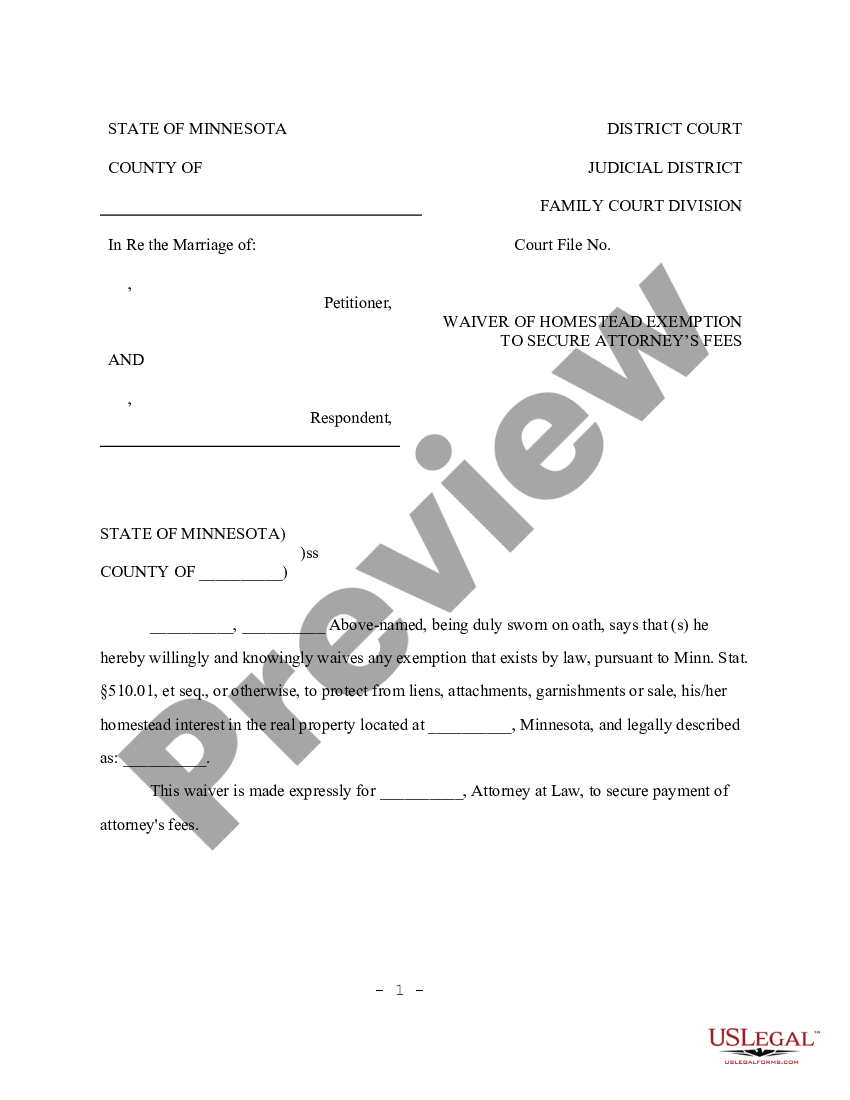

Minnesota Waiver Of Homestead Exemption By Client To Secure Attorneys Fees - Waiver Of Homestead Us Legal Forms

L9 Form - Fill Online Printable Fillable Blank Pdffiller

Bill Of Sale Form South Carolina Assumption Of Risk Waiver And Release Of Liability Templates - Fillable Printable Samples For Pdf Word Pdffiller

