And the standard deduction is increasing to $25,900 for married couples filing together and $12,950 for. On annual earnings from £2,098 to £12,726:

Best Online Auto Insurance Quotes In 2021

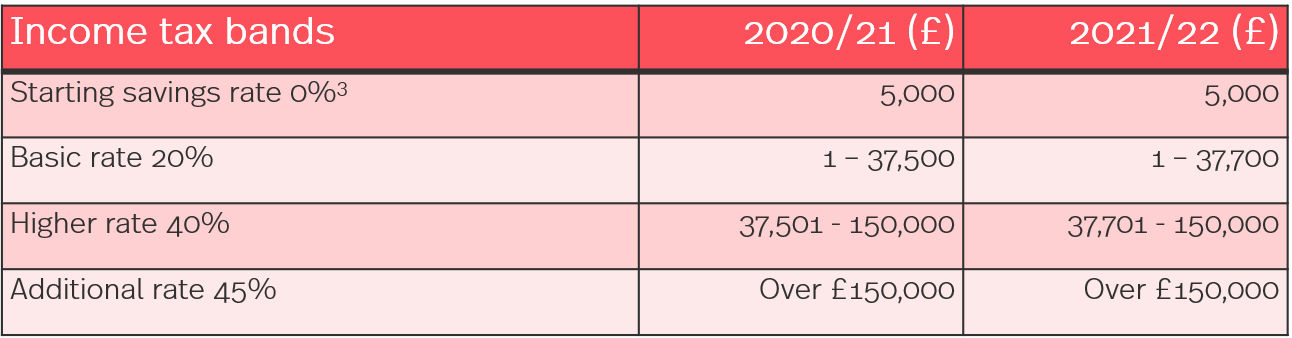

It will set the personal allowance at £12,570, and the basic rate limit at £37,700 for the following tax years:

Income tax rates 2022 uk. The dividend rates of income tax following the april 2022 increase will be 8.75 percent for taxpayers subject to income tax at the basic rate, 33.75 percent at the higher rate and 39.35 percent at the additional rate (the annual income threshold for the additional rate being £150,000). Starting from the 2022 fiscal year onwards, the corporate income tax rate is 22 percent,” wrote the dgt in a written statement, wednesday (13/10). In scotland the starter rate of 19% is paid on taxable income over the personal allowance to £2,097, the basic rate of 20% is paid from £2,098 to £12,726 and the.

The dividend ordinary rate will be set at 8.75%, the dividend upper rate will be set at 33.75% and. Income taxes in scotland are different. 2022 federal income tax brackets and rates.

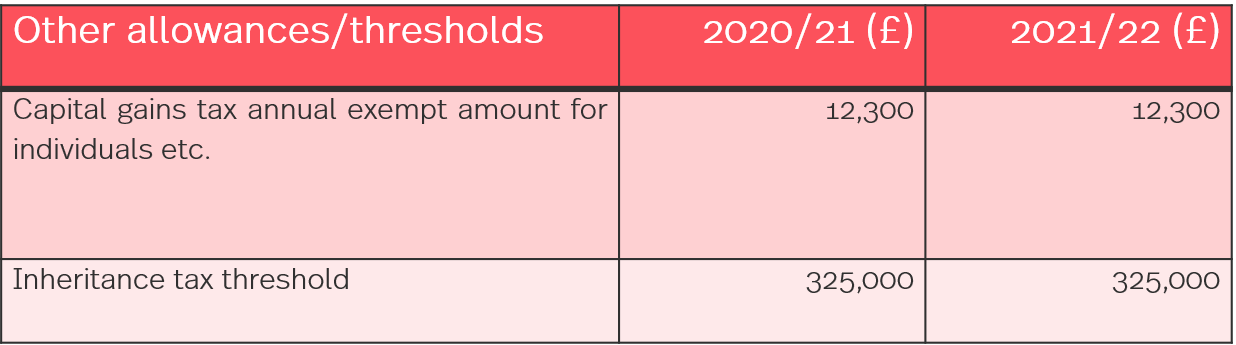

On annual earning above the paye tax threshold and up to £2,097: Uk income tax rates and bands 2021/22. • income tax relief at 50% • capital gains exemption on disposal capital gains from the disposal of other assets may be exempt up to £50,000 per annum by making an seis investment.

• income tax relief at 30% • capital gains exemption on disposal In england, wales and northern ireland the basic rate is paid on taxable income over the personal allowance to £37,700. Find out more in our guide to income taxes in scotland.

The last ten years has seen a sharp decrease of canadian tax rates. High income child benefit charge (hicbc) 1% of child benefit for each £100 of adjusted net income between £50,000 and £60,000. As announced at budget 2021, the government will maintain the personal allowance at £12,570 and higher rate threshold at £50,270 for 2022 to 2023, 2023 to.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The scottish rates and bands do not apply for savings and dividend income, which are taxed at normal uk rates. The new measure will apply to workers, pensioners and limited company directors.

You’ll pay anywhere between 0% to. The scottish rates and bands do not apply for savings and dividend income, which are taxed at normal uk rates. £ 151.97 per week or 90% of average weekly earnings (whichever is the lower) £ 156.66 per week or 90% of average weekly earnings (whichever is the lower) higher rate for smp/sap

2022/2023 (for whole weeks commencing from 3rd april 2022) earnings threshold: The scottish rates for 2022/23 have not yet been announced. The scottish rates for 2022/23 have not yet been announced.

