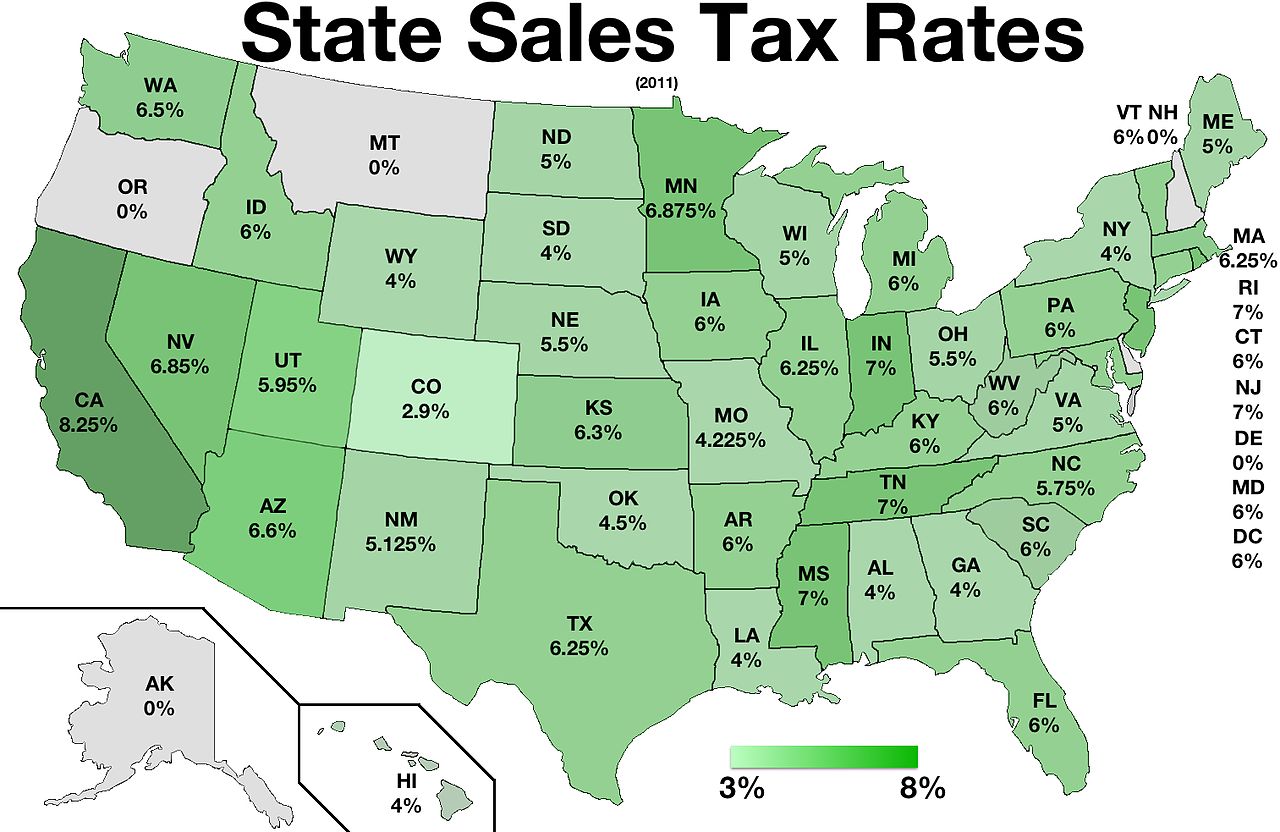

The tax data is broken down by zip code, and additional locality information (location, population, etc) is also included. There are a total of 265 local tax jurisdictions across the state, collecting an average local tax of 0.46%.

2

The local sales tax rate in milwaukee county is 0.5%, and the maximum rate (including wisconsin and city sales taxes) is 5.5% as of november 2021.

Milwaukee county wi sales tax rate. The wisconsin state sales tax rate is 5%, and the average wi sales tax after local surtaxes is 5.43%. Yearly median tax in milwaukee county. A sample of the 882 wisconsin state sales tax rates in our database is provided below.

The proposed 6.5 percent would still be among the. Your brand can grow seamlessly with wix. The current milwaukee county sales tax rate is 5.6 percent.

