After the final payment, families can expect the rest of the tax credit next year after they claim the child tax credit for 2021. It doesn’t matter if they were born on january 1 at 12:01 a.m.

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

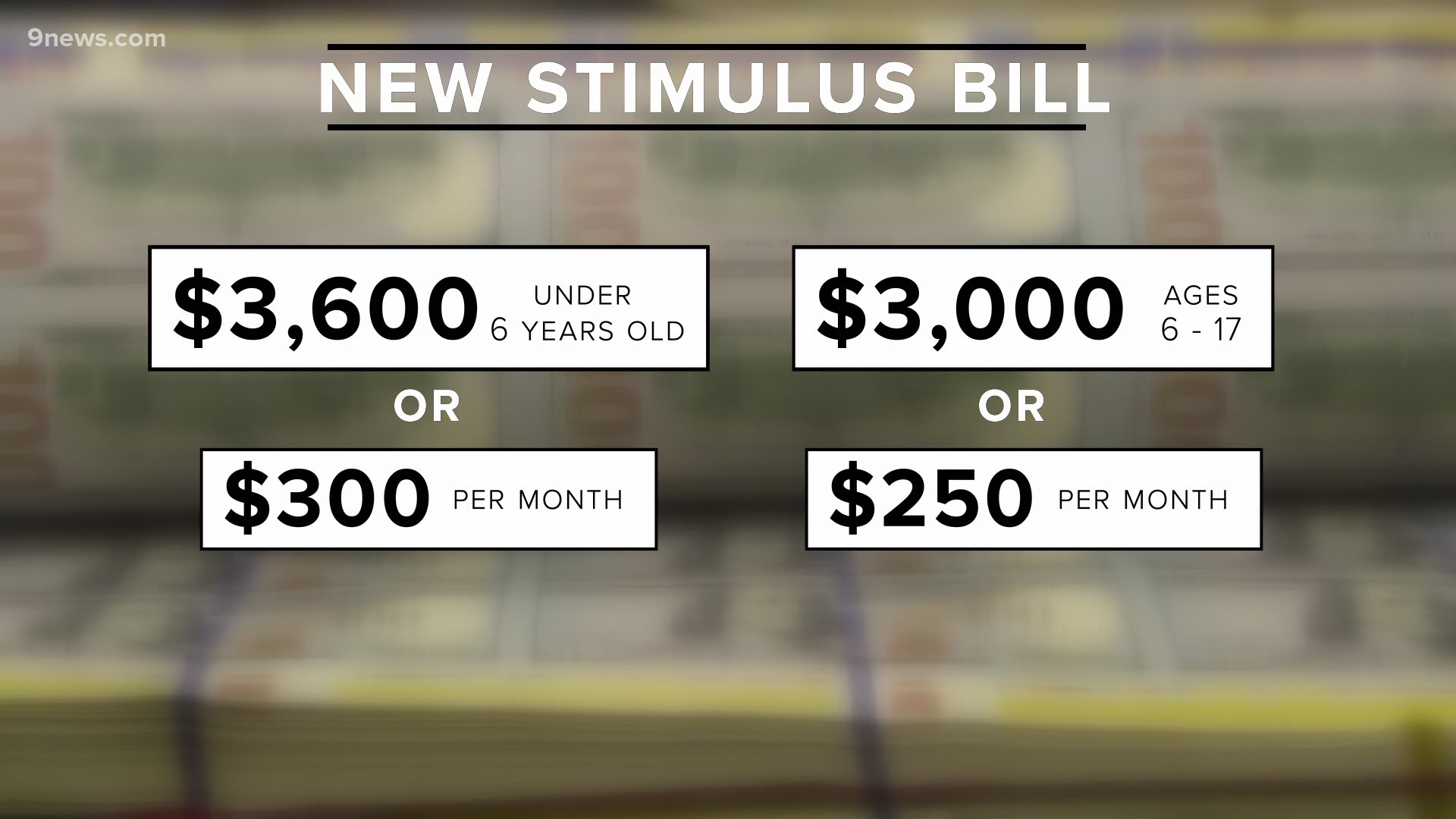

The child tax credits are worth $3,600 per child under six in 2021, $3,000 per child between six and 17 and $500 for college students aged up to 24.

Child tax credit after december 2021. 2021 child tax credit payments end this month. Are you getting the december child tax credit payment? 2021 child tax credit maximum payments age 5 and younger up to $3,600, with half as $300 advance monthly payments

