The filing fee for llcs is $100. There were a few filing fee changes as well.

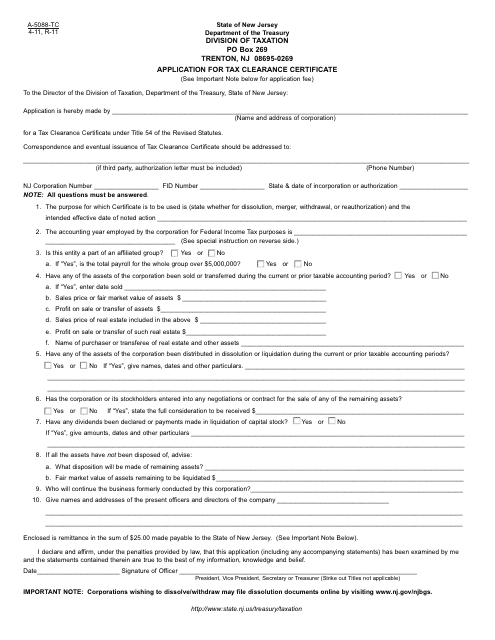

Application For Tax Clearance Certificate - Levy Clearance Certificate Template - Having This Certificate Means You Are In Sars Good Books - Clarksolt

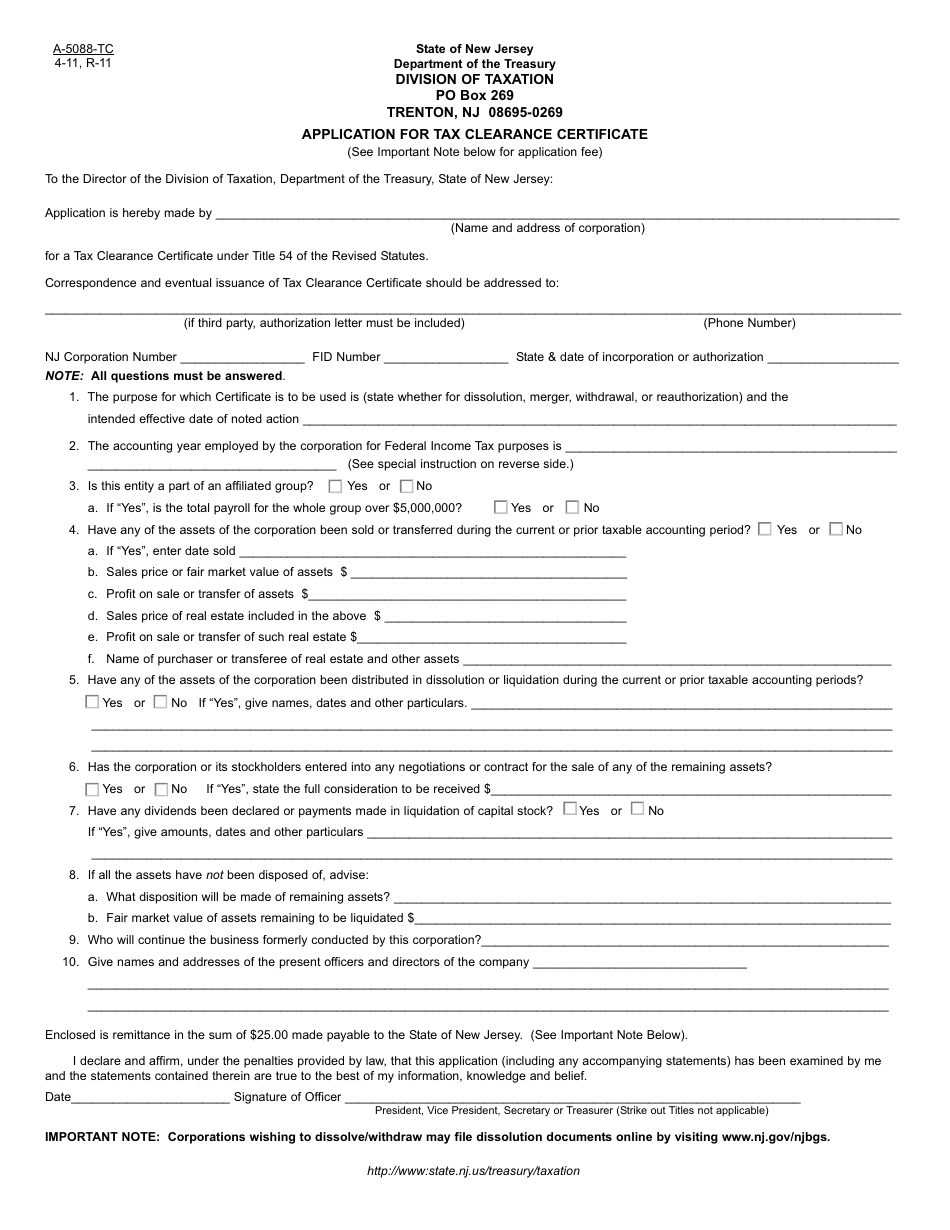

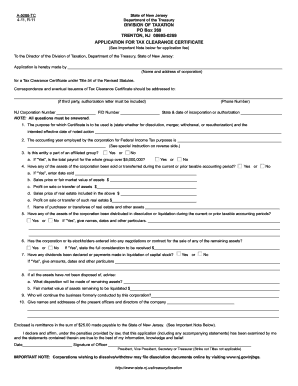

Fill out, securely sign, print or email your 5088 tc nj form instantly with signnow.