Click any locality for a full breakdown of local property taxes, or visit our wisconsin sales tax calculator to lookup local rates by zip code. , wi sales tax rate. Milwaukee county treasurer's office 901 n.

If you need access to a database of all wisconsin local sales tax rates, visit the sales tax data page. The december 2020 total local sales tax rate was 5.600%. The wisconsin sales tax is a 5% tax imposed on the sales price of retailers who sell, license, lease, or rent tangible personal property, certain coins and stamps, certain leased property affixed to realty, or certain digital goods, or sell, license, perform, or furnish taxable services in.

The wisconsin state sales tax rate is currently %. The current total local sales tax rate in milwaukee, wi is 5.500%. Depending on the zipcode, the sales tax rate of milwaukee may vary from 5% to 5.6%.

Every 2021 combined rates mentioned above are the results of wisconsin state rate (5%), the county rate (0.5%), and in some case, special rate (0% to 0.1%). The city of milwaukee created a local exposition district, the wisconsin center district, which is contiguous to milwaukee county. Groceries and prescription drugs are exempt from the wisconsin sales tax;

The minimum combined 2021 sales tax rate for milwaukee county, wisconsin is. There is no applicable city tax or. Wisconsin has state sales tax of 5% , and allows local governments to collect a local option sales tax of up to 0.6%.

The county sales tax rate of 0.5% is imposed on retailers making taxable retail sales, licenses, leases, or rentals or providing taxable services in a wisconsin county that has adopted the county tax. What is the tax rate? The 5.5% sales tax rate in milwaukee consists of 5% wisconsin state sales tax and 0.5% milwaukee county sales tax.

Our dataset includes all local sales tax jurisdictions in wisconsin at state, county, city, and district levels. Milwaukee county collects, on average, 2.24% of a property's assessed fair market value as property tax. Ad create an online store.

Rates were rounded to two decimal places for presentation purposes. The milwaukee county sales tax rate is %. Milwaukee county has one of the highest median property.

* includes school bonds ** less state credit *** state tax was eliminated in assessment year 2017 matc=milwaukee area technical college mmsd=milwaukee metropolitan sewerage district rates are per $1,000 of assessed value. Beginning april 1, 2020, retailers cannot collect 0.1% baseball stadium tax. Verification and processing of claims takes four to eight weeks.

Utilize quick add to cart and more!. Utilize quick add to cart and more!. Milwaukee county, wi sales tax rate the current total local sales tax rate in milwaukee county, wi is 5.500%.

The median property tax in milwaukee county, wisconsin is $3,707 per year for a home worth the median value of $165,700. The county use tax rate of 0.5% is imposed on purchasers of items used, stored, or consumed in counties that impose county tax. This is the total of state and county sales tax rates.

Wisconsin has 816 special sales tax jurisdictions with local sales taxes in addition to the. The december 2020 total local sales tax rate was 5.600%. Average sales tax (with local):

2018 brown county adopted the county sales tax. There is no city sale tax for milwaukee. What is the sales tax rate?

Ad create an online store. Milwaukee county collects a 0.6% local sales tax, the maximum local sales tax allowed under wisconsin law milwaukee county has a higher sales tax than 100% of wisconsin's other cities and counties milwaukee county wisconsin sales tax exemptions Your brand can grow seamlessly with wix.

The treasurer's office will contact the claimants to inform them when their claim is completed. The 2018 united states supreme court decision in south dakota v. Counties and cities can charge an additional local sales tax of up to 0.6%, for a maximum possible combined sales tax of 5.6%;

Checks will be mailed to the address provided by the claimant in the unclaimed funds request form. There is no applicable city tax or special tax.

Fair Deal

Fair Deal

2

Sales Taxes In The United States - Wikiwand

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Wisconsin Property Tax Calculator - Smartasset

2

2

Fair Deal

North Central Illinois Economic Development Corporation - Property Taxes

Wisconsin Sales Tax Rates By City County 2021

Wisconsin Sales Tax - Small Business Guide Truic

Wisconsin Income Tax Calculator - Smartasset

Spending - Wisconsin Budget Project

Us Property Taxes Comparing Residential And Commercial Rates Across States - The Journalists Resource

Sales Taxes In The United States - Wikiwand

Sales Taxes In The United States - Wikiwand

Sales Taxes In The United States - Wikiwand

2