Kansas has a 6.5% statewide sales tax rate , but also has 376 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.555% on top. Property tax can be estimated by going to the property tax calculator and entering the owner's last name initial, year, make and model of your vehicle.

This Is The Most Expensive State In America According To Data Best Life

A question is answered every 9 sec.

Johnson county kansas vehicle sales tax calculator. Use the customer information form to upload vehicles due for renewal. Has impacted many state nexus laws and sales tax. The johnson, kansas, general sales tax rate is 6.5%.the sales tax rate is always 7.5% every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (1%).

There may be additional sales tax based on the city of purchase or residence. The median property tax on a $209,900.00 house is $2,707.71 in kansas. There is no city sale tax for johnson.

New york, for example, bases the fee on a vehicle's weight, while colorado employs a complicated formula based on the vehicle's year, weight, taxable value, and date of purchase. A $5.00 fee will be applied to each transaction handled at any of the tag offices. Renew your vehicle by mail or in person.

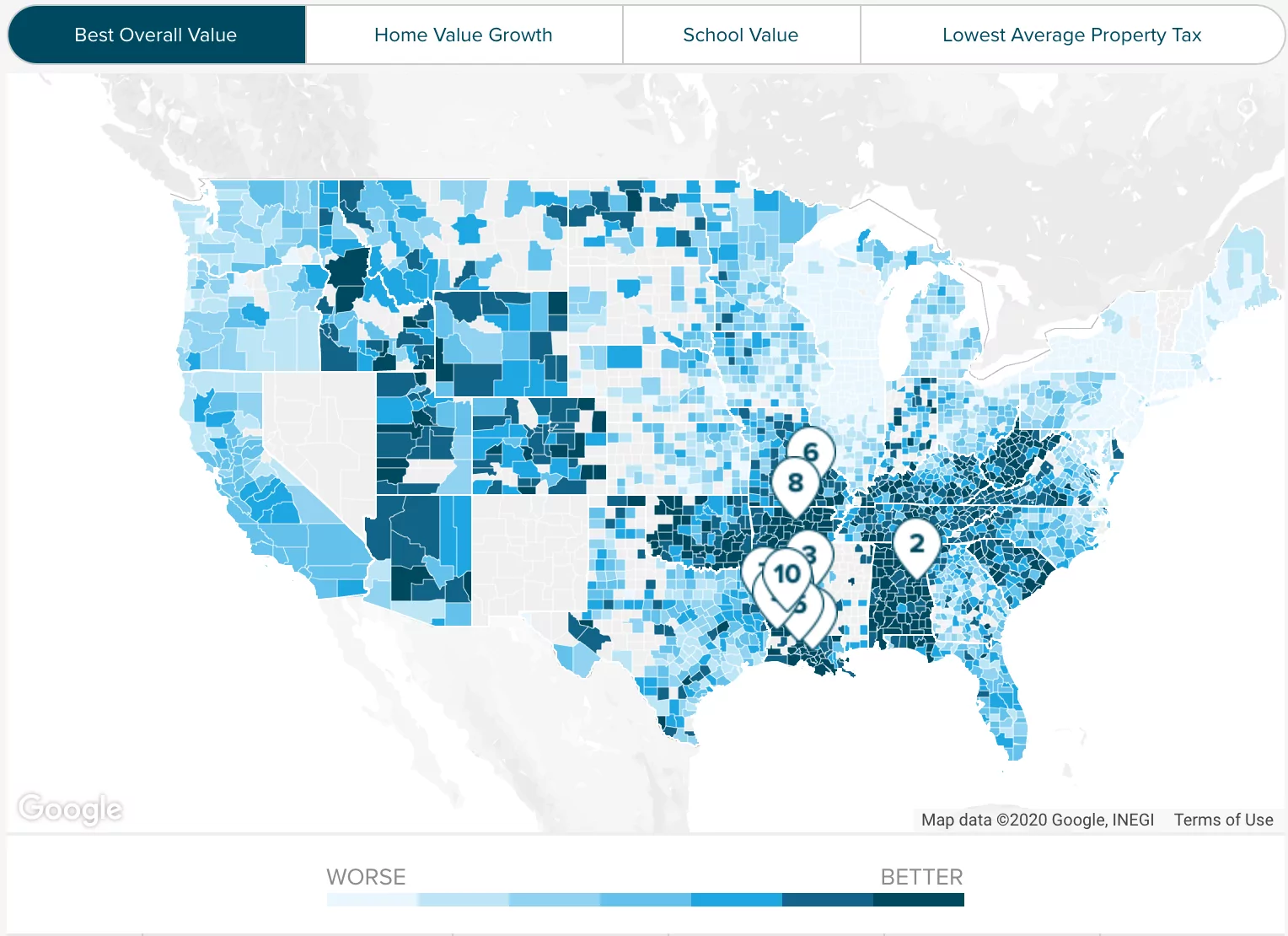

For additional information click on the links below: The state in which you live. The minimum combined 2021 sales tax rate for johnson county, kansas is 9.48%.

