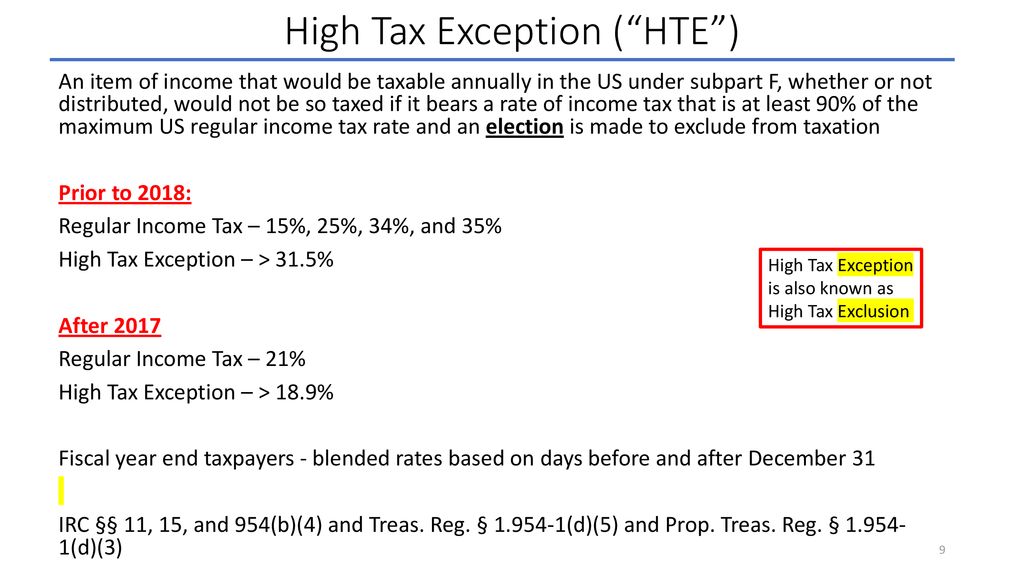

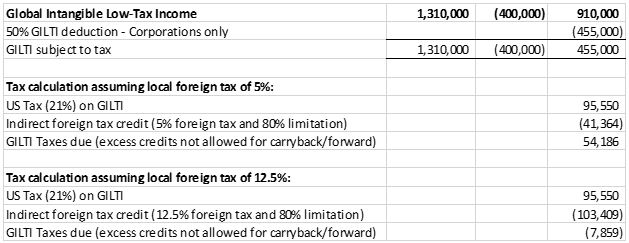

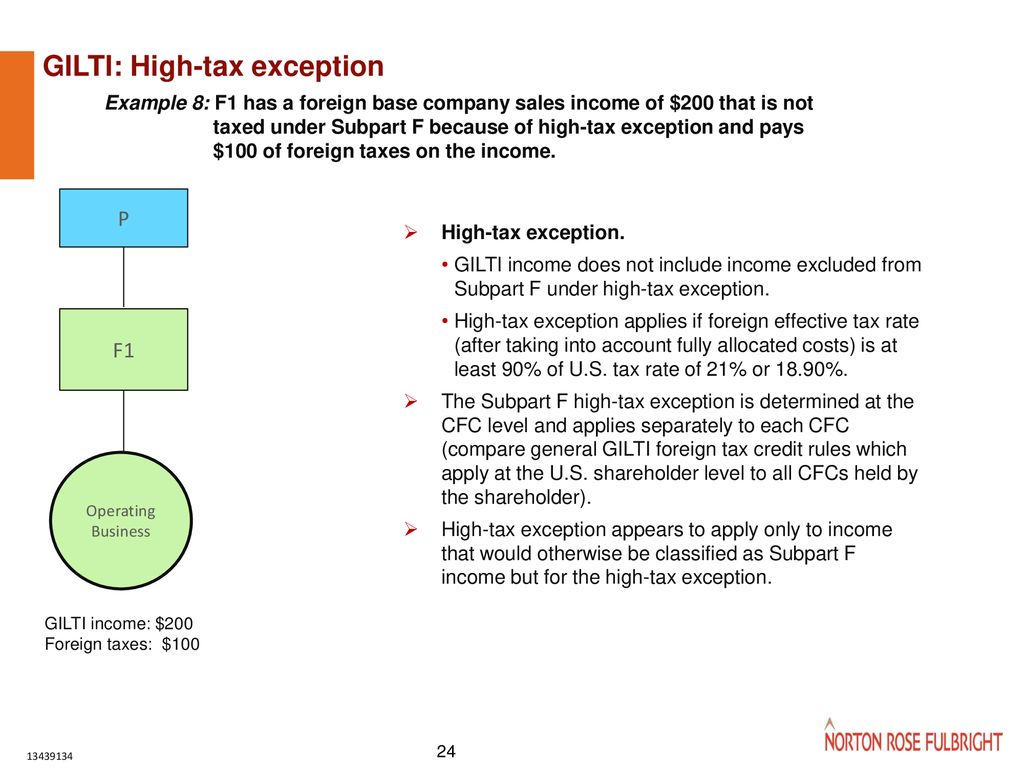

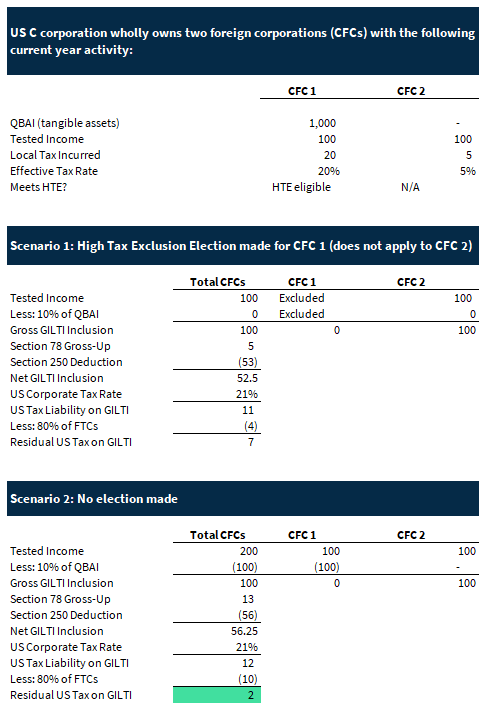

Similar to a subpart f inclusion, “u.s. If a foreign corporation is incorporated in a country with a high tax rate rate (over 18.9%), gilti income may be exempt.

5 Things To Know About The Gilti High-tax Exclusion Crowe Llp

A cfc group is an affiliated group as defined in sec.

Gilti high tax exception election statement. Shareholder already recognizes as subpart f income and gross income excluded from subpart f due to the high. Subpart f income, but not gilti, may be reduced by certain prior year e&p deficits in accumulated. Shareholder uses to compute gilti income.

1504(a), modified to include foreign. 9902) were published in the federal register on july 23, 2020. Enacted in the tax cuts and jobs act (tcja), §951a excludes certain types of gross income from the tested income of a cfc that a u.s.

1(c)(5)) of cfcs may make a gilti hte election by filing a statement with eith er a timely filed original return or an amended tax return as long as (1) the amended return is filed within 24 months of the unextended due date of the original return, (2) each u.s. Shareholder affected by the gilti hte election The final regulations also give taxpayers the option of making a gilti high tax exclusion election with an amended income tax return as long as all u.s.

