The income limit for the basic star credit is $500,000 (the income limit for the basic star exemption is $250,000); Enhanced star is for homeowners 65 and older whose total household income for all owners and spouses who live with them is $92,000 or less.

Understanding The School Tax Relief Star Program In Nyc - Yoreevo Yoreevo

It lowers the tax burden on new york residents who live in school districts.

How much is the nys star exemption. The enhanced star exemption amount is $70,700 and the school tax rate is $21.123456 per thousand. Select your municipality and then scroll to your school district, or. 59 rows the star exemption amount multiplied by the school tax rate (excluding any library levy portion) divided by 1000;

Determine the star exemption amount for which you qualify. Basic star averages about $800 a year, and enhanced star is about $1,400 a year. $500,000 or less for the star credit;

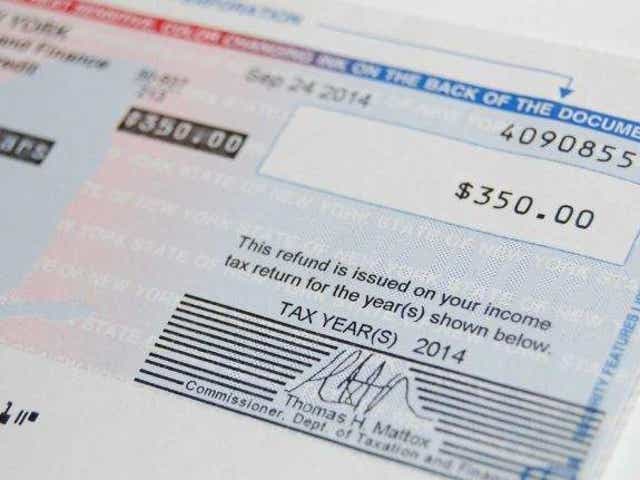

The maximum star exemption savings. In 2019, the checks will be as high as 85 percent of the star rebate for those earning $75,000 a year or less. Based on the first $30,000 of the full value of a home enhanced star

How much is ny star exemption? According to new york state, “beginning in 2019, the value of the star credit savings may increase by as much as 2% each year, but the value of the star exemption savings cannot increase.” so, while it might be less convenient to receive a check than to have this amount deducted from your tax bill, in future years you may end up with more. The benefit is estimated to be a $293 tax reduction.

When the basic exemption is fully phased in, they will receive at least a. There is no age limit for basic star, which exempts the first $30,000 of the full value of a home from school taxes. The star savings is substantial:

$250,000 or less for the star exemption; The total amount of school taxes owed prior to the star exemption is $4,000. Provides an increased benefit for the primary residences of senior citizens (age 65 and older) with qualifying incomes:

It would be up to the state legislature in 2019 to decide whether to. Beginning in 2016 any homeowner who is applying for the first time on a property, meaning you have never had any star exemptions on your property before or you are a new homeowner of a property, is required to register with new york state department of taxation and finance. However, star credits can rise as much as 2 percent annually.

The total amount of school taxes owed prior to the star exemption is $4,000. We are also getting a maintenance increase as of april 1st. If you or your spouse turn 65 at any time in 2012, you may be eligible for the enhanced star exemption.

Married people may receive only one star benefit regardless of how many properties they own purchasers who own the property under an executory contract of sale The maximum enhanced star exemption savings on our website is $1,000. Why switch to the star credit from the star exemption.

The star exemption program is closed to all new applicants. Use the links below to find the maximum star exemption savings amount for your school district segment. Annually for each school district segment, the amount of savings as a result of the star exemption cannot exceed the savings of the prior year.

For example, if you own the property and are applying for an exemption that will begin on july 1, 2021, you or your spouse or sibling must be 65 or older by december 31, 2021. How much is nys enhanced star exemption? When the basic exemption is fully phased in, they will receive at least a $30,000 exemption from the full value of their property.

