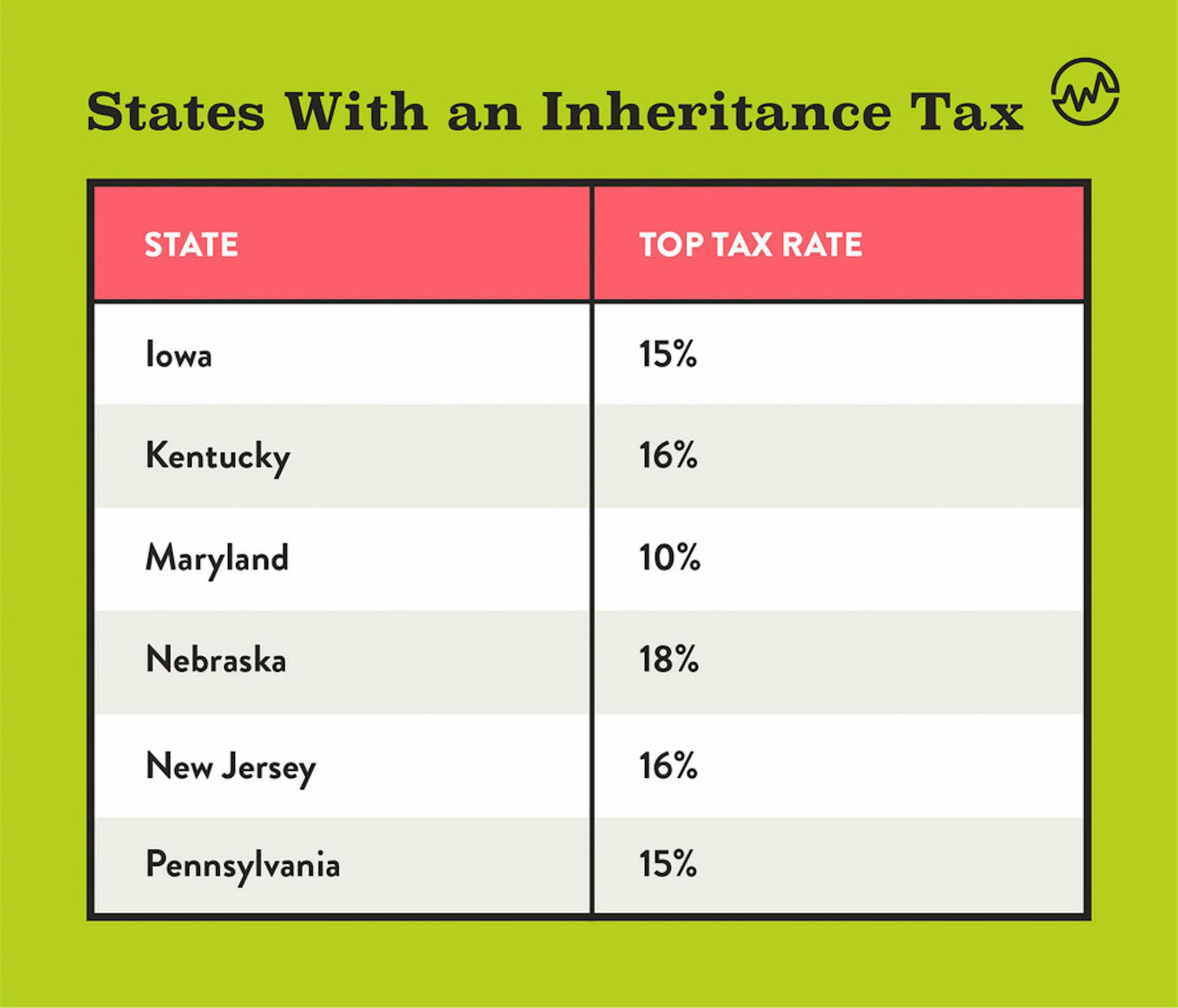

For any amount over $12,500 but not over $25,000, then. Kentucky is one of seven states that has it inheritance tax.

Jefferson County Ky Property Tax Calculator - Smartasset

Class a beneficiaries pay no taxes on their inheritances.

Kentucky inheritance tax calculator. The kentucky inheritance tax is a tax imposed on certain beneficiaries who inherit property or money from a kentucky estate. Immediate family (spouse, parent, child) exempt. Immediate family such as a surviving spouse, child, or parent is often exempt from paying taxes on an inheritance received from the deceased.

Free estate tax calculator to estimate federal estate tax in the u.s. While they do assess an income tax and of course real estate taxes, there is no estate tax. The inheritance tax is not the same as the estate tax.

