It’s the same as if your company gave. There is a threshold if your under you don’t have to file.

Blog Upstart Wealth

With local taxes, the total sales tax rate is between 7.250% and 10.750%.

Rsu tax rate california. On my typical paycheck though, i only pay about 33%, so i'm guessing i'll get a rebate? The capital gains tax rate when you sell the shares you own; Spouse with a california agi of $90,896 or less $120 credit individual tax rates the maximum rate for individuals is 12 3%

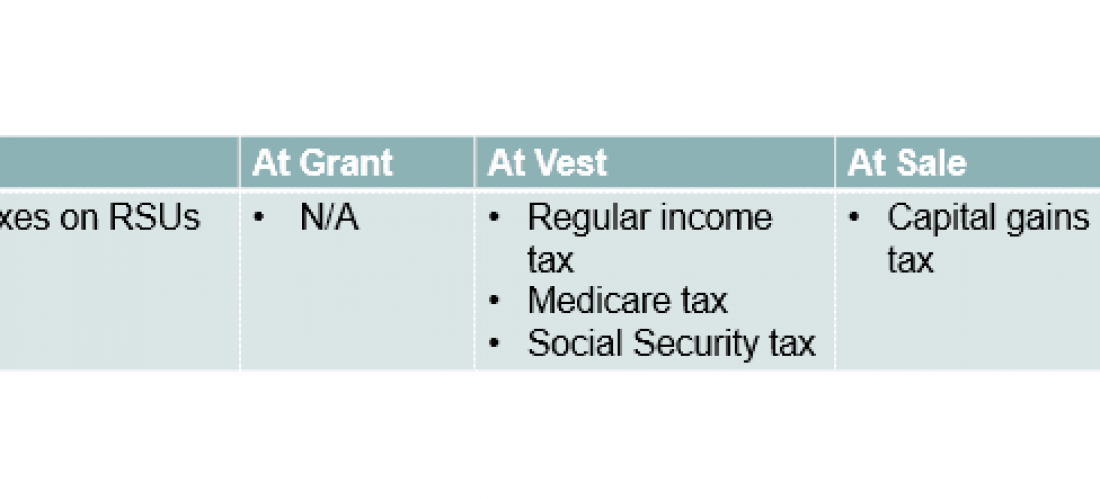

When the rsu vest with the employee he need to include it in his salary income as perquisite and pay tax on same. The closing price of the stock on that day is $50, and the tax withholding rate is 40%. Rsus can trigger capital gains tax, but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

On a same day sale, i would be paying capital gains at a higher tax rate (like a disqualifying disposition), similarly for a “sell to cover” option, i would be paying capital gains at a short term rate for the portion of shares i. It’s important to remember that the rsu tax rate will be the same as your income tax rates. 22% (37% once your supplemental wages exceed $1,000,000) medicare:

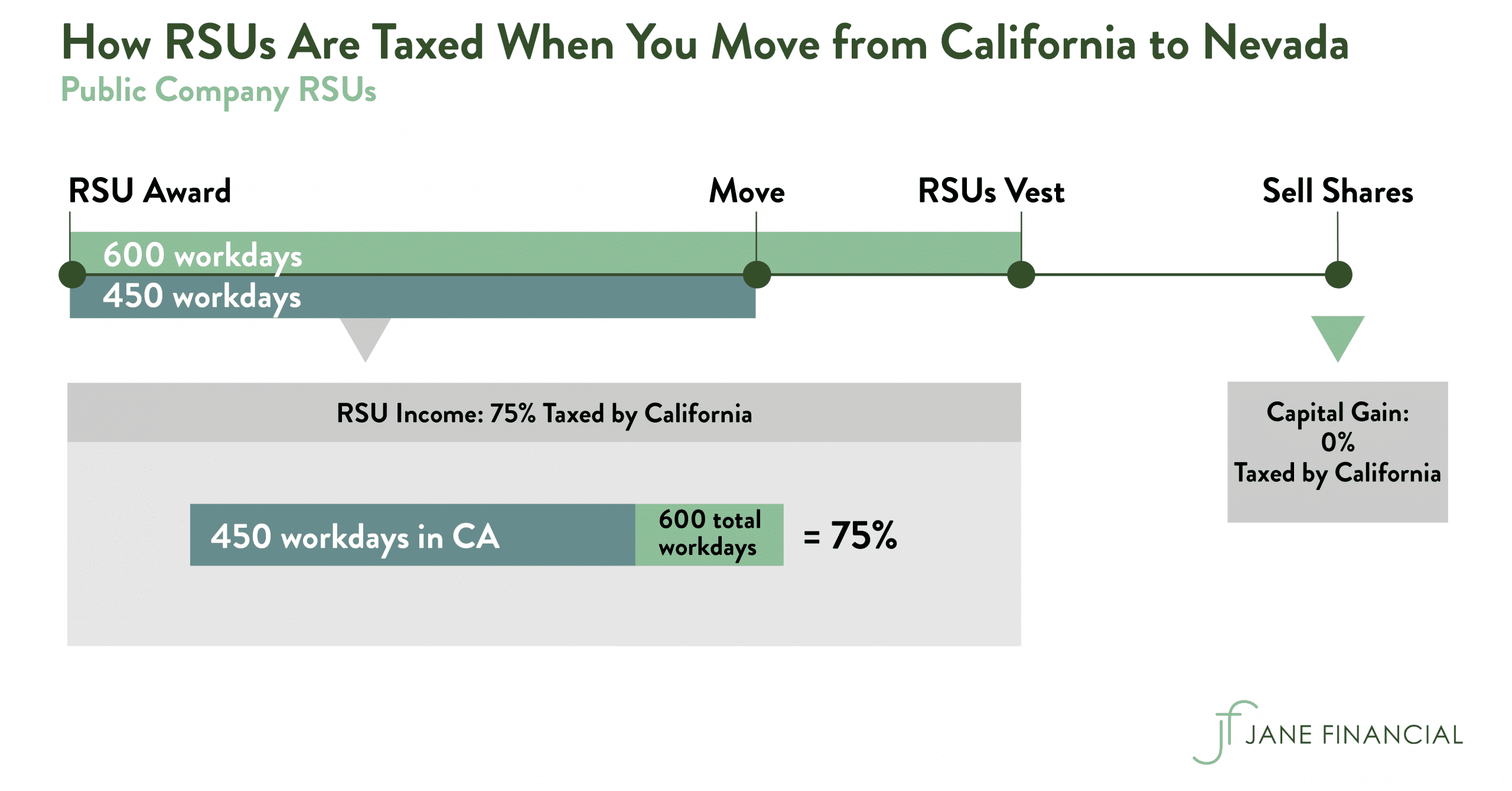

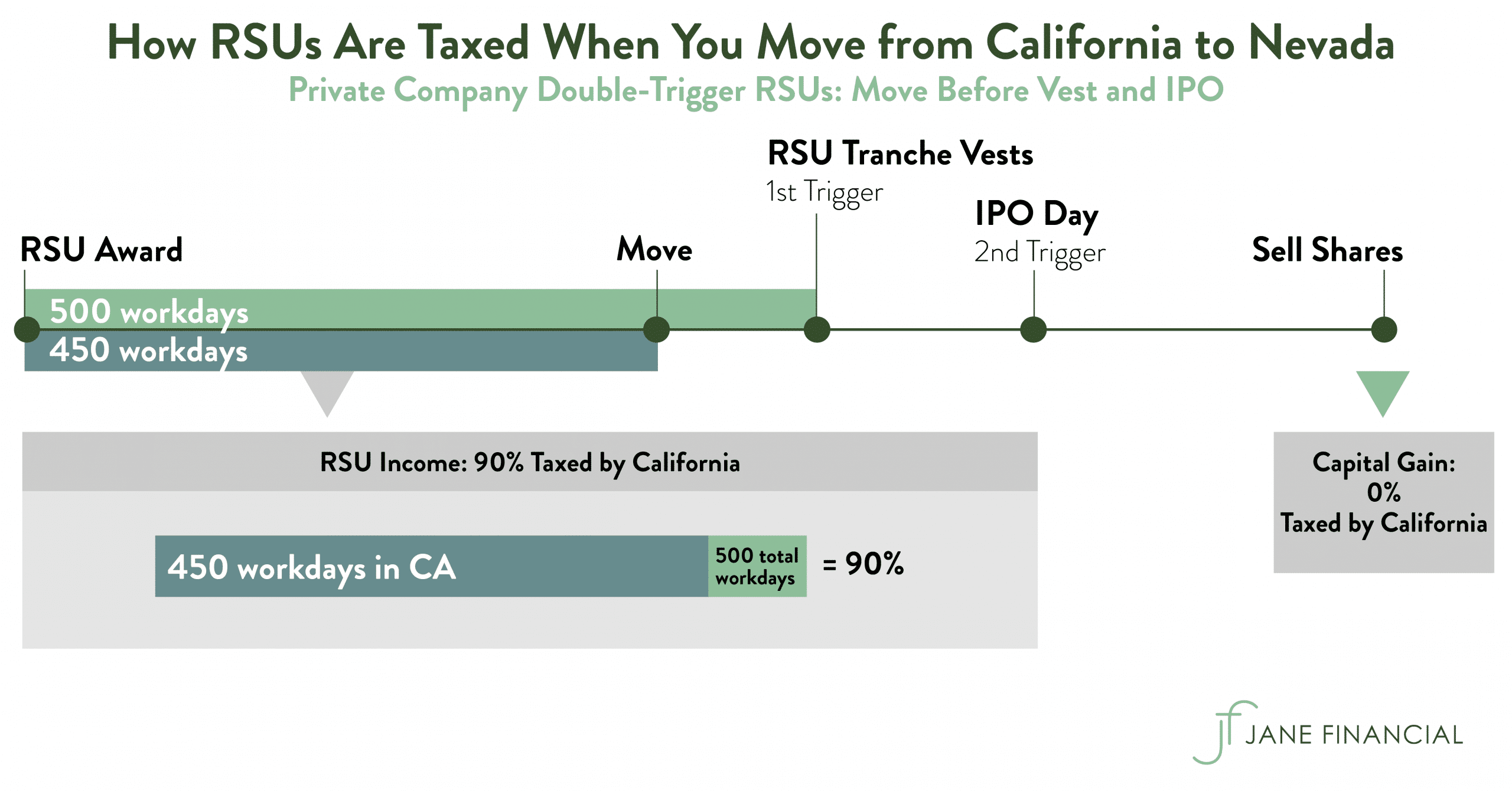

The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting to the employee and transfer the remaining shares in name of. Look up non resident ca state tax return to figure out the rules. It’s important to understand the amount withheld on (future) rsus to avoid hefty tax charges afterward or even penalties.

Say 10 rsus vest on one day, and the stock price on that day is $5 per share. As part of the mental health services act, this tax provides funding for mental health programs in the state. Technically, tax brackets end at 12.3% and there is a 1% tax on personal income over $1 million.

This is because rsus, stock grants, and bonuses are treated as. California state tax rates are 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. They’ll tax you on that $50 income.

For the irs, it is the same as your company having paid you $50 on that day. What is the tax rate for an rsu? Suppose you had 100 rsus vested on october 31.

Current sdi rates are available online at rates and withholding. When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income. We have 7.5% state tax.

I'm in the 28% federal bracket. In two installments (1) taxes paid upfront at vest. 2022 california tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