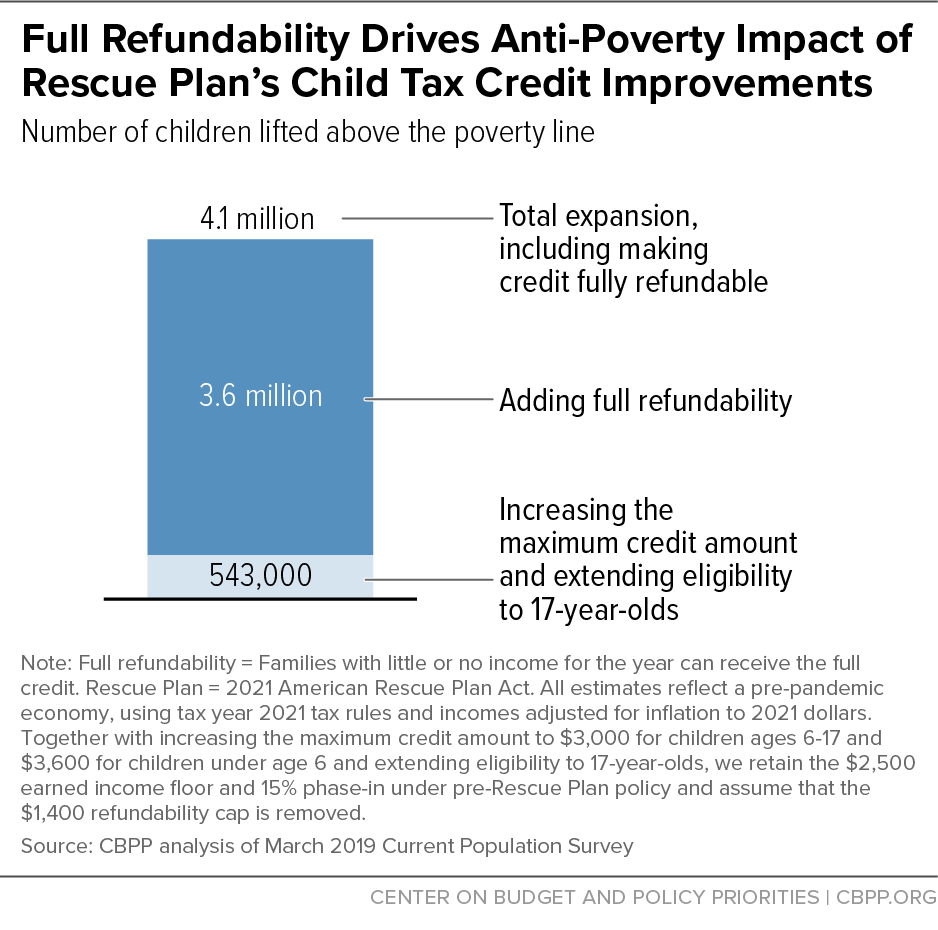

Important changes to the child tax credit are helping many families get advance payments of the credit: A recent study published by the urban institute shows that if the child tax credit is extended beyond 2021, it could substantially reduce child poverty in the vast majority of us states. In 2021 there were six monthly payments sent between july and december, with the second half of the child tax credit arriving in 2022, whereas for.

Only one child tax credit payment remains in 2021, with the last payment set to roll out on december 15. But you could still get an extra $1,800 per kid. After the last advance payment this december, more money awaits you in 2022.

The 2021 advance monthly child tax credit payments started automatically in july. Half the total credit amount is being paid in advance. The child tax credit monthly payments began in july 2021 and will continue through december.

Eastern time on november 29, 2021. You may need to pay it back. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m.

In 2021 then you will receive the child tax credit, so long as your income is below $440,000 (if you’re married and filing jointly). The enhanced child tax credit is set to expire after december 2021. Or december 31 at 11:59 p.m., if your child was born in the u.s.

However, biden, in his american families plan, proposed to extend it through 2025. This means a december payment of up to $1,800 for each child under 6, and up to $1,500 for each child age 6 to 17. Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money.

Families will be able to claim the remaining value of the credit during tax season. Millions of american families with kids are set to receive the last of six advance monthly child tax credit payments dec. 31, 2021, will receive the full $3,600 tax.

Based on the guidance published by the irs in their contingency plan, it does not seem likely that the december child tax credit payment will be impacted. The final $300 advanced child tax credit payment for 2021 is coming on december 15 credit: Payments have been worth up to $300 per child, per month since they began in july 2021.

The child tax credits are worth $3,600 per child under six in 2021, $3,000 per child aged between six and 17, and $500 for college students aged up to 24. Child tax credit the final payment for the child tax credit will be made on 15 december. Families with kids under age 6 can expect up to $1,800, while families with kids between the ages of 6 and 17 can expect up.

The payments have been issued as part of president joe biden's american rescue plan. Those families who are receiving the payment by a physical check should expect it to arrive by the end of december. Families will also receive the second part of the child tax credit when they file their taxes in 2022.

That means all qualifying children (there are other requirements we explain below) born on or before dec. This is the same total amount that most other families have been receiving in up. Yet, just a few days earlier, dec.

Scam Alert Child Tax Credit Is Automatic No Need To Apply - Oregonlivecom

What To Know About The First Advance Child Tax Credit Payment

What A Government Shutdown Would Mean For Last Child Tax Credit Check

Child Tax Credit 2021 Payments How Much Dates And Opting Out - Cbs News

Ea_hqrg-etgyqm

Child Tax Credit Schedule Last Payment Coming On December 15 Marca

Decembers Payment Could Be The Final Child Tax Credit Check What To Know - Cnet

2021 Child Tax Credit Heres Who Will Get Up To 1800 Per Child In Cash And Who Will Need To Opt Out

/cdn.vox-cdn.com/uploads/chorus_asset/file/22959685/AP21257518603072.jpg)

Stimulus Checks Will There Be Child Tax Credit Payments In 2022 - Deseret News

Todays The Last Day To Opt Out Of The December Child Tax Credit Check What To Know - Cnet

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know - Cnet

The Child Tax Credit Toolkit The White House

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs - Fingerlakes1com

Child Tax Credit Dates As Irs Set To Send Out New Payments

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Child Tax Credit Key Deadline Nears As November Payment Looms

November Child Tax Credit Deadline To Opt Out Near Irs Reveals Updated Payment Dates - Fingerlakes1com

Irs Child Tax Credit Payments Start July 15