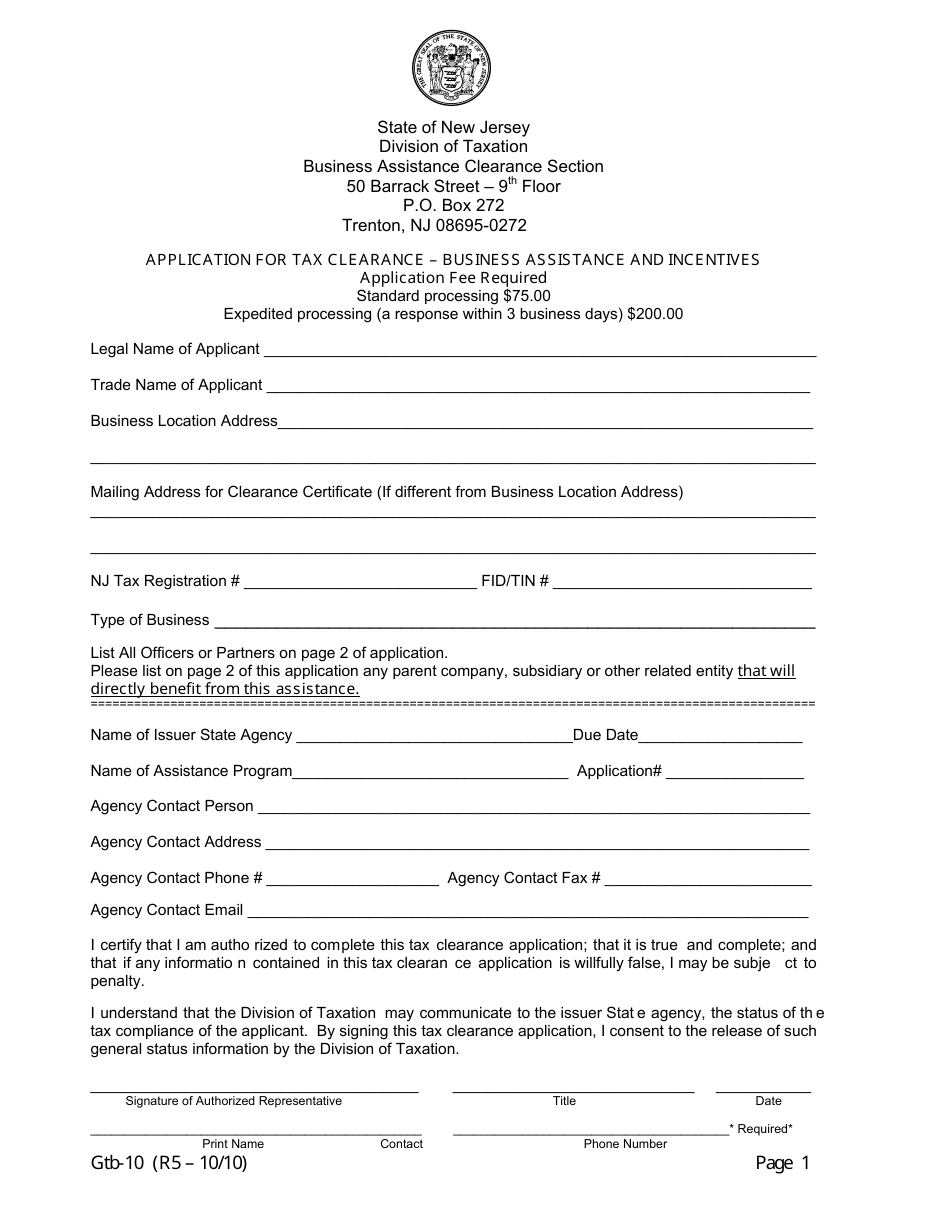

Nj tax clearance certificate for reinstatement. For all other business types, tax clearance is not required. A new jersey corporation has to pay a $120 filing fee, which includes $95 for the dissolution filing and $25 for the tax clearance. New jersey offers grants, incentives, and rebates to businesses, and every recipient must obtain a business assistance tax clearance certificate from the division of taxation.

Instructions for filing tax returns can be found on the form “procedure for dissolution, withdrawal or surrender”. Do i have to pay outstanding annual reports to close? New jersey offers grants, incentives, and rebates to businesses, and every recipient must obtain a business assistance tax clearance certificate from the division of taxation.

When will my annual report filing by reflected on the state's of new jersey's official. You will be able to complete the reinstatement process completely online. Available for pc, ios and android.

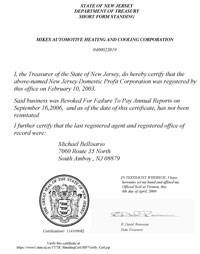

You will be notified of the reinstatement after the division of taxation issues the required tax clearance certificate. In new jersey a tax status compliance certificate is called a business entity status report and is issued by the new jersey division of revenue for a company (corporation or llc) or sole proprietor which has met all of its new jersey tax obligations. Revoked corporations also need tax clearance from the new jersey division of taxation to complete the reinstatement.

Application for tax clearance certificate must be typewritten or printed, and should be addressed to: New jersey's online annual reports and change services pursuant to state law, effective 7/9/2020, revoked domestic and foreign corporations seeking to reinstate will not be required to obtain tax clearance certificates, provided they file for. You will be able to complete the reinstatement process completely online.

In tennessee a tax status compliance certificate is called a letter of tax clearance and is issued by the tennessee department of revenue for a company or sole proprietor which has met all of its tennessee tax obligations. A tennessee department of revenue (dor) letter of tax clearance is often required for loans, to renew business licenses. To reinstate your new jersey entity you need to file application for reinstatement with new jersey department of the treasury and pay any fees, missing annual reports and penalties.

Do i owe any annual reports? New jersey offers grants, incentives, and rebates to businesses, and every recipient must obtain a business assistance tax clearance certificate from the division of taxation. Foreign corporations will be required to pay a separate $25.00 fee for the tax clearance certificate directly to the division of taxation.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Tax clearance certificate nj provides a comprehensive and comprehensive pathway for students to see progress after the end. If tax clearance is not required, you will be able to complete the reinstatement process completely online.