The johnson county sales tax rate is 1.48%. Subtract these values, if any, from the sale. The median property tax on a $209,900.00 house is $2,203.95 in the united states.

The type of license plates requested. There is also 249 out of 803 zip codes in kansas that are being charged city sales tax for a ratio of 31.009%. In addition to taxes, car purchases in kansas may be subject to other fees like registration, title, and plate fees.

The rate in sedgwick county is 7.5 percent. Other 2021 sales tax fact for kansas as of 2021, there is 165 out of 659 cities in kansas that charge city sales tax for a ratio of 25.038%. With a population of more than 585,000, johnson county is the largest county in kansas.

There are also local taxes up to 1%, which will vary depending on region. Home » motor vehicle » sales tax calculator. New car sales tax or used car sales tax.

(the sales tax in sedgwick county is 7.5 percent) interest/payment calculator johnson county collects a 1.475% local sales tax, the maximum local sales tax allowed under. This is the total of state and county sales tax rates. Kansas sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

This is the total of state and county sales tax rates. The minimum combined 2021 sales tax rate for johnson county, kansas is. The kansas state sales tax rate is currently %.

Find your state's vehicle tax & tag fees when purchasing a vehicle, the tax and tag fees are calculated based on a number of factors, including: How 2021 sales taxes are calculated in johnson. Home careers contact facilities list legal disclosures ada accommodations request

Find your kansas combined state and local tax rate. A question is answered every 9 sec. Motor vehicle titling and registration.

(the sales tax in sedgwick county is 7.5 percent) interest/payment calculator johnson county collects a 1.475% local sales tax, the maximum local sales tax allowed under. Renew online, not in line with online tag renewal. Local tax rates in kansas range from 0% to 4.1%, making the sales tax range in kansas 6.5% to 10.6%.

Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. The johnson county sales tax rate is %. Ad a tax agent will answer in minutes!

The median property tax on a $209,900.00 house is $2,665.73 in johnson county. The base state sales tax rate in kansas is 6.5%. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

You can find these fees further down on the page. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Motor vehicle titling and registration.

The county the vehicle is registered in. May 10, 2021 and november 10, 2021. The median real estate tax payment in johnson county is $3,018, one of the highest in the state.

The 2018 united states supreme court decision in south dakota v. Sep 28, 2018 — motor vehicle title and registration for johnson county property tax payment. However, the county actually has a relatively low average property tax rate of 1.24%.

New york, for example, bases the fee on a vehicle's weight, while colorado employs a complicated formula based on the vehicle's year, weight, taxable value, and date of purchase. Ad a tax agent will answer in minutes! Everything you need to know to renew your tags and registration each year.

