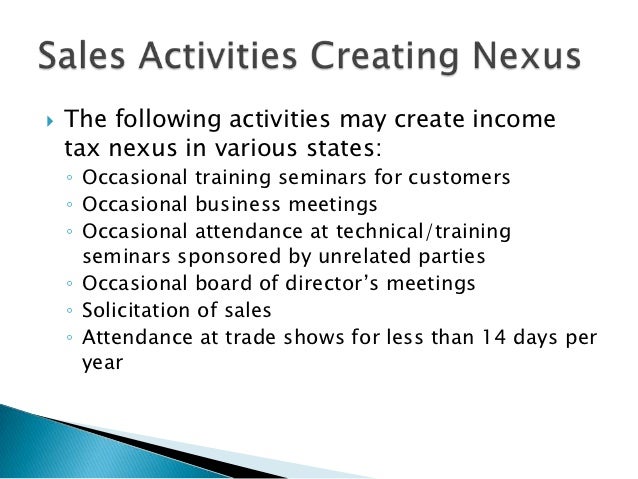

The advisory provides guidance involving sales and use tax, corporate income tax, and related topics. Economic nexus exists if the business.

Stripe Understanding Us Sales Tax And Economic Nexus A Guide For Startups

See today's announcement for a full explanation of what filings and payments are affected.

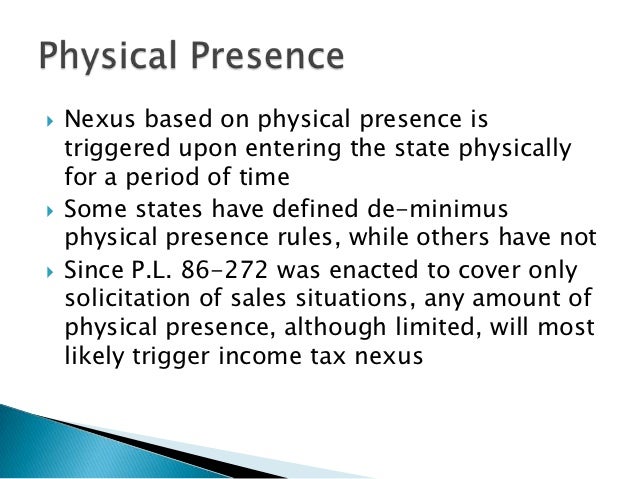

Rhode island income tax nexus. Note that this policy is predicated on the condition that the company would not otherwise have nexus due to physical presence or economic nexus in rhode island. Establishing nexus generally means that a business has sufficient connection or presence in rhode island for the state to have taxing authority. Each state has its own income tax provisions defining what activities will create nexus for a business.