On july 20, 2020, the irs finalized the gilti high foreign tax exception election regulations. Such exclusions include—but are not limited to—income the u.s. Shareholders of the cfc file the amended return within 24 months of the due date of the original income tax return.

Shareholders” of cfcs include gilti in income on an annual basis. That election is binding for all u.s.

International Aspects Of Tax Cuts And Jobs Act

Harvard Yale Princeton Club - Ppt Download

Harvard Yale Princeton Club - Ppt Download

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Global Intangible Low-tax Income - Working Example Executive Summary - Mksh

Form 8992 Gilti Calculation Pitfall - Latest To Know For 2020

Gilti High Tax Exception A Valuable Tax Planning Tool Warren Averett Cpas Advisors

Lwcom

How Foreign Subsidiary Owners Can Plan For Gilti Hte

Hard Hit On Global Supply Chain Structures - Ppt Download

Btcpanet

Final Regulations Clarify Potential Benefits Of The Gilti High-tax Exclusion Our Insights Plante Moran

Lwcom

Lwcom

Lwcom

Gilti High-tax Exclusion How Us Shareholders Can Avoid The Negative Impact Sch Group

Lwcom

High-tax Exception Now Available For Gilti Income Sciarabba Walker Co Llp

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low-taxed Income Gilti Income Inclusions Thomas - Ppt Download