Kansas Property Tax Calculator - Smartasset

Jackson County Mo Property Tax Calculator - Smartasset

Why Do Blue States Have Higher Effective Tax Rate Than Red States - Quora

Which Us States Charge Property Taxes For Cars - Mansion Global

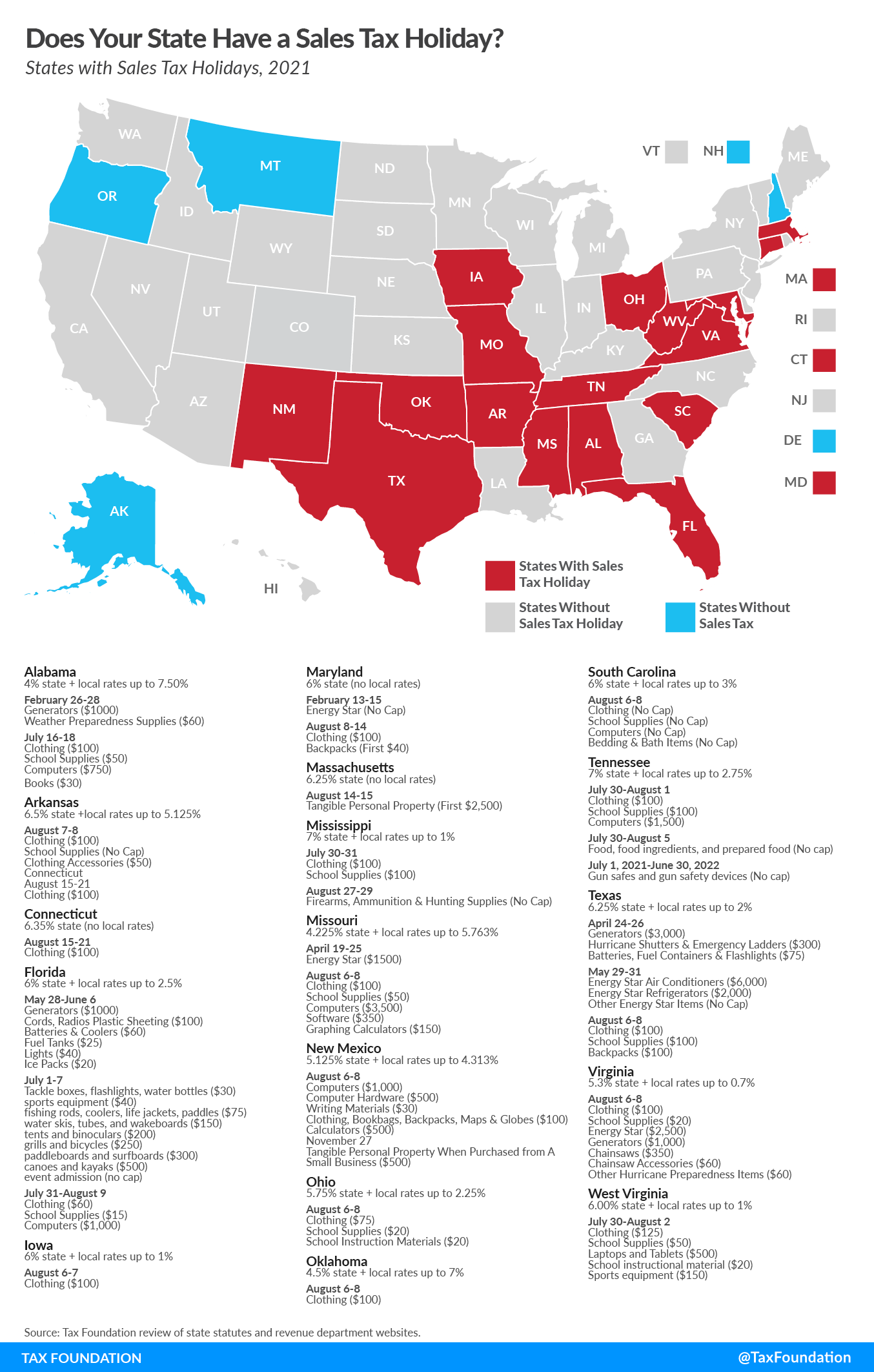

Sales Tax Holidays By State Sales Tax-free Weekend Tax Foundation

Sales Tax On Cars And Vehicles In Nebraska

Missouri Sales Tax Rates By City County 2021

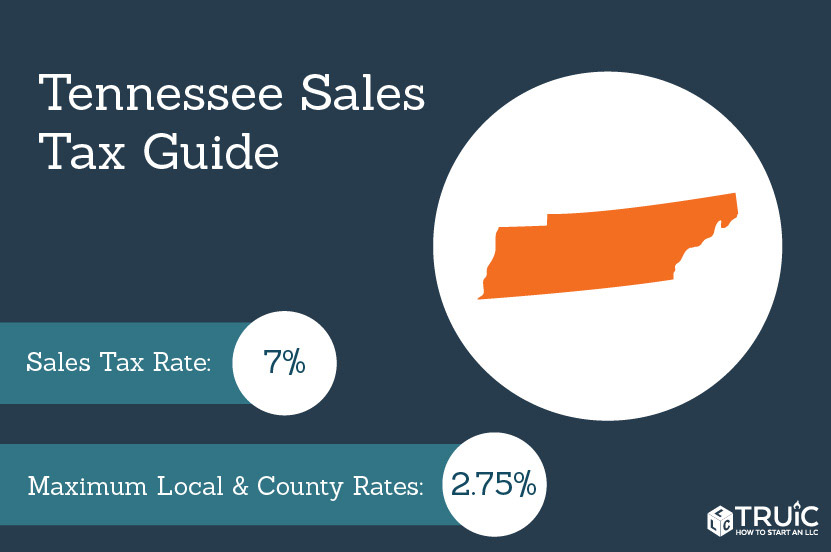

Tennessee Sales Tax - Small Business Guide Truic

Is Food Taxable In North Carolina - Taxjar

Faqs On Personal Property - Crawford County Ks

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kansas Sales Tax - Taxjar

Maintaining Merriam City Of Merriam

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Georgia Sales Tax Rates By City County 2021

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax On Cars And Vehicles In Iowa

Sales Tax On Cars And Vehicles In Kansas

Rhode Island Property Tax Calculator - Smartasset