Tax clearance certificates are issued by the new jersey division of. If tax clearance is required, the system will generate an application and instructions for requesting a tax clearance certificate. Nj tax clearance certificate for reinstatement.

Ab 5607 also included a tax clearance certificate requirement for domestic and foreign limited liability companies (llcs) and domestic limited partnerships (lps) filing reinstatement requests two or more years after the entity has been placed on the inactive or revoked list. This includes the $95 filing fee and the $25 tax clearance fee. $75 for each outstanding annual report + $75 if revoked within the past 2 years or $95 if revoked over 2 years ago + $3 filing fee.

State of new jersey division of taxation po box 269 trenton, n.j. How do i close or end my business? $20.00 for tax clearance certificate (required if business was revoked for failure to pay annual reports over 2 years ago) $25.00 change of registered agent/office (if applicable) $3.00.

There is a $125 filing fee to cancel a new jersey foreign limited liability company. The reinstatement process won’t be finished until you submit the form and the division of taxation issues your tax clearance certificate. If you no longer wish to do business in new jersey, you must complete the reinstatement process first, then withdraw, cancel, or dissolve the business (also through dores).

Do you need to get a tax clearance certificate from the new jersey division of taxation? You will need tax clearance to reinstate a new jersey corporation. Not required to obtain a tax clearance certificate.

A tax clearance letter (known in new jersey as a tax clearance certificate) is a statement showing that a new jersey corporation has paid all state taxes it owes, including any penalties, interest, or fees due. New jersey department of the treasury : An additional $15 will apply for 8.5 business hours over the counter expedited service.

For the tax clearance certificate, you will have to pay $25. There is a $120 fee to withdraw a new jersey foreign corporation. Start a free trial now to save yourself time and money!

Do i have to reinstate my business in order to close? You will see the total payment due when you complete the online new jersey reinstatement process. Meanwhile, the current annual report fee is $50.

Has my application for tax clearance/reinstatement of corporate charter been processed? Nj tax clearance certificate for reinstatement. Credit card payments incur an additional $3 processing fee.

Application For Tax Clearance - New Jersey Free Download

Njgov

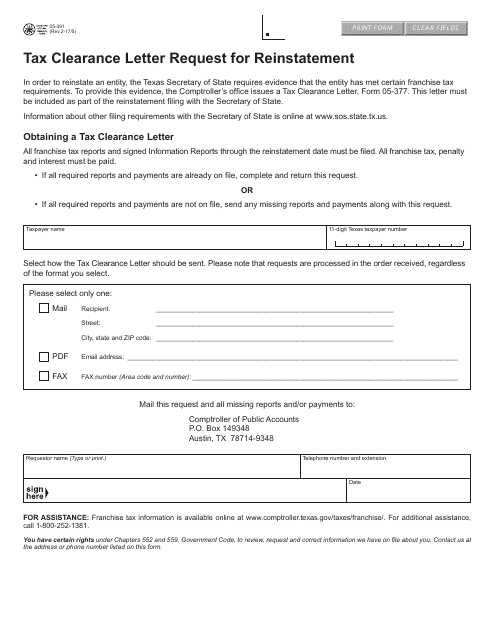

Form 05-391 Download Fillable Pdf Or Fill Online Tax Clearance Letter Request For Reinstatement Texas Templateroller

Tax Clearance - Fill Out And Sign Printable Pdf Template Signnow

Form A-5088-tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Tax Clearance Certificates Department Of Taxation

Application For Tax Clearance Certificate - Levy Clearance Certificate Template - Having This Certificate Means You Are In Sars Good Books - Clarksolt

