Residence allowance gives you an additional amount of value your estate can reach before inheritance tax is due on it. Despite these recommendations, the government confirmed in the march 2021 budget that the personal allowance for cgt will be frozen until 2026.

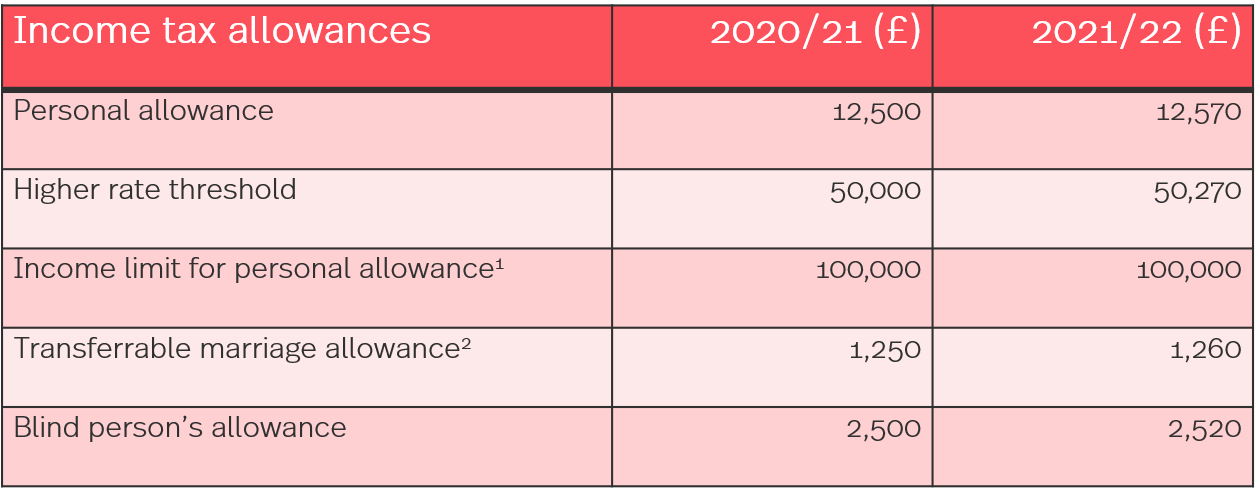

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Capital gains tax uk changes are coming.

Inheritance tax changes 2021 uk. Capital gains tax allowance frozen The introduction of any changes to inheritance tax has been ruled out by the uk government. The inheritance tax charged will be 40% of £175,000 (£500,000 minus £325,000).

The second part of the report is due in 2021. The inheritance tax (delivery of accounts) (excepted estates) (amendment) regulations 2021 comes into force on 1 january 2022 and make the following changes: Your spouse or civil partner has the same allowance, effectively doubling what you can pass on to £350,000.

In the current tax year, 2021/22, no inheritance tax is due on the first £325,000 of an estate, with 40% normally being charged on any amount above that. Proposed changes to capital gains tax rules, which would affect certain types of land sales, have also been ruled out. For gifts of cash the donor would be required to withhold 10% of the gift to pay the tax.

Hmrc data published last month showed that inheritance tax receipts were up £700million in the period, reaching £2.7billion, as both the nil rate band and residence nil rate remained frozen at. Under the proposed changes, these families could find themselves with a bill for up to 20% tax (subject to a de minimus value of £2 million). They raise the gross threshold value of an excepted estate from £1,000,000 to £3,000,000.

The exact allowance will change each tax year, for example it was £125,000 in the 2018/2019 tax year, £150,000 in 2019/2020, and £175,000 in 2020/2021. This means the value of assets one can cash in without paying tax could be much smaller. However, there are some important exceptions to the rule.

The key changes to the inheritance tax treatment of settlements are summarised below. First, your spouse or civil partner never has to pay iht when inheriting your estate. This measure implements a commitment given in command paper ‘tax policies and consultations spring 2021’ (cp 404, march 2021) to reduce administrative burdens for those dealing with iht.

The property allowance will be layered on top of your inheritance tax allowance, which has. Changes to cgt on inherited. However, what is charged will be less if you leave behind your home to your direct descendants, such as children or grandchildren.

Annual allowance of £30,000 which cannot be carried forward. The ots recommended the new personal allowance be reduced from £12,300 to between £2,000 and £4,000. A recent report from the uk office of tax simplification (ots) following a review of the capital gains tax (cgt) has outlined some recommended changes to capital gains tax.

Gifts in excess of £30,000 would be taxed at 10%. The estate can pay inheritance tax at a reduced rate of 36% on some assets if. Will inheritance tax change in 2021?

A rise in the value threshold of the estate’s chargeable trust property from £150,000 to £. Whilst any liability could be paid in instalments, the cash would still need to be found either by selling the assets or from the recipient’s net income. It still means, however, that married couples and civil partners can give away up to £1m free of inheritance tax.

Reducing the iht tax rate of 40% to a rate of 10% for estates up to £2m, 20% for estates over £2m.

