Yellen emphasized, however, that the tax was not a wealth tax. Democrats are gearing up to impose a tax on unrealized capital gains.

Chapter 5 Monetary Accounts And Analysis In Macroeconomic Accounting And Analysis In Transition Economies

Capital gains tax is a tax on the profit that investors realise on the sale of.

Taxing unrealized gains explained. The madness of taxing unrealized capital gains. President biden’s proposal to require roughly 700 u.s. I wouldn’t call that a wealth tax.”.

Nearly every post on social media and forums concerning this. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. Currently, the tax code stipulates that unrealized capital gains are not taxable income.

The new proposal would tax unrealized capital gains, meaning that the wealthy would no longer be able to defer tax payments on gains made each year. These incomes escape taxation until the investors realize them, or sell the assets, yellen explained. The tax would apply to people who make more than us$ 100 million a year for three years in a row or if one makes us$ 1 billion in annual income.

An unrealized gain is a type of profit that an investor, company or individual is yet to receive but is expected to make in the future. “it’s not a wealth tax, but a tax on unrealized capital gains of exceptionally wealthy individuals,” the treasury secretary concluded. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government.

House of representatives speaker nancy pelosi. During an interview with cnn on sunday, yellen touted the idea of taxing the unrealized capital gains of the wealthiest 1 percent, though she claimed. A profit that is recorded on paper is an unrealized gain, such profit can be made through an investment or sales by a company.

President biden’s proposal to require roughly 700 u.s. If the proposal were to pass, billionaires. The tax targets “unrealized capital gains,” which are oxymorons that exist only in the minds of tax law enthusiasts.

Payments could be spread out over five years. The impacted assets include stocks, bonds, real estate, and art. As the wsj explains, this new unrealized capital gains tax would look at the value of the asset on january 1 and then again on december 31 of the same year.

This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. There are plenty of other objections to taxing unrealized capital gains and, writing back in 2019, david. Democrats want to impose a new tax on america’s wealthiest by taxing unrealized capital gains similar to other types of income.

Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government. Taxing unrealized gains grants the government the ability to monitor your each and every move. If a billionaire’s real estate.

Yellen explained the concept, which aims to tax americans on unrealized capital gains stemming from liquid assets. Of course, like the controversial $600 irs monitoring proposal, yellen stressed that the proposal was aimed at “extremely wealthy individuals, billionaires.”. Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government.

We need to stick it to the taxpayer. The madness of taxing unrealized capital gains. Posted on november 4, 2021.

A capital gain is the profit you make when you sell an investment asset for. Then, going forward, payers would be on the hook for annual capital gains taxes on new unrealized income — although unrealized losses could be carried forward as offsets. President biden’s proposal to require roughly 700 u.s.

Janet yellen, the treasury secretary in the joe biden administration, has proposed a tax on unrealised capital gains. House of representatives speaker nancy pelosi. Treasury secretary janet yellen proposed taxing billionaires’ unrealized capital gains to fund president joe biden’s $2 trillion spending bill — a bill which the president has claimed costs $0.

Democrats unveil billionaire’s tax on unrealized capital gains. Once lawmakers have the power to tax unrealized gains, it will be just a matter of time before lawmakers running out of tax revenue will set their aim at one of the largest sources of wealth hiding from the irs, unrealized gains in real estate and mutual funds that the public holds. Across all demographic groups, americans strongly oppose.

That would impose a tax on unrealized capital gains on liquid assets held by extremely wealthy individuals — billionaires. Nearly every post on social media and forums concerning this subject is littered with commentary that indicates americans think taxing unrealized gains is a horrible idea. Us treasury secretary, janet yellen, explained the plan to tax unrealized gains on cnn's state of the union this sunday, october 24th, “what’s under consideration is a proposal.

Taxing unrealized gains grants the government the ability to monitor your each and every move. Tax on unrealized capital gains, explained. The madness of taxing unrealized capital gains.

Is The Proposed Wealth Tax Constitutional Answer Depends On Direct Tax Definition