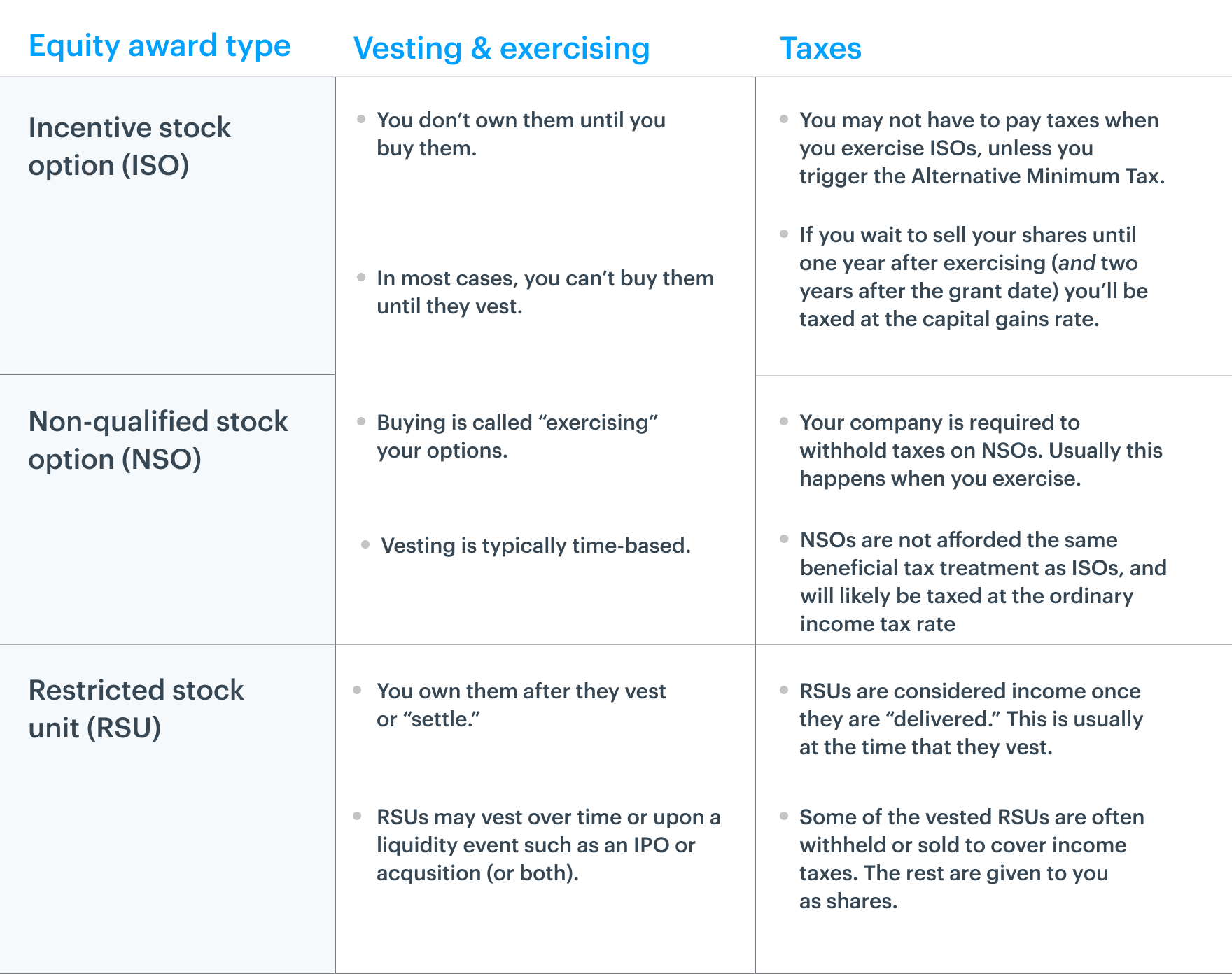

Rates used are for demonstration purposes only, sdi rates are set by law each year. Plan for the rsu vesting event once you’ve used the rsu tax calculator to determine your estimated taxes and estimated proceeds, you’ll want to make a plan so you know what you want to do with your company shares after the vesting date. Rsus are a type of income known as “supplemental wages.” the irs and california ftb applies a series of mandatory flat taxes to supplemental wages:

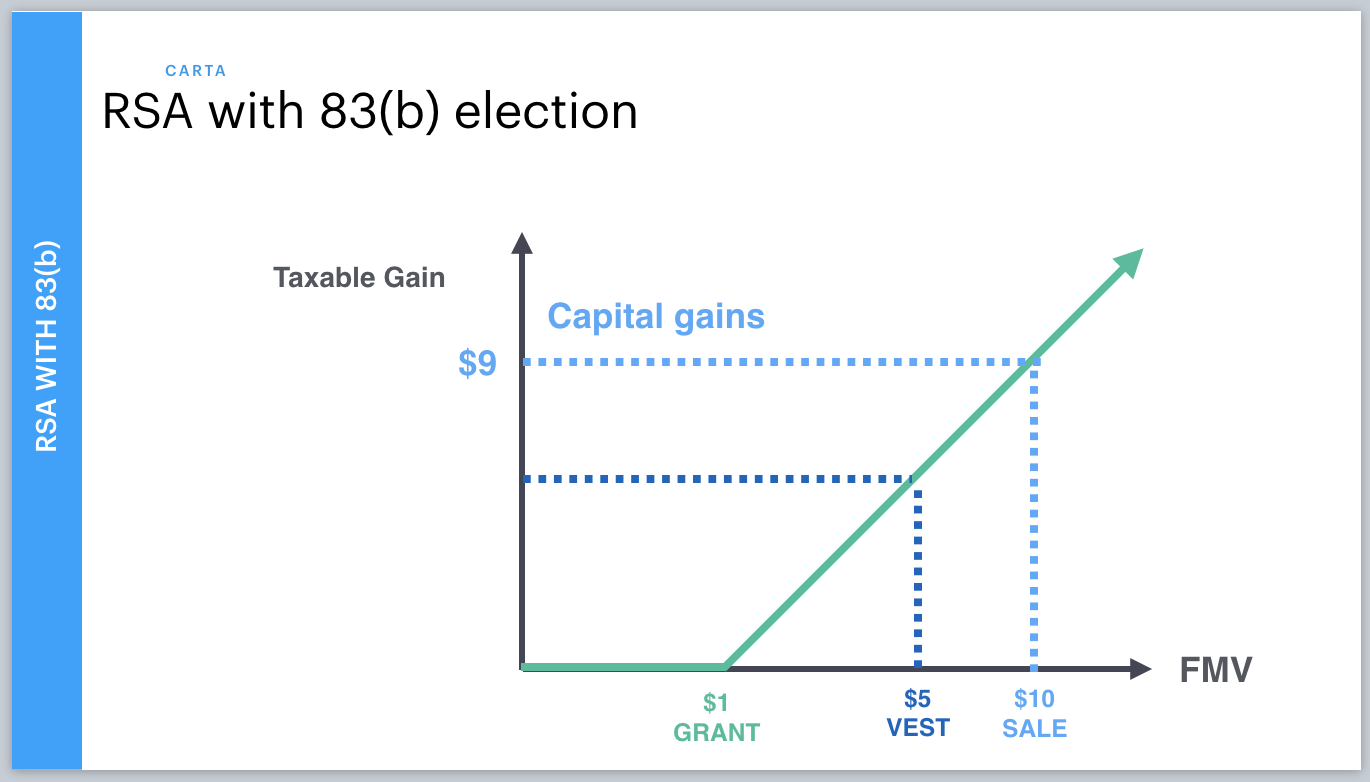

In some states, such as california, the total tax withholding on your rsu is around 40%. Thus, the rsu above attracts tax two times: At the time of vesting:

Rsus are taxed at the ordinary income tax rate when they are issued to an employee, after they vest and you own them. The ordinary earned income tax rate when the rsus vest, or; Ca has a jock tax and you owe 1/240th of your w2 income for every day you work in ca.

The withholding rate is what might be different, which is a common source of confusion. On the date that your rsus vest you will get shares net of the tax your employer withholds. This is true whether we’re talking about:

The exact tax rate will depend on your specific tax bracket as determined by your income. A 1% mental health services tax applies to income exceeding $1. Refer to how to determine taxable wages for additional information on determining the taxable wages to be used in the calculation.

(1) at the time of vesting and (2) at the time of sale. In other words, if the stock increase in value after you’ve paid ordinary income tax on it, and you sell it in the future at a. Payment of federal and ca taxes on rsu income:

Rsu’s are taxed on the date of vesting for the full vested amount. In all, there are 10 official income tax brackets in california, with rates ranging from as low as 1% up to 13.3%. When your rsus vest they will with old taxes like a bonus, and you could owe more taxes based on your income tax rate.

Rsus are as good as cash. Most employers will withhold taxes on your rsus at a rate of 22%, but you could easily be in a higher tax bracket than that. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower

California (ca) sales tax rates by city (s) the state sales tax rate in california is 7.250%.

Restricted Stock Units - Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Blog Site Of Exactcpacom The 1 Online Tax Cpa With Over 190 5-star Reviews How To Sell Your Single-stock Position Tax-efficiently

Restricted Stock Units - Jane Financial

The Mystockoptions Blog Tax Planning

Restricted Stock Units - Jane Financial

What Is The Rsu Tax Rate

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Units - Jane Financial

How Equity-holding Employees Can Prepare For An Ipo - Carta

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units - Jane Financial

Blog Upstart Wealth

Blog Upstart Wealth

Blog Upstart Wealth

Compounds Guide To The Ipo

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation - Flow Financial Planning