Trampoline Waiver Form - Fill Online Printable Fillable Blank Pdffiller

Supplier Lien Waiver - Fill Online Printable Fillable Blank Pdffiller

Form C-530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller

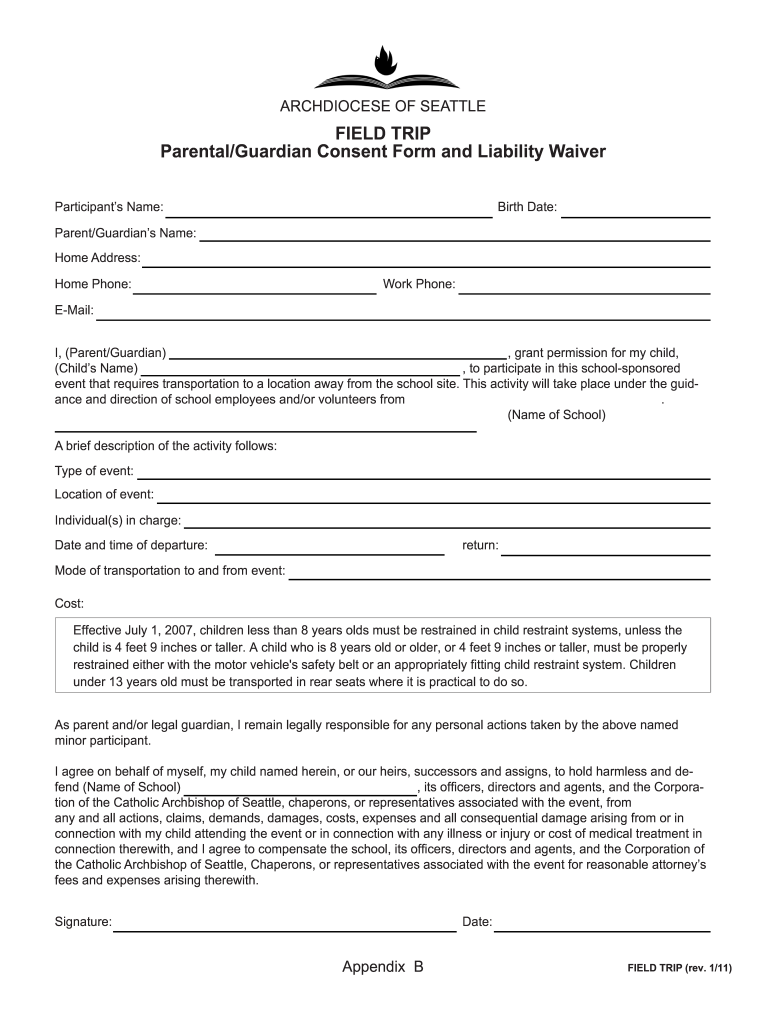

Field Trip Liability Waiver - Fill Online Printable Fillable Blank Pdffiller

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing Finals

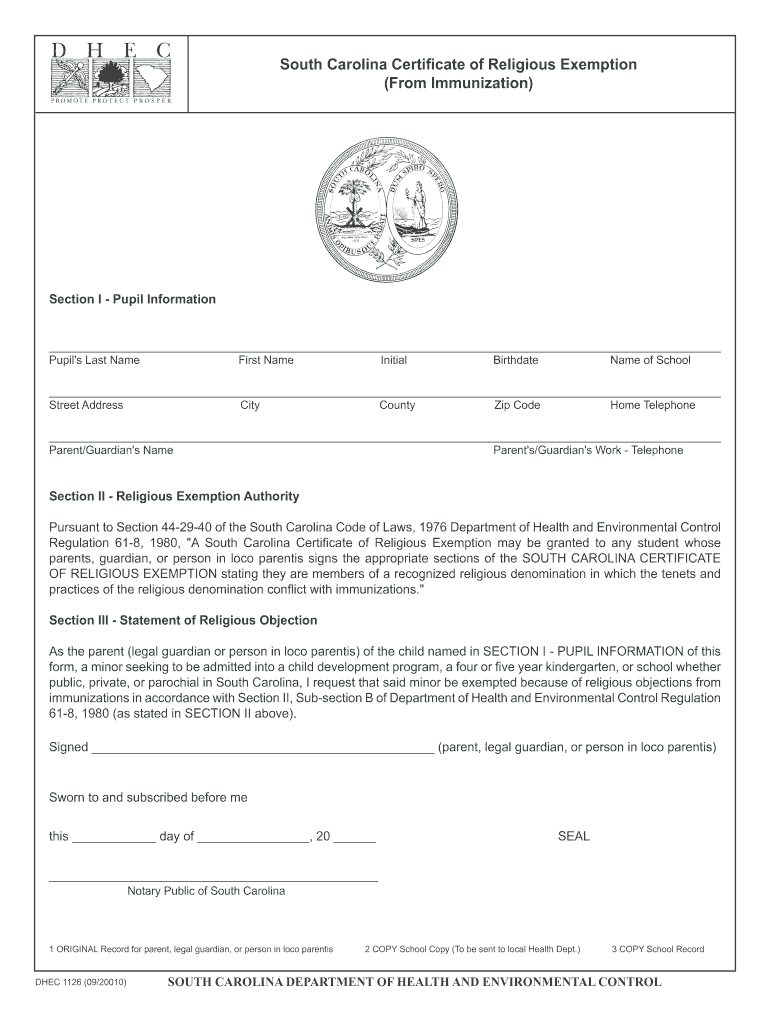

Religious Exemption Form - Fill Out And Sign Printable Pdf Template Signnow

Printable Sample Liability Waiver Form Template Form Liability Waiver Free Basic Templates Legal Forms

Gym Waiver Form - Fill Online Printable Fillable Blank Pdffiller

Lien Waiver Form - Fill Online Printable Fillable Blank Pdffiller