Kentucky's revised statutes (krs 391.035) outlines court procedures for the handling of. The kentucky inheritance tax is a tax on a beneficiary’s right to receive property from a deceased person. However, class a beneficiaries, which consist of the decedent’s closest relatives (such as the son in this example), are completely exempted from the tax.

If someone dies without a will, the division of their property must be decided by the state in a process known as probate, which is a legal proceeding that can be costly and takes several months to complete. But this calculator can help you estimate what potential inheritance tax bill your heirs might potentially have to pay. Some states, like tennessee, impose neither an inheritance or estate tax (though federal estate taxes may apply to qualifying estates).

Ad an inheritance tax expert will answer you now! In kentucky, real and personal property will be valued at its fair cash value on the decedent's date of death. Most of the time, the closer the relationship the greater the exemption and the smaller the tax rate.

Kentucky is a reasonably friendly tax state. Class b beneficiaries are subject to an inheritance tax ranging from 4% to 16% class c beneficiaries are subject to an inheritance tax ranging from 6% to 16%. Inheritance tax paid on what you leave behind to your heirs, and they could pay as much as 40% tax on what they inherit.

In iowa, siblings will pay a 5% tax on any amount over $0 but not over $12,500. The kentucky inheritance tax is a tax on the right to receive property upon the death of another person. Unlike estate tax, which can be levied by both the federal government and states, inheritance tax comes out of the beneficiary’s pocket — not out of the estate.

Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a property owner. States levy inheritance tax on money and assets after they’re already passed on to a person’s heirs. Class a, class b, and class c.

216 rows kentucky has a flat income tax rate of 5%, a statewide sales tax of 6% and. The kentucky inheritance tax rates. Kentucky inheritance tax is levied on three classes of estate beneficiaries at the decedent’s death:

The highest marginal rate of inheritance tax is 16%. The size of the inheritance and the beneficiary. Kentucky has an inheritance tax ranging from 4% to 16% that varies based on.

The class c group can end up paying tax rates anywhere from 6% to 16%. The kentucky revenue cabinet has published a convenient guide to inheritance and estate taxes which includes a tax table on page 6 that helps to calculate the amounts due under kentucky’s inheritance tax. Ad an inheritance tax expert will answer you now!

Most states do not impose an inheritance tax or an estate tax. Kentucky inheritance and estate tax laws can be found in the kentucky revised statutes, under chapters: Inheritance tax is a state tax charged by only six states when someone receives an inheritance from someone who has died.

Kentucky does have an inheritance tax. The rate of tax and the exemptions allowed depend on the legal relationship of the beneficiary to the decedent. Kentucky inheritance and gift tax.

By way of example, if the deceased person was a resident of kentucky (rather than a nonresident who owned property in kentucky), a class b inheritor who inherited $25,000 would pay $860 plus 6% of the amount over $20,000 or $2,060. Click to see full answer. The calculation of the inheritance tax depends on what class of heir you fall under and the net estate amount.

Like most other states that impose this tax, the kentucky inheritance tax rates are straightforward and easy to understand. For a detailed chart, see the inheritance tax table in the kentucky department of revenue's inheritance tax guide. Like most estate taxes, inheritance taxes are progressive in all states that use them.

Iowa department of revenue (2020). The six states with inheritance taxes are: Gifts made within three years of death will also be taxed.

The good news is that there are lots of ways to cut down your bill, which we've explained in full in our guides to inheritance tax. The amount of the inheritance tax depends on the relationship of the beneficiary to the deceased person and the value of the property. Beneficiaries are responsible for paying the inheritance tax.

Immediate family (spouse, parent, child, sibling) exempt. Class b beneficiaries pay a tax rate that can vary from 4% to 16%.

The Kentucky Income Tax Rate Is 5 - Learn How Much You Will Pay On Your Earnings

How To File The Inventory Tax Credit - Department Of Revenue

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Historical Kentucky Tax Policy Information - Ballotpedia

Pin On Finance

The Kentucky Income Tax Rate Is 5 - Learn How Much You Will Pay On Your Earnings

Kentucky Income Tax Calculator - Smartasset

2

Kentucky Estate Tax Everything You Need To Know - Smartasset

Calculating Inheritance Tax - Lawscom

Clerk Network - Department Of Revenue

States With Highest And Lowest Sales Tax Rates

Kentucky Estate Tax Everything You Need To Know - Smartasset

This Client Received Over 500000 In 179d Epact Tax Deductions For Their Energy Efficiency Efforts Engineered Tax Services

Property Taxes On Owner-occupied Housing By State Tax Foundation Infographic Map Map Social Science

Pin On Campaign Posters

Kentucky Estate Tax Everything You Need To Know - Smartasset

Kentucky Income Tax Calculator - Smartasset

Alcohol Taxes - Department Of Revenue