Nj Temporarily Expedites Reinstatement And Dissolution Processes

Form A-5088-tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

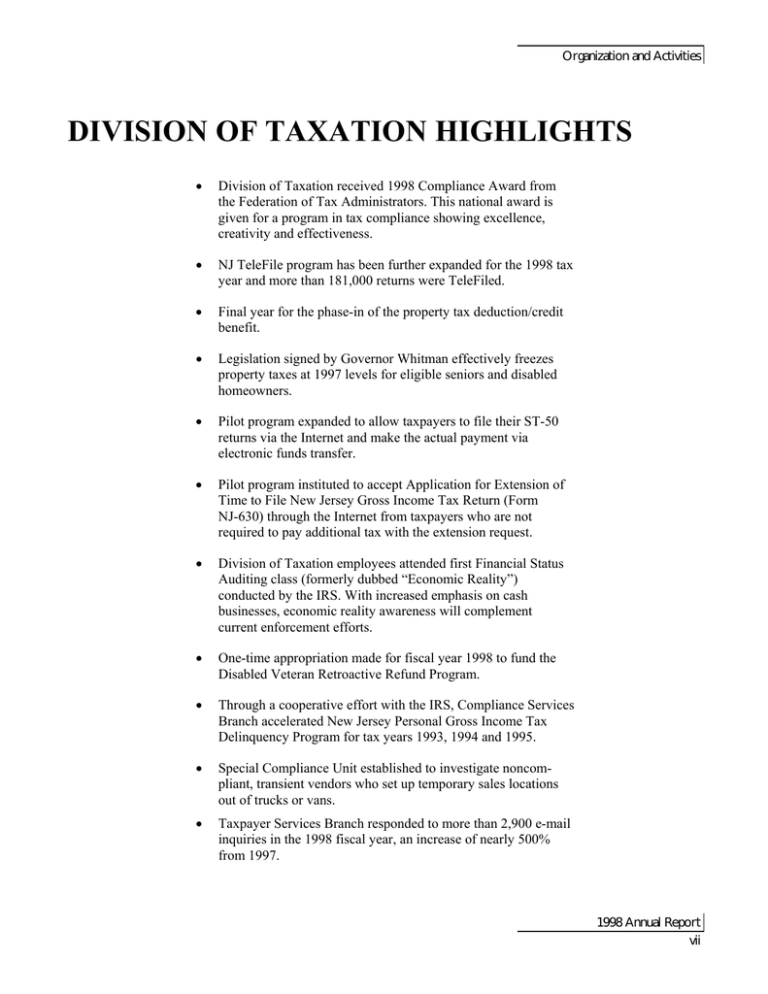

Division Of Taxation Highlights

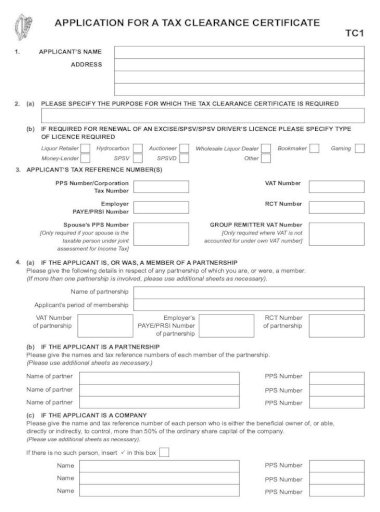

Application For Tax Clearance Certificate For An Individual In The Uk To Get This Information There Is No Actual Certificate - Formasi Dewa19 Dari Waktu Ke Waktu

Tax Clearance Certificate - Awesome_lock Down Sunday_special Tax Clearance Certificate New Application Renewal R 120-00 No Deposit Required No Upfront Payment More Information Whatsapp Call 0661593768 Tel 0875101847 Email Sarseservice

New Jersey Good Standing Certificate - New Jersey Certificate Of Existence

Statenjus

Form Gtb-10 Download Fillable Pdf Or Fill Online Application For Tax Clearance - Business Assistance And Incentives New Jersey Templateroller

How To Dissolve A New Jersey Corporation Incorporation Rocket

A 5088 Tc - Fill Out And Sign Printable Pdf Template Signnow

Application For Tax Clearance - New Jersey Free Download

Tax Clearance Certificate Nj - Fill Online Printable Fillable Blank Pdffiller