For people who are considering buying a home in a particular city, property taxes are just one of many considerations that should be taken into account when deciding upon affordability and fit. Wayne county collects, on average, 2.07% of a property's assessed fair market value as property tax.

Tips For Year-end Tax Planning Filing Taxes Tax Extension Tax Services

In fiscal year 2016, property taxes comprised 31.5 percent of total state and local tax collections in the united states, more than any other source of tax revenue.

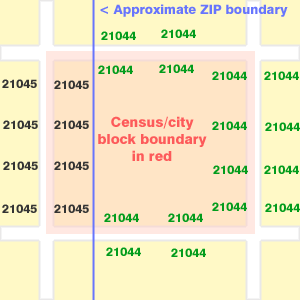

Michigan property tax rates by zip code. The average combined rate of every zip code in michigan is 6%. Sales tax and use tax rate of zip code 48144 is located in lambertville city, monroe county, michigan state. United states number of homes:

United states number of homes: Tax amount varies by county. The median property tax in wayne county, michigan is $2,506 per year for a home worth the median value of $121,100.

Albion, battle creek, benton harbor, big rapids, east lansing, flint, grayling, hamtramck, hudson, ionia, jackson, lansing, lapeer, muskegon, muskegon heights,. The average tax rate paid by residential property owners in michigan was 40.8 mills in 2014, the data shows. You can use the property tax map above to view the relative yearly property tax burden across the united states, measured as percentage of home value.

48144 zip code sales tax and use tax rate | lambertville {monroe county} michigan. This is equal to the median property tax paid as a percentage of the median home value in your county. For 2020 the following michigan cities levy an income tax of 1% on residents and 0.5% on nonresidents.

To find more detailed property tax statistics for your area, find your county in the list on your state's page. Don't edit mackinaw township includes the village of mackinac city at the foot of the mackinac bridge. Julie mack writes for mlive/kalamazoo gazette.

Millage rates can vary significantly by municipality. The median property tax in michigan is $2,145.00 per year for a home worth the median value of $132,200.00. In our calculator, we take your home value and multiply that by your county's effective property tax rate.

To estimate your yearly property tax in any county based on these statistics, you can use our property tax calculator. The essential services assessment (esa) is a state specific tax on eligible personal property owned by, leased to or in the possession of an eligible claimant. Kent county’s average effective tax rate is 1.51%.

Use our free michigan property records tool to look up basic data about any property, and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. At that rate, a homeowner with a home worth $150,000, about the median home value in the county, would pay $2,265 annually in property taxes. Michigan state tax commission property classification mcl 211.34c issued november 2018

Located in western michigan, kent county contains the city of grand rapids and has property tax rates lower than many of michigan’s other urban counties. Summer tax mils + winter tax mils = total annual mils. The average property tax rate in the united states is about 1.5%, but there are a handful of states where the rate is over 2%.

Our property records tool can return a variety of information about your property that affect your property tax. Below are some other factors that should be looked at: Property taxes are an important tool to help finance state and local governments.

This link will provide information on esa, who must pay esa and how to file a statement and remit payment. Here is a list of millage rates for michigan. United states number of homes:

In that same year, property taxes accounted for 46 percent of localities’ revenue from their own sources, and 27 percent of overall local. The millage rate database and property tax estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout michigan. The average combined rate of every zip code in michigan is 6%.

Michigan property tax rates by zip code. Counties in michigan collect an average of 1.62% of a property's assesed fair market value as property tax per year. [ 0 ] state sales tax is 6.00%.

Wayne county has one of the highest median property taxes in the united states, and is ranked 278th of the 3143 counties in order of median property taxes.

States With Highest And Lowest Sales Tax Rates

Texas Sales Tax - Small Business Guide Truic

50 Communities With Michigans Highest Property-tax Rates - Mlivecom

Map Reveals 5 Utah Zip Codes With Most Covid-19 Deaths

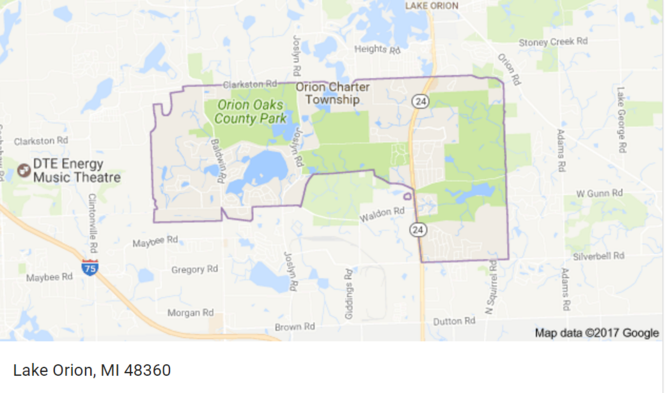

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

How To Calculate Property Tax On Your Home To Find Out What You Owe

Top 25 Most Expensive Chicago Area Zip Codes In 2019 - Propertyshark Real Estate Blog

Amazoncom Wayne County Michigan Zip Codes - 48 X 36 Laminated Wall Map Home Kitchen

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

Primer Zapolneniya Nalogovoy Formi W-8ben Dlya Shuterstok Shutterstock Broshyura Graficheskiy Dizayn Byudzhet

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

Free Zip Code Map Zip Code Lookup And Zip Code List Zip Code Map Coding Map

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

Map Of The United States Showing The Twelve States That Do Not Tax Personal Retirement Income Such As Four O One Retirement Retirement Income Retirement Money

Stop Using Zip Codes For Geospatial Analysis By Matt Forrest Towards Data Science

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom

Michigans 50 Wealthiest Zip Codes Based On Irs Data - Mlivecom