At a total sales tax rate of 9.250%, the total cost is $382.38 ($32.38 sales tax). Groceries is subject to special sales tax rates under tennessee law.

What Canadian Businesses Need To Know About Us Sales Tax - Madan Ca

Furthermore, each location may only.

What items are exempt from sales tax in tennessee. Sales of medical devices are exempt from the sales tax in tennessee. Sales and use tax certificate verification application; This means that an individual in the state of tennessee who sells school supplies and books would be required to charge sales tax, but an individual who owns a store which sells groceries medication is not required to charge sales tax on all of its.

Tennessee crates not exempt as packaging materials the tennessee department of revenue issued revenue ruling no. (page 59) (3) change in the date of the annual fall sales tax holiday to begin on the last friday in july Tennessee does not exempt any types of purchase from the state sales tax.

Apparel items priced at more than $100 are not eligible for the sales tax exemption. Law exempts motor fuel and liquefied natural gas from sales tax. Other deductions including sales of specified digital products and of merchandise sold through vending machines (6) _____ 1.

*items sold together, such as shoes. This does not include a book primarily published and distributed for sale to the general public. Therefore, no holiday is necessary.

Items such as jewelry, handbags, or sports and recreational equipment. For example, prescription drugs are exempt from tennessee's sales and use taxes, but under the business tax scheme, the business of selling prescription drugs and patient medicines is. Textbooks and workbooks are exempt from sales tax;

In the state of tennessee, the exemption is applicable to used clothing which is being sold by some nonprofit organizations. Back to tennessee sales tax handbook top. It is important to understand that the farmer selling the product must have raised the product for the sale to be exempt.

Property and services are tax exempt. In the state of tennessee, the exemptions may be applicable to use with any software which has been developed and fabricated by an affiliated company or for fabrication of software by a person for that person's own use or consumption. Sales of medical services are exempt from the sales tax in tennessee.

When calculating the sales tax for this purchase, steve applies the 7.000% state tax rate for tennessee, plus 2.250% for shelby county’s tax rate. Sales of medicines are subject to sales tax in tennessee. Modern market telecommunications providers privilege tax;

We recommend businesses review the tennessee sales and use tax guide (beginning on page 56) to see which goods are taxable and which are exempt, and under what conditions. A customer living in clarksville finds steve’s ebay page and purchases a $350 pair of headphones. A textbook is defined as a printed book that contains systematically organized educational information that covers the primary objectives of a course of study.

Exempt if $100 or less per item. Local sales tax and single article; Generally, nonprofit entities are exempt from paying sales or use tax on their purchases of property and services.

Some goods are exempt from sales tax under tennessee law. In the state of tennessee, only the entity that remitted the tax to the state can be refunded the tax dollars, therefore tennessee manufacturers must request a sales tax refund directly from their vendors. If an organization qualifies as exempt from sales and use tax under tenn.

Taxable single article sales from $1,600 to $3,200. In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate. Several examples of of items that exempt from tennessee sales tax are medical supplies, certain groceries and food items, and items used in packaging.

Clay school art supplies are exempt. Examples include some industrial machinery, agricultural equipment, fuel, and medical supplies. Tennessee manufacturers can recover sales tax dollars erroneously paid on exempt items up to 3 years (36 months) after the sales tax was paid.

A nonprofit entity must apply for and receive the sales and use tax certificate of exemption from the department of. Several examples of items that are considered to be exempt from tennessee sales tax are medical supplies, certain groceries and food items, and items which are used in the process of packaging.

Tennessee Sales Use Tax Guide - Avalara

Tennessee Department Of Revenue Announces Three Sales Tax Holidays - Clarksville Online