Income is federal adjusted gross income minus the taxable amount of. Once you are approved for basic star, you need not reapply each year unless you move to a new primary residence. Eligible applicants have to own the property;

The dates pertain to assessing units that publish. This amount is computed by multiplying your municipality's prior year equalization rate by 30,000 multiplied by your county's sales price differential factor or your prior year's star exemption multiplied by.89 whichever amount is greater. I applied last august for the senior citizen homeowners’ exemption (sche) property tax exemption.

If you’re a new homeowner or you weren’t receiving the star exemption on your current home in 2015, you can register for the star credit to receive a check directly from new york state. If the total income of all owners and their spouses who live on the property is more than $250,000, you must register for the star credit with new york state. The maximum enhanced star exemption savings on our website is $1,000.

Basic star is for homeowners whose total household income is $500,000 or less. Enhanced star is available for seniors with incomes of $88,050 or less and is.

Ny Star Exemption

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Assessor

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Star Program Town Of Coeymans

Star Conference

Nys Changes Are Causing Confusion With The Star School Tax Relief Program

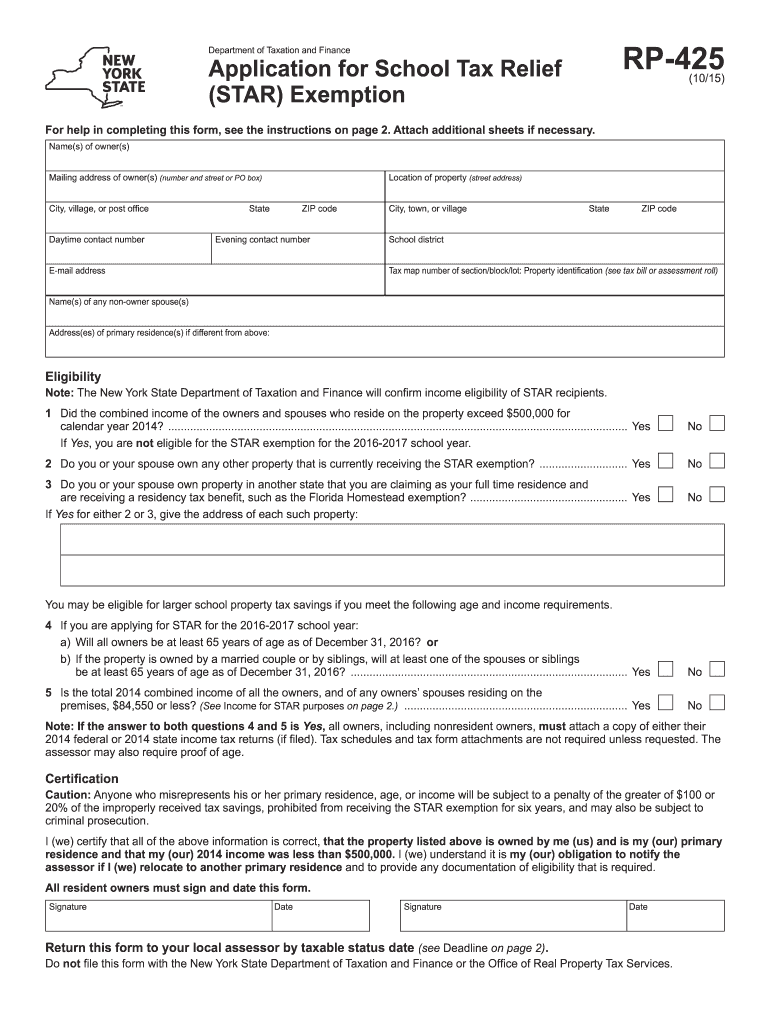

2015-2021 Form Ny Dtf Rp-425 Fill Online Printable Fillable Blank - Pdffiller

Lower Your School Taxes With The New York Star Program

2

The School Tax Relief Star Program Faq Ny State Senate

Star Conference

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Deadline For Star Approaching - Roohan Realty

Propertytax Exemptions In Jamestown At 37 Percent Higher Than 30 Percent Upstate Ny Average

