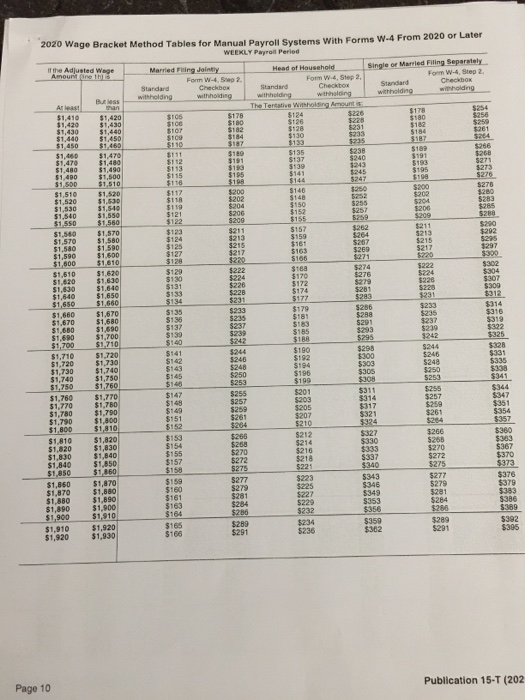

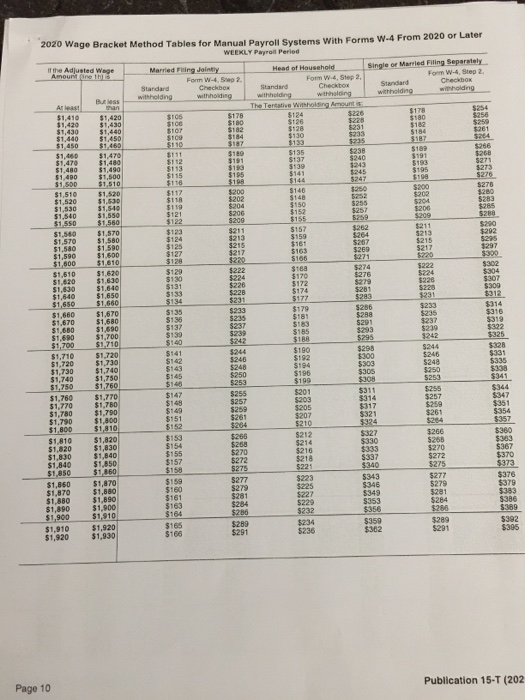

The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time. All tables within the circular en have changed, and should be used for wages, pensions and annuities, and gambling winnings paid on or after january 1, 2022.

Nebraska Payroll Tools Tax Rates And Resources Paycheckcity

For employees who earn more than $200,000 per year, you’ll need to withhold an additional medicare tax of 0.9%, which brings the total employee medicare withholding above $200,000 to 2.35%.

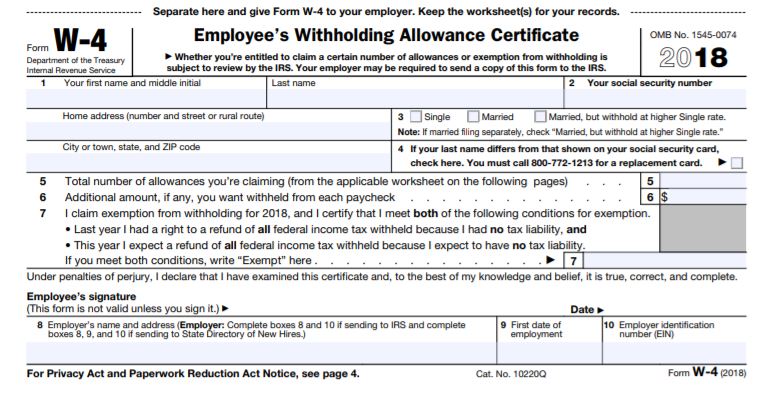

Nebraska tax withholding calculator. Free federal and nebraska paycheck withholding calculator. In 2012, nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Instead you fill out steps 2, 3, and 4.)