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Tax Holiday

Tennessee Sales Tax - Small Business Guide Truic

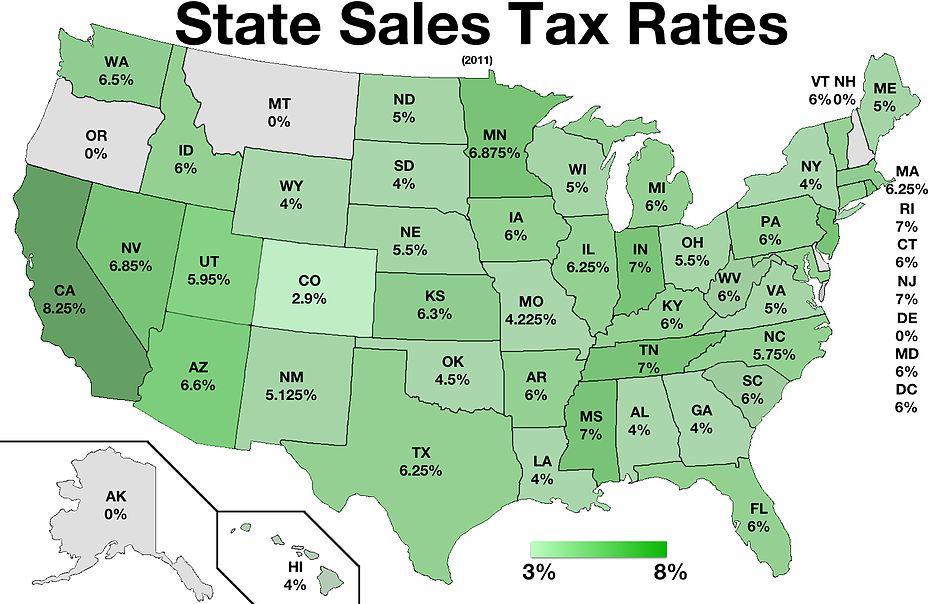

States With Highest And Lowest Sales Tax Rates

Home Depot Sales Tax On Tool Rental Home Depot Sales Home Tools Rental

Tennessee Holding Three Sales Tax Holidays For 2021 Heres What You Need To Know Wjhl Tri-cities News Weather

Sales Tax Holidays By State Sales Tax-free Weekend Tax Foundation

Sales Taxes In The United States - Wikiwand

Eqkdqb7mjbevtm

Sales Tax Exemptions Finance And Treasury

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Shop Until You Drop During Your States Tax-free Holiday Tax Holiday Tax Free Weekend Tax Free

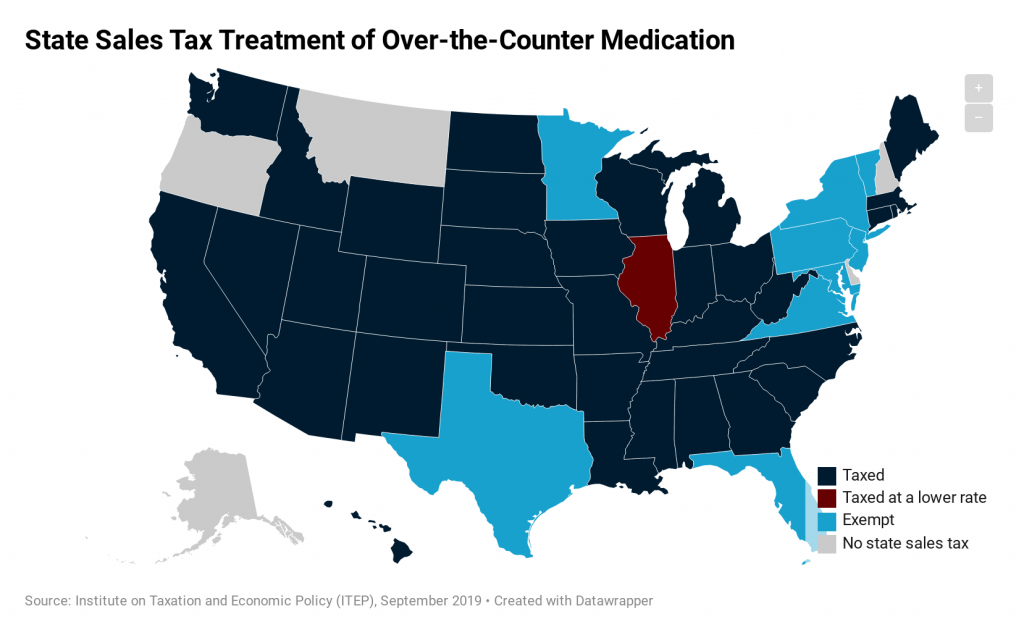

How Do State Tax Sales Of Over-the-counter Medication Itep

Printable Tennessee Sales Tax Exemption Certificates Tax Exemption Sales Tax Certificate

Sales Tax On Grocery Items - Taxjar

How To Register For A Sales Tax Permit - Taxjar

States Sales Taxes On Software Software Sales Marketing Software Tax Software

Understanding Californias Sales Tax