Inheritance Tax Planning December 2021 Uk Guide

Inheritance Tax Do You Qualify For The New 1m Allowance Brewin Dolphin

What Reliefs And Exemptions Are There From Inheritance Tax Low Incomes Tax Reform Group

Should You Claim 0 Or 1 On Your Tax Return Tax Return Personal Financial Planning Tax

The Comprehensive Guide To Inheritance Tax Moneyfactscouk

Can An Executor Inherit From A Will In 2021 Medical Health Insurance Health Insurance When Someone Dies

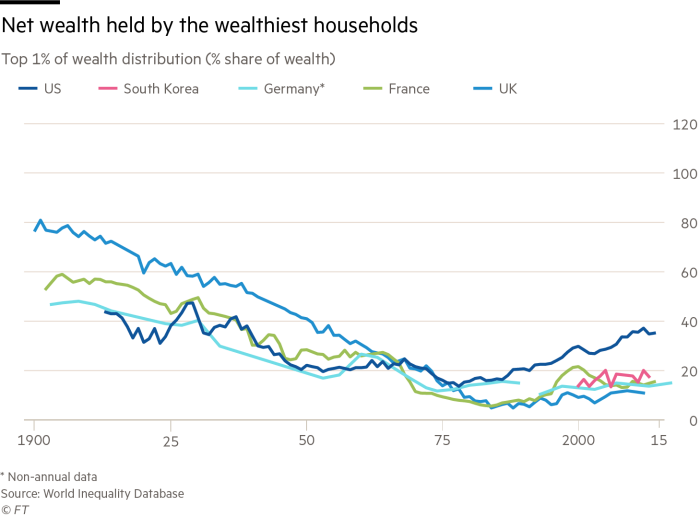

The Future Of Uk Inheritance Tax Lessons From Other Countries Financial Times

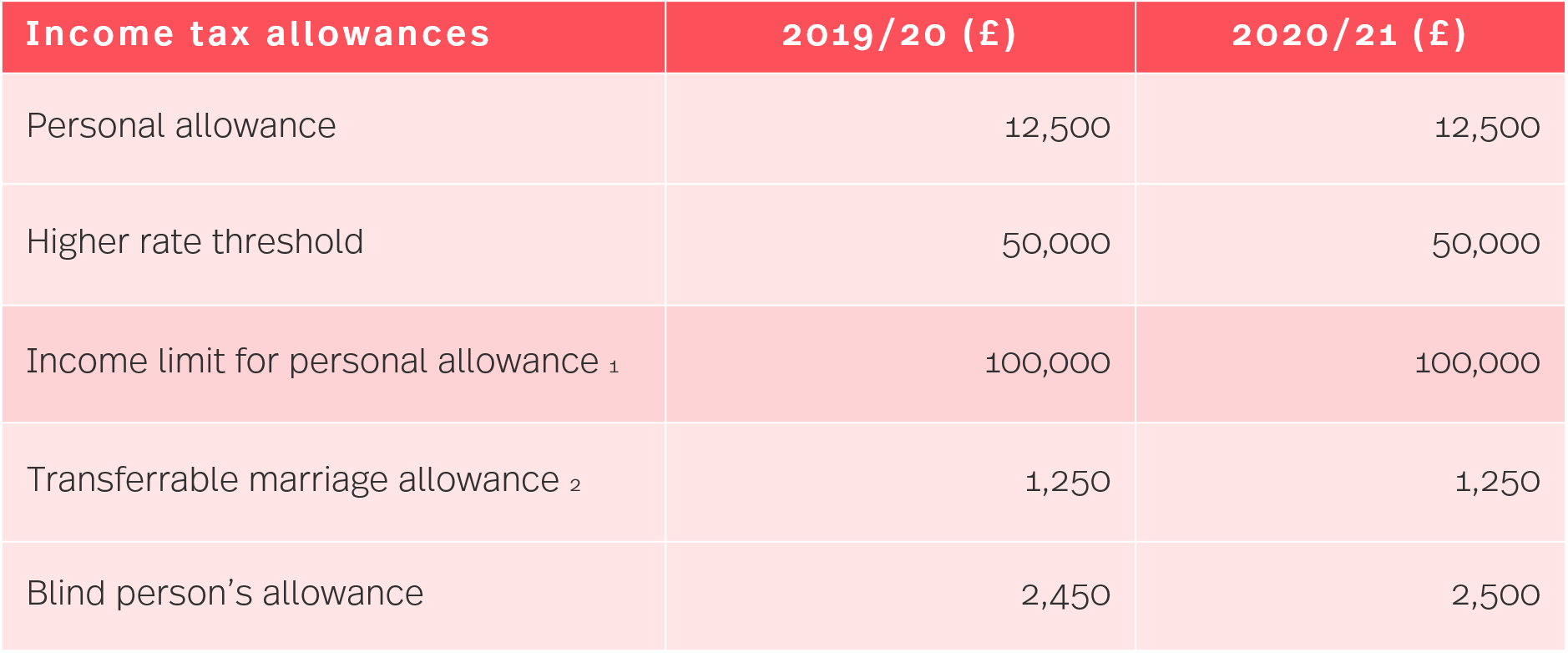

Simmons Simmons Hmrc Tax Rates And Allowances For 202021

The Future Of Uk Inheritance Tax Lessons From Other Countries Financial Times

Devolution In Chaebol Family Lg Nominated Chairman May Face With Usd 1 Billion Inheritance Tax Inheritance Tax Rochester Institute Of Technology Inheritance

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

The Telegraph Tax Guide 2021 - 45th Edition By Joe Mcgrath Hardcover In 2021 Tax Guide Inheritance Tax Financial News

The Proposed Changes To Cgt And Inheritance Tax For 20212022 - Bph

Tax Planning For Non-residents Non Doms 201920 Paperback - Walmartcom In 2021 Inheritance Tax How To Plan Tax Guide

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Can An Executor Inherit From A Will In 2021 Medical Health Insurance Health Insurance When Someone Dies

Making Tax Digital Accountant In 2021 Accounting Services Bookkeeping Services Accounting

Klwrj6vojcafkm

Papers Of The International Academy Of Estate And Trust Law - 2001 Hardcover In 2021 Academy Trust Common Law