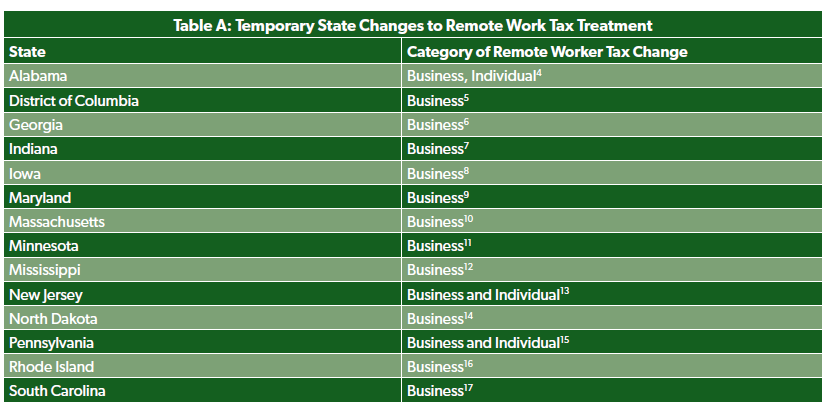

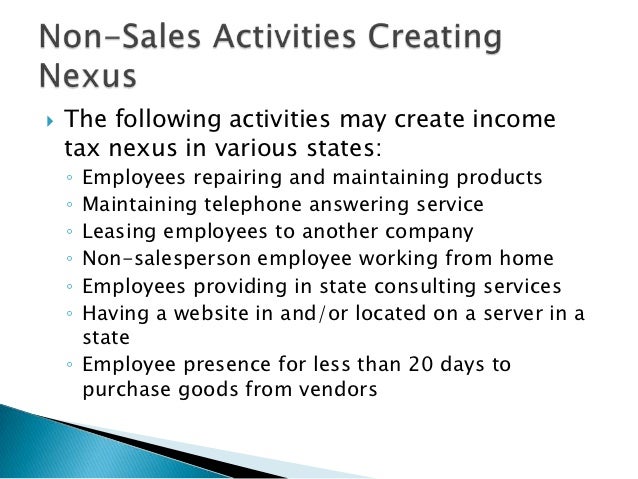

A foreign corporation is subject to rhode island corporate income tax if it conducts business activity in rhode island and has income properly apportionable to rhode. For the duration of rhode island’s coronavirus state of emergency, the division of taxation will not seek to establish nexus for rhode island corporate income tax purposes solely because an employee is temporarily working from home during the state of emergency, or because an employee is temporarily working from home during the state of. Only corporation m has nexus with rhode island.

Income tax nexus with rhode island. You can read rhode island’s economic nexus law (and notice and reporting requirements) here. This rule describes activities that are sufficient for creating corporate income tax nexus between the state of rhode island and a foreign corporation.

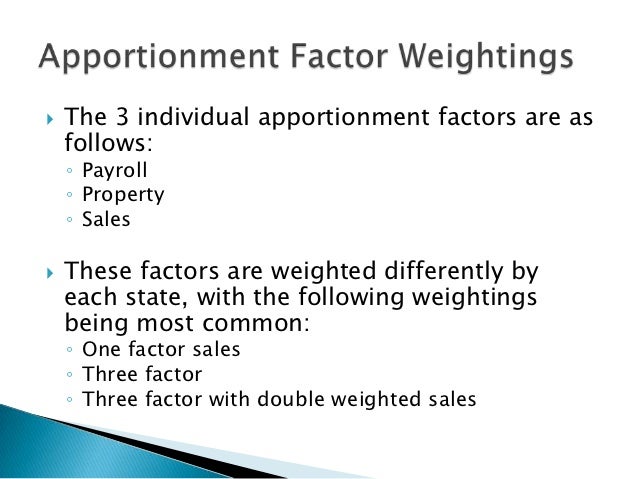

Nexus for the duration of rhode island’s coronavirus state of emergency, the rhode island division of taxation will not seek to establish nexus for rhode island corporate income tax purposes solely because an employee is temporarily working from home during the state of emergency, or The rhode island division of taxation today posted an advisory in response to some related inquiries that the division has received involving potential nexus and apportionment issues. The activities enumerated in this rule below are.

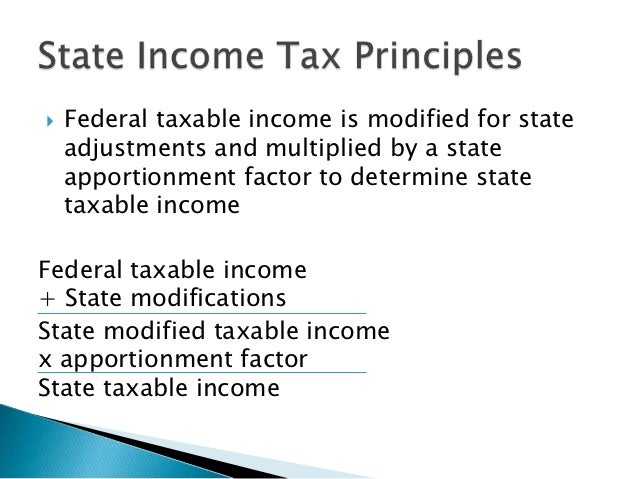

The move mainly involves quarterly estimated payments of personal and business income tax that would normally be due june 15, 2020. These provisions may include things like deriving receipts from the state, or having the following in the state: To whether the member has nexus in rhode island (the “finnigan” approach).24 asc 740 treatment pursuant to asc 740 (formerly known as “statement 109, accounting for income taxes” or “fas 109”), companies are required to account for the effect of a change in income tax law in the period that includes the

As a result, additional corporations may find they are obligated to pay income tax in rhode island. The rhode island division of taxation has postponed more filing and payment deadlines to july 15, 2020. Rhode island enacts economic nexus and reporting requirements provisions.