This tax calculator performs as a standalone state tax calculator for nebraska, it does not take into account federal taxes, medicare decustions et al. August 5, 2021 by kevin e. Categories federal withholding tables tags nebraska tax withholding calculator, nebraska withholding tax, nebraska withholding tax account, nebraska withholding tax application, nebraska withholding tax due date, nebraska withholding tax form, nebraska withholding tax form 2021, nebraska withholding tax rate, nebraska withholding tax.

Payroll check calculator is updated for payroll year 2021 and new w4. By the quantity of cash being held back, the employees have the ability to claim tax returns credit history. Read listed below to learn more about it, in addition to to obtain nebraska.

Calculate your state income tax step by step 6. Average for states with income taxes. The ne tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in nes.

Income tax withholding reminders for all nebraska employers circular en. If you need to create the paychecks and paystubs by entering the federal and state tax amount, you can refer to this article how to generate after the fact paychecks with stubs The top rate of 6.84% is about in line with the u.s.

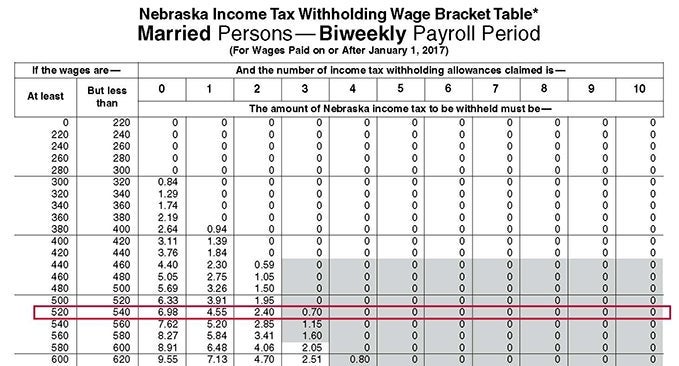

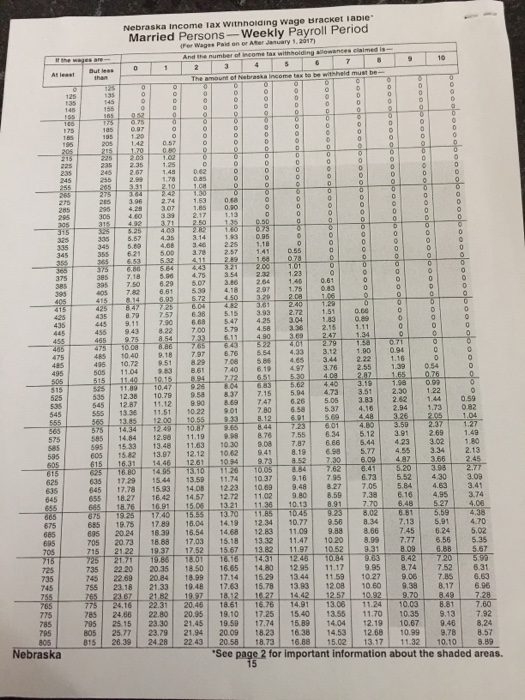

Divide the annual nebraska tax withholding calculated in step 6 by the number of pay dates in the tax year to obtain the biweekly nebraska tax withholding. Check the 2020 nebraska state tax rate and the rules to calculate state income tax 5. You don’t need to match the.

Calculate net payroll amount (after payroll taxes), federal withholding, including social security tax, medicare, and state payroll withholding, such as state disability insurance, state unemployment insurance and others. It provides many changes such as the tax bracket changes and the tax price yearly, combined with the option to use a computational link. This year of 2021 is also not an exemption.

The nebraska income tax calculator is designed to provide a salary example with salary deductions made in nebraska. If you like to calcualte state tax withholdings manually, you can refer to the nebraska tax tables; The circular en also includes the percentage method tables and the tax table brackets used to calculate nebraska taxes for income tax withholding from each employee for wages paid on or after january 1, 2017.