There are seven federal income tax rates in 2022: The amount of gross income you can have before your personal allowance is reduced personal allowance is reduced by £1 for every £2 over the limit * personal allowance will only be reduced to the basic personal allowance unless income is over £100,000. Venture capital trusts (vcts) relief on investments in certain quoted companies up to £200,000 per annum:

Income limit (born after 5. The irs has announced higher federal income tax brackets for 2022 amid rising inflation. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Income tax rates 2022/23 gov.uk. Standard rate for smp, shpp, spp, sap, spbp: This measure increases the rates of income tax applicable to dividend income by 1.25%.

Pin On M Afzal

Best Personal Finance Software For Money Management Budgeting - Mac Windows Money Management Personal Finance Budgeting

Mt5pn6szcntdsm

Our Todays Xauusd Profit Earn 300-400usd Profit Based On Investment Success Rate 85 In 2021 Success Rate Forex Financial Advisors

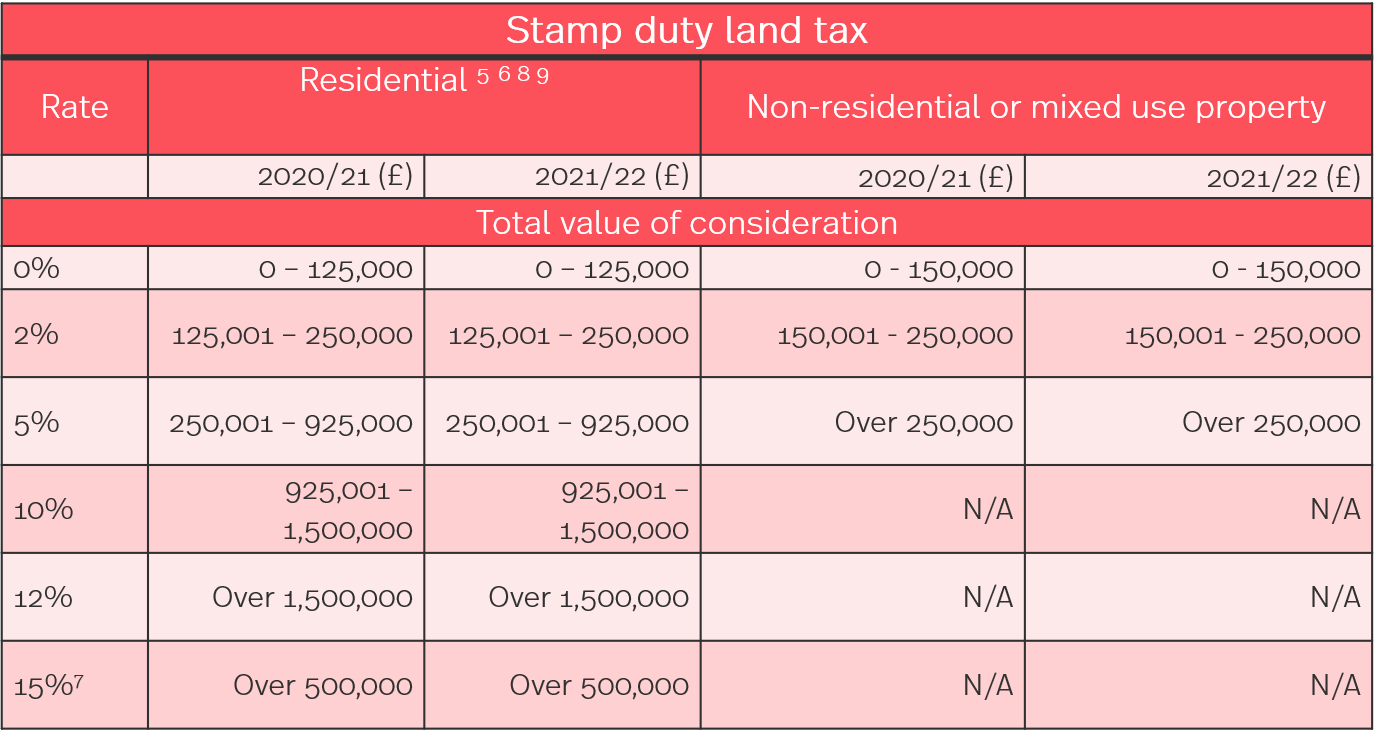

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Quickbooks Online Login Intuit Uk Quickbooks Online Login Quickbooks Online

Pin By Rearooswx On Freelance 2022 In 2021 Fiverr Incoming Call

Dollar To Euro - Youtube Currency Symbol Euro Sign Euro Exchange Rate

Pin On Finance

Nepal Currency Watch My Video Nepal Currency And Learn About The Nepalese Rupee I Show You How To Convert Nepalese Rupee Npr Curren Nepalese Currency Nepal

10 Long Term Capital Gain Tax To Benefit P2p Lending Players Read Our Complete Article Published On Moneyc Peer To Peer Lending P2p Lending Capital Gains Tax

Budget 2019 - Revised Section 87a Tax Rebate - Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

Pin On Templates

Pin On Taxes

Expatistan Cost Of Living Cost Of Living Moving To The Uk Cost

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Pin On Tax

Irs 2019 Tax Tables Tax Table Federal Income Tax Tax Brackets