Rhode island corporate income tax: Employers and employees should be cognizant of the varying rules among the states in which their employees are telecommuting. The guidance provided by the dot also addresses income tax nexus as it relates to telework during the state of emergency.

A business will have nexus with rhode island for purposes of corporate income tax either if the business has a physical or an economic presence in the state. The combined group of corporations m, n, and o must file a combined report with rhode island Corporations m, n, and o, all foreign corporations, are engaged in a unitary business and are members in the same combined group.

For more information on the nexus relief, contact harley duncan. In the revised rules, physical presence, including presence of holding property, agents, representatives or independent contractors who sell goods or services within rhode island, could trigger income tax nexus. You can read guidance for vendors from the rhode island department of revenue here.

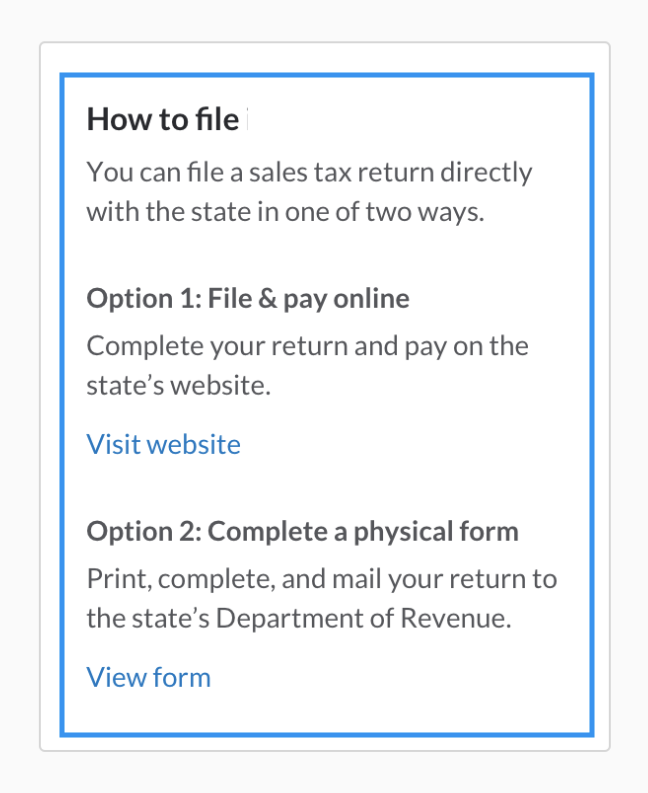

Rhode island requires a remote business to register and collect and remit sales tax on january 1 of the year following the calendar year they crossed the economic nexus threshold. The division of taxation construes rhode island law to assert the tax jurisdiction of rhode island to the fullest extent permitted by the united states constitution and the laws of. Income tax nexus rules associated with the introduction of mandatory combined reporting.

Notice and report effective date: Different requirements apply if the threshold was passed in 2018. Threshold:gross revenue equal to or exceeding $100,000 or200 or more separate transactions.

2

State Income Tax Nexus

How To File A Maryland Sales Tax Return Taxjar Blog

A Legislative Framework For Addressing Remote Work Nexus Issues - Foundation - National Taxpayers Union

State Income Tax Nexus

State Income Tax Nexus

2

Bulletin On Passthrough Entities To Non-resident Taxpayers Ri Division Of Taxation

How To File A Maryland Sales Tax Return Taxjar Blog

2

State Income Tax Nexus

State Income Tax Nexus

Rhode Island Sales Tax - Small Business Guide Truic

State Income Tax Nexus

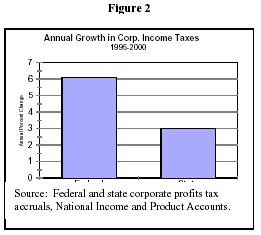

Closing Three Common Corporate Income Tax Loopholes Could Raise Additional Revenue For Many States Rev 52303

Closing Three Common Corporate Income Tax Loopholes Could Raise Additional Revenue For Many States Rev 52303

2

Stripe Understanding Us Sales Tax And Economic Nexus A Guide For Startups

State Income Tax Nexus