If you want professional guidance for your estate planning after. For example, kansas estate planning attorney victor panus says that surviving spouses are entitled to exempt property, including household furnishings and one vehicle.

Ebay Will Collect Sales Tax In 5 More States Sales Tax Marketing Communication States

For many years, kansas had an inheritance tax.

Kansas inheritance tax rules. Questions answered every 9 seconds. The executor files a petition to close probate, which will allow them to distribute any remaining assets to the heirs. The waiver is filed with the register of deeds in the county in which the property is located.

This will depend on the state. The person who inherits the assets pays the inheritance tax. However, if you are inheriting property from another state, that state may have an estate tax that applies.

In this detailed guide of the inheritance laws in the sunflower state, we break down intestate succession, probate, taxes, what makes a will valid and more. Fortunately, neither kansas nor missouri has an inheritance tax. Not every state has them.

Kansas does not have an estate tax or inheritance tax, but there are other state inheritance laws of which you should be aware. • the personal estate tax exemption. In 2019, that is $11,400,000.

On the other hand, let us consider new jersey for our garden state subscribers. Twelve states and washington, d.c. There are taxes imposed on properties that exceed exemption limit $5.34 million (as of year 2014).

In pennsylvania, for instance, the inheritance tax applies to anyone inheriting property from a pennsylvania resident, even if the inheritor lives. Here are some tax rates and exemptions that you should be aware of: Impose estate taxes and six impose inheritance taxes.

Ad an estate lawyer will answer now! You may also need to file. If you live in kansas and you inherit from a decedent in a different state, you may be responsible for paying inheritance tax on it.

The kansas inheritance tax applies to the estates of decedents dying befor e july 1, 1998. Kansas inheritance and gift tax. Kansas does not assess an inheritance tax either.

Another state’s inheritance laws may apply, however, if you inherit money or assets. The federal estate and gift tax exemption has been increased from $5,000,000 in 2017 to $10,000,000 in 2018, indexed to. Questions answered every 9 seconds.

The executor pays all creditors and any other expenses. A resident estate is the estate of a person who was a kansas resident at the time of death. They provide an accounting to the court.

Another state’s inheritance laws may apply, however, if you inherit money or assets from someone who lived in another state. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the. Kansas inheritance and gift tax.

The executor must file a final tax return and pay any owed taxes. Maryland is the only state to impose both. Inheritance tax is a state tax on assets inherited from someone who died.

If you received property from someone who died after july 1. Inheritance taxes differ by state. Ad an estate lawyer will answer now!

Kansas has no inheritance tax either. As a general rule, only estates larger than $ 5.34 million have to pay federal estate taxes. The fiduciary of a resident estate or trust must file a kansas fiduciary income tax return if the estate or trust had any taxable income and/or there is withholding tax due for the nonresident beneficiaries.

Kansas does not collect an estate tax or an inheritance tax. Maryland is the only state to impose both. When they do, how is the tax paid?

The kansas estate tax, which applies to the estates of decedents dying on or after july 1, 1998, continues in effect. (a) an election under k.s.a. Additionally, the spouse and minor children are entitled to a family allowance of $35,000 and a homestead exemption of 1 acre of a city residence or 160 acres outside of.

The first $ 5.34 million is exempted from taxes. However, the kansas inheritance tax may be payable even though no federal estate tax is due. All other estates are nonresident estates.

Kansas law provides several protections for surviving spouses. (b) in the event the alternate valuation method is elected for federal estate tax purposes pursuant to 26 u.s.c. The notice of election and agreement to special valuation shall be made in accordance with.

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Kansas eliminated its state inheritance tax in 1998, and has not reinstated an inheritance tax as of march 2013. 2032, the alternate valuation method shall also be used for kansas inheritance tax purposes, as provided in k.s.a.

However, another state’s inheritance tax rules could apply if you inherit money from someone who passes away in another state.

Qnups - Protect Your Worldwide Assets From Uk Taxation The Beatles Beatles Funny Beatles Pictures

Assessing The Impact Of State Estate Taxes Revised 121906

The Old Perry Theater At The Corner Of Perrysville Avenue And Mairdale Street Pittsburgh Pa Pittsburgh Hometown

Why Are Texas Property Taxes So High Home Tax Solutions

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Assessing The Impact Of State Estate Taxes Revised 121906

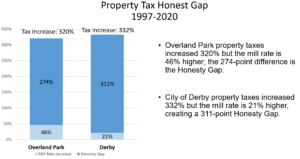

Gov Kelly Signs Property Tax Transparency Bill - Kansas Policy Institute

Pin On Design Inspiration Art

Estate Tax And Inheritance Tax In Kansas Estate Planning

Street Calculus Calculus Seventh Grade Learning Objectives

Does Kansas Charge An Inheritance Tax

City Of Reno Property Tax City Of Reno

Forgot To Roll Over Your Old 401ks Youre Not Alone This New Bill Could Help In 2021 Retirement Savings Plan Bills Financial Literacy

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Legal Services

Biden Businesses Tax Collections Would Be Highest In 40-plus Years

Mafia Crime Mobster Luciano Genovese Gangster Movies Real Gangster Mafia Gangster

States With No Estate Tax Or Inheritance Tax Plan Where You Die