Additional information can be found in the code of alabama 1975, title 40, chapter 10, sale of land. Please continue to pay online and use the mail service when possible.

Property Tax Alabama Department Of Revenue

220 2nd avenue east, room 105, oneonta, al 35121.

Alabama delinquent property tax phone number. Once you have found a property for which you want to apply, select the cs number link to generate an online application. Accurate records must be kept at all times, since this office is involved in the collection of taxes. 3925 michael blvd suite g.

Sale of tax liens for collecting delinquent property tax. Taxes can be paid between october 1st and december 31st without penalty. The tax collecting official of each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien or the sale of property to collect delinquent property taxes and the method.

Tax delinquent properties for sale search. Below is a listing by county of tax delinquent properties currently in state inventory. 220 2nd avenue east, room 105, oneonta, al 35121.

Alabama’s law requires that any property with unpaid property taxes is sold in the department’s annual tax lien. The interest is equivalent to 1% of the tax per month, plus a delinquency fee of $5. 114 court street grove hill, alabama 36451.

Beginning with tax year 2019 delinquent properties, the mobile county revenue commission decided to migrate to the sale of tax liens, and will continue to use this alternative. Ph 251.275.3376 fx 251.275.3498 example: Search blount county property tax, appraisal and assessment records by name, address or parcel number, and view tax maps by parcel number.

Alabama department of revenue ad valorem tax division p. The transcripts are updated weekly. All unpaid property is sold at auction in may to the lowest bidder.

Alabama has a fixed assessment ratio established at 20% of assessed value for businesses. You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in which the property was assessed when it sold to the state. Assessor, revenue commissioner and tax sales.

View how to read county transcript instructions. Our purpose is to supervise and control the valuation, equalization, assessment of property, and collection of all ad valorem taxes. Box 6406 dothan, al 36302 phone numbers:

Industrial projects might be abated from property taxes for up to ten years except educational taxes. Taxes become delinquent after december 31st. Our sale will now be a tax lien online sale in april.

Taxes are due every year october 1st. 114 court street grove hill, alabama 36451. Tax search & pay property.

Any unpaid taxes are assessed fees and 1% interest per month beginning in january of each calendar year. P o box 447 carrollton, al 35447. Installment payments are subject to 1% per month interest on the unpaid balance for the second and third payments.

There are additional penalties and fees for any property taxes that remain unpaid on march 1st. The tax collector must advertise and hold a tax sale once a year for any unpaid taxes on real estate or any special assessments. Assessor, revenue commissioner and tax sales.

Search blount county property tax, appraisal and assessment records by name, address or parcel number, and view tax maps by parcel number. New registrations can now be processed online at www.easytagal.com. The property tax division also advises and assisting county elected officials and their personnel, county commissioners, members of the boards of equalization, and other officials charged with mapping and appraisal duties, relating to laws,.

Michelle kirk, pickens county revenue commissioner. An alabama title application and bill of sale are required to use this link. Signature of applicant telephone number (include area code) address city, state , zip code return application to:

A tax map is used to identify ownership of each parcel of land in the.

What Happens When Your House Goes Up For Auction Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

2

April 29 2021 Ouachita Parish Delinquent Property Tax Notices Click To Download Public Notices Hannapubcom

2

Delinquent Tax Collections Letters Are In The Mail - Allongeorgia

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Opelika Observer - Lee County 2019 Delinquent Tax List By Opelikaobserver - Issuu

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Alabama Department Of Revenue

How To Find Tax Delinquent Properties In Your Area Rethority

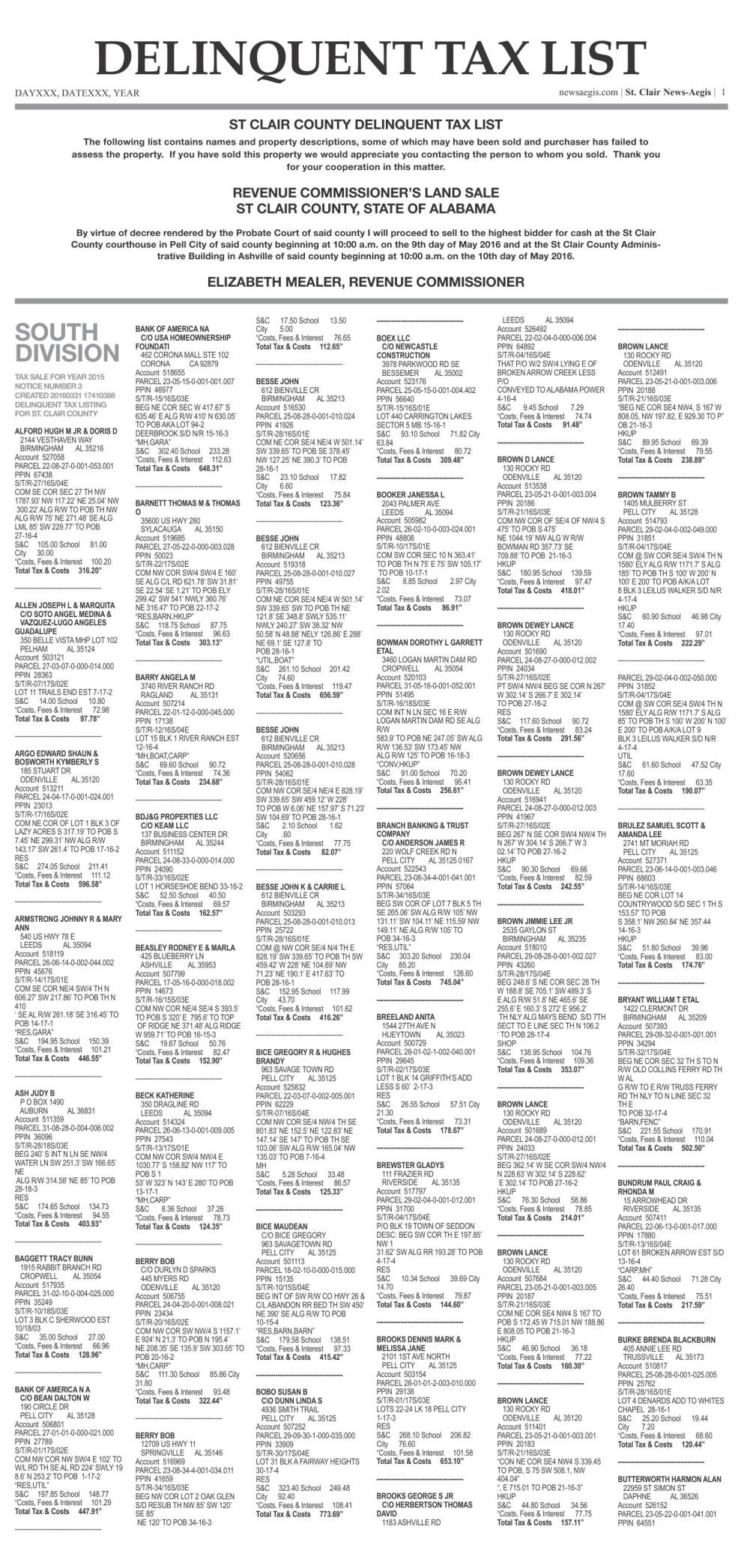

Delinquent Property Tax List - St Clair County 2016 Newsaegiscom

Everything You Need To Know About Getting Your Countys Delinquent Tax List - Retipster

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Marengo County Alabama - 2017 Delinquent Property

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers Property For Sale

Tax Certificate And Tax Deed Sales - Pinellas County Tax

How To Find Tax Delinquent Properties In Your Area Rethority