Income Tax Impact Of Switching In Mutual Funds Explained In 5 Points

Corporate Tax 2021 Laws And Regulations Indonesia Iclg

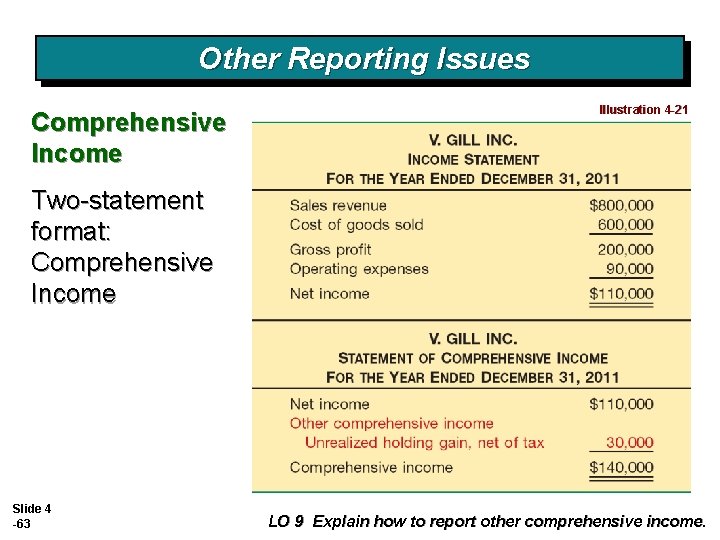

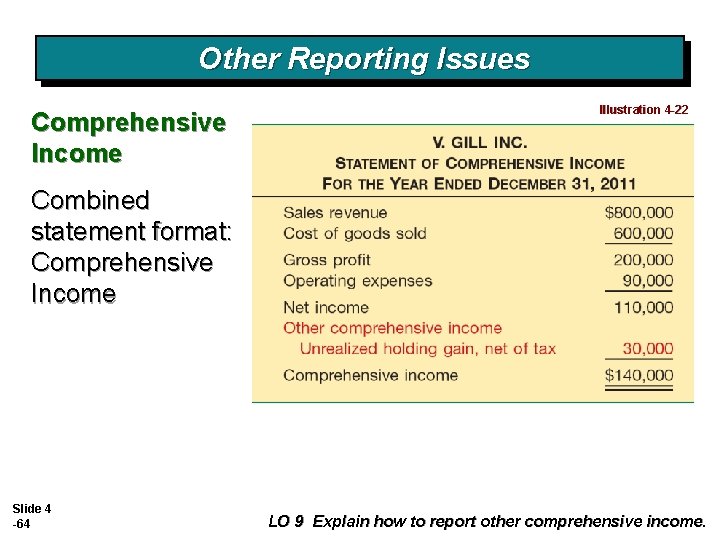

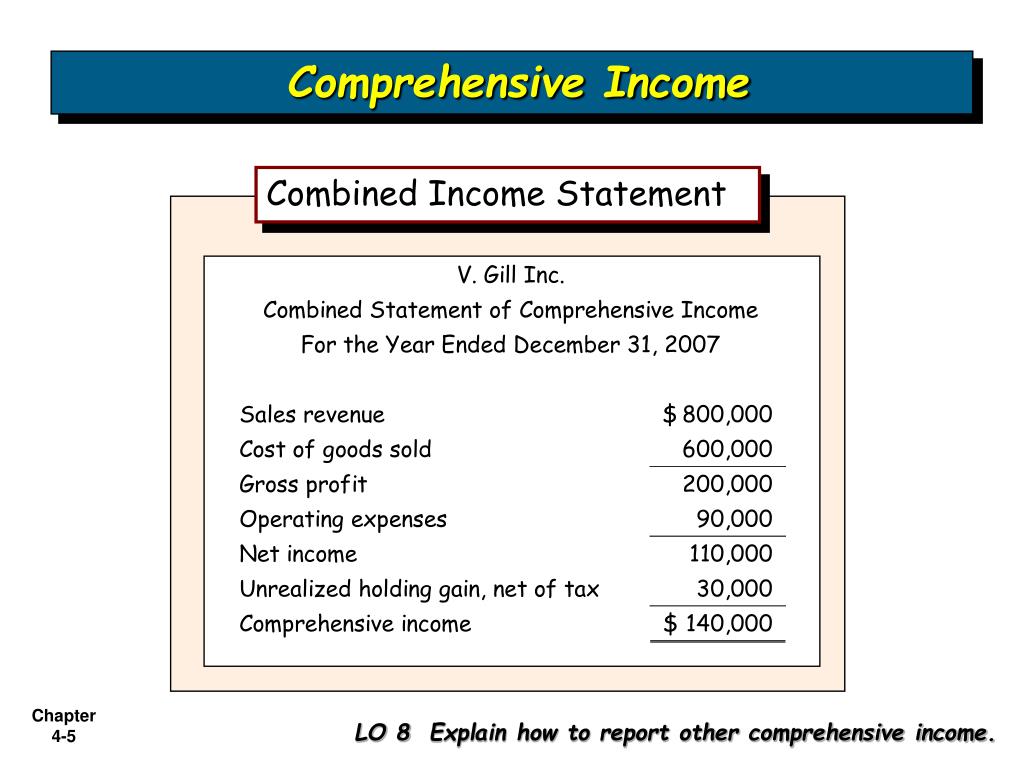

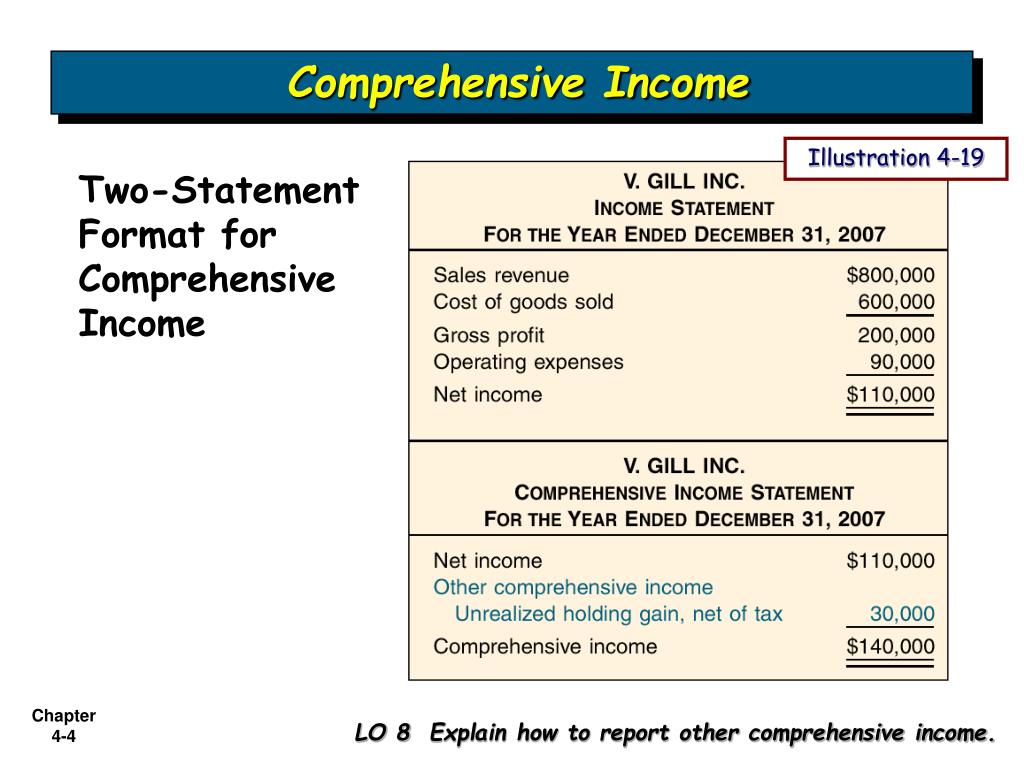

Slide 4 1 Chapter 4 Income Statement And

Sec Filing Patria Investments Limited

Slide 4 1 Chapter 4 Income Statement And

Ppt - Comprehensive Income Powerpoint Presentation Free Download - Id5575621

Chapter 5 Monetary Accounts And Analysis In Macroeconomic Accounting And Analysis In Transition Economies

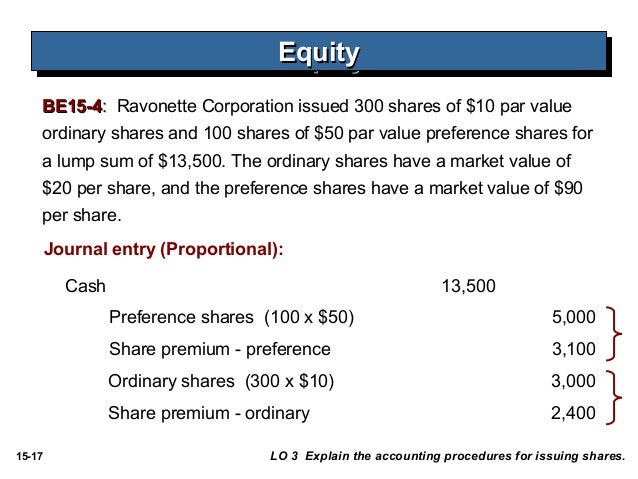

Ch15

Accounting Conservatism And Income Smoothing Practices In Eu Food And Drink Industry Emerald Insight

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Call Option Definition

Sec Filing Patria Investments Limited

:max_bytes(150000):strip_icc()/dotdash_Final_Excess_Returns_Dec_2020-01-2a81d7a448684458b0ed30db04fd145c.jpg)

Excess Returns Definition

Basics Of Accounting Chart Of Accounts General Journal General Led Chart Of Accounts Accounting Accounting Basics

Passive Foreign Investment Company Expat Tax Online

Accounting Conservatism And Income Smoothing Practices In Eu Food And Drink Industry Emerald Insight

Chapter 5 Monetary Accounts And Analysis In Macroeconomic Accounting And Analysis In Transition Economies

Ppt - Comprehensive Income Powerpoint Presentation Free Download - Id5575621

Gold Price 50000 An Ounce Is Possible Jim Rickards Prediction Explained Predictions Gold Price Dollar Collapse