Check out paycheckcity.com for nebraska paycheck calculators, withholding calculators, tax calculators, payroll information, and more. The nebraska withholding tax can be used after you follow the method to determine the federal tax withholding. The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for nebraska residents only.

It will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status, payroll frequency of pay (payroll period), number of dependents or federal and state exemptions). Calculate nebraska state income tax manually; 2021 payroll tax and paycheck calculator for all 50 states and us territories.

The overview may be utilized by employers to calculate the total of their staff member’s withholding federal income tax from their salaries. The nebraska tax calculator is designed to provide a simple illlustration of the state income tax due in nebraska, to view a. Federal income tax withholding method:

Today, nebraska’s income tax rates range from 2.46% to 6.84%, with a number of deductions and credits that lower the overall tax burden for many taxpayers. No cities in the cornhusker state have local income taxes. It is not a substitute for the advice of an accountant or other tax professional.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. Employer federal tax withholding tables 2021. Free nebraska payroll tax calculator and ne tax rates.

Review additionally to recognize just how the procedure works officially. The nebraska tax calculator is updated for the 2021/22 tax year. And step by step guide there.;

The nebraska tax calculator is updated for the 2021/22 tax year. To use our nebraska salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. Until 5:00 p.m., monday through friday.

Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status. Nebraska tax withholding calculator nebraska withholding tax. The lincoln office is open from 7:30 a.m.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. If you want to simplify payroll tax calculations, you can download ezpaycheck payroll software, which can calculate federal tax, state tax, medicare tax, social security tax and other taxes for you. The nebraska department of revenue is issuing a new nebraska circular en for 2022.

Nebraska Payroll Tools Tax Rates And Resources Paycheckcity

W-4 State Withholding Tax Calculation 2020 Based On The State Or State-equivalent Withholding Certificate Sap Blogs

Income Tax Withholding Faqs Nebraska Department Of Revenue

Nebraska Paycheck Calculator - Smartasset

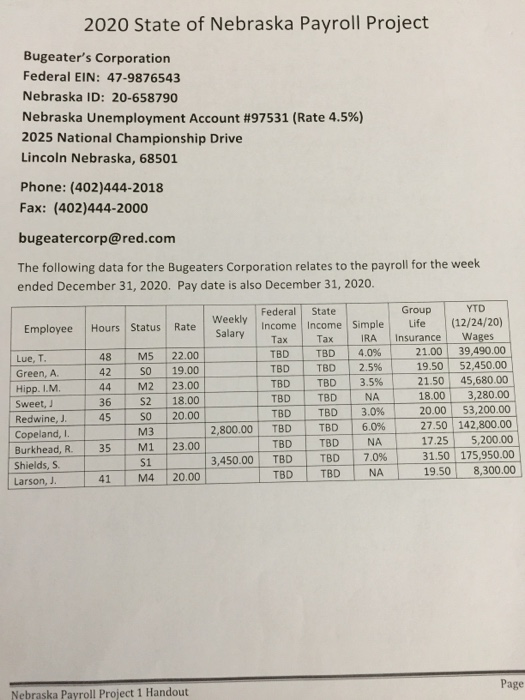

I Really Need Your Help Please Help Me I Need Get Cheggcom

1040ez Tax Calculator Nebraska Energy Federal Credit Union

Accounting For Agriculture Federal Withholding After New Tax Bill Cropwatch University Of Nebraskalincoln

Nebraska Paycheck Calculator - Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2021

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Nebraska Payroll Calculator 2021 Ne Tax Rates Onpay

How To Adjust Your Tax Withholdings Using The New W-4 - Entertainment Partners

2021 Federal Tax Withholding Tables Printable - Federal Witholding Tables 2021

Nebraska Payroll Tools Tax Rates And Resources Paycheckcity

Irs Issues New Federal Payroll Tax Withholding Tables Nebraska Today University Of Nebraskalincoln

I Really Need Your Help Please Help Me I Need Get Cheggcom

Sales Taxes In The United States - Wikipedia

Nebraska Salary Calculator 2022 Icalculator

I Really Need Your Help Please Help Me I Need Get Cheggcom