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Ny Updates The Star Program Lumsden Mccormick

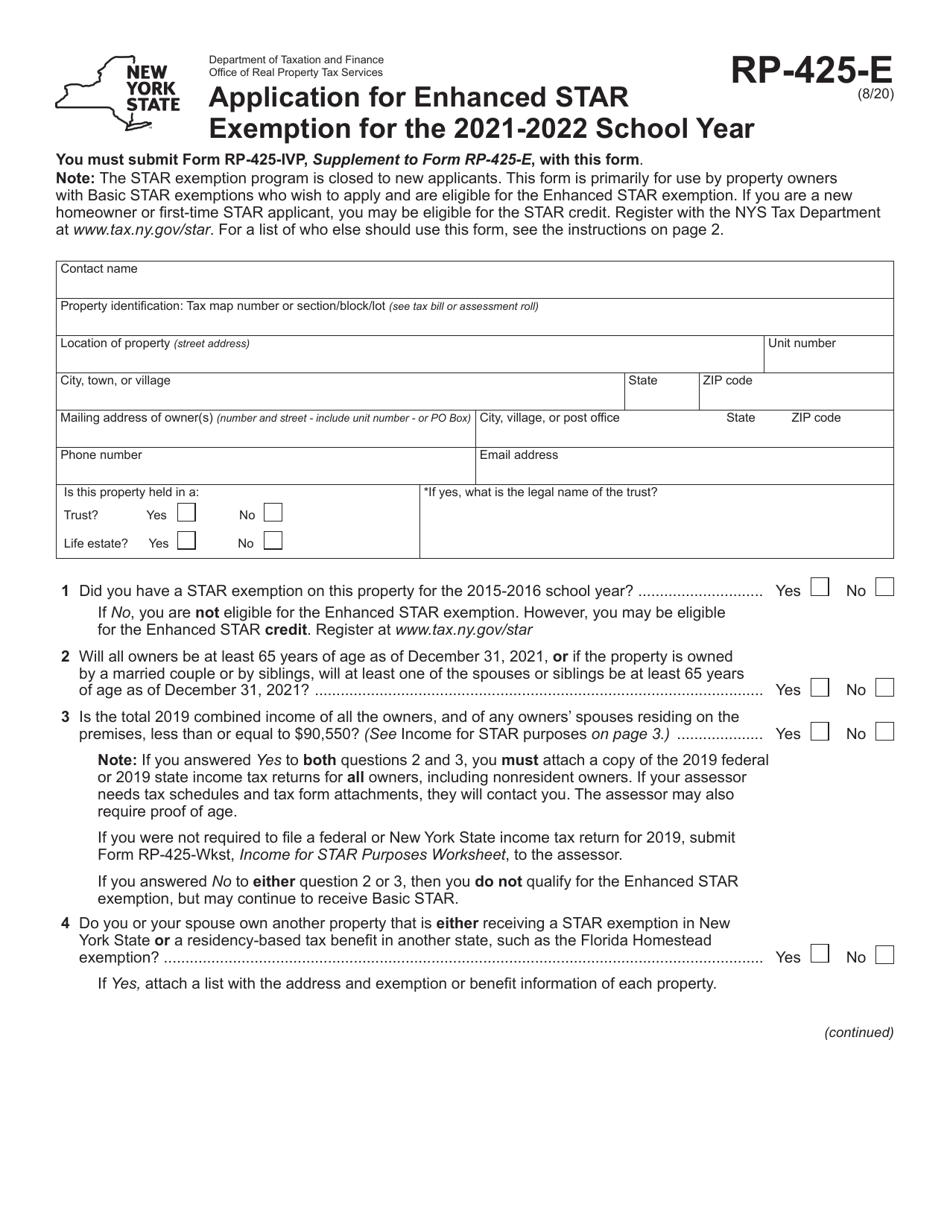

Form Rp-425-e Download Fillable Pdf Or Fill Online Application For Enhanced Star Exemption - 2022 New York Templateroller