Spouses and the state and local tax deduction spouses filing separately. You must also itemize the deduction to claim it.

The Tax Break-down The State And Local Tax Deduction Committee For A Responsible Federal Budget

It should be eliminated not expanded christopher pulliam and richard v.

Are salt taxes deductible in 2020. House of representatives passed the restoring tax fairness for states and localities act (h.r. The tax cuts and jobs act of 2017 capped state and local tax (salt) deductions at $10,000. November 17, 2020 | article.

It also aims to double the salt deduction to $20,000 for married couples filing jointly in 2019. Reeves friday, september 4, 2020 You will report the $250 refund as income on your 2020 tax return.

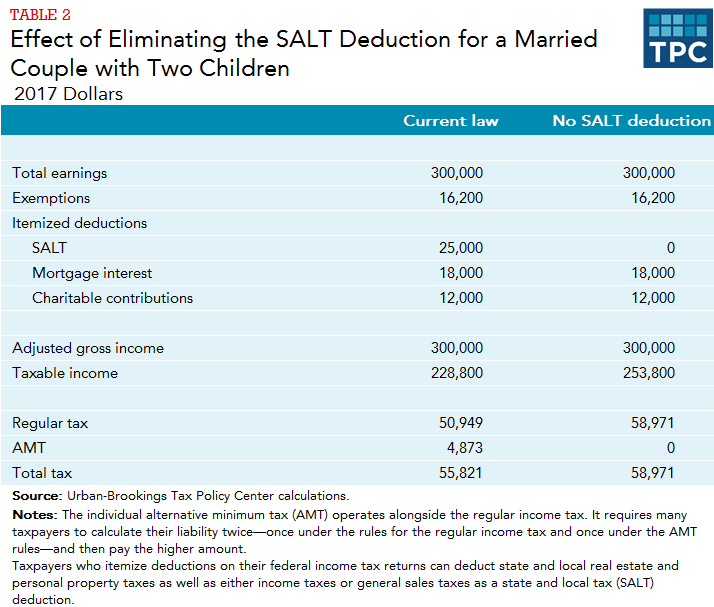

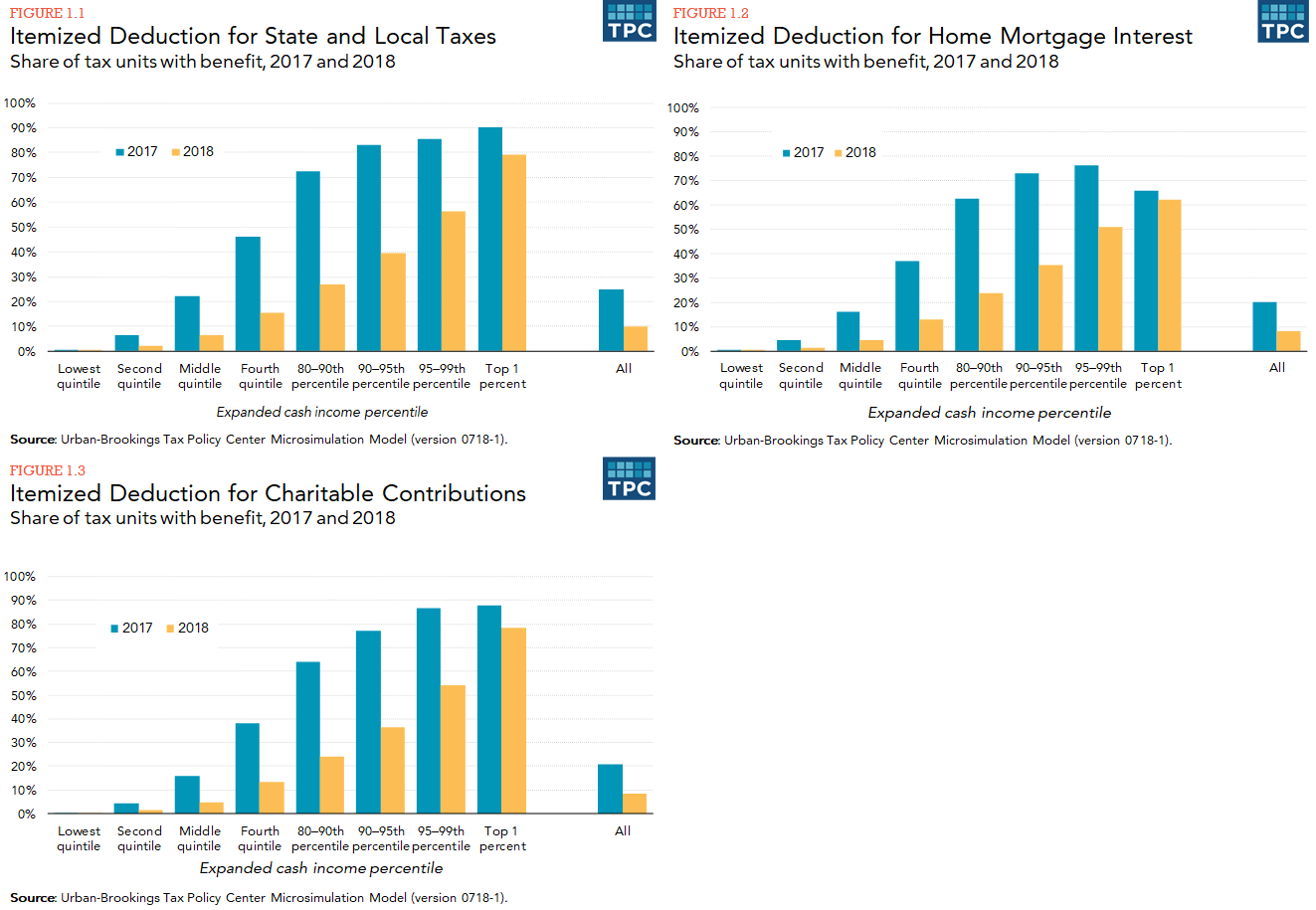

During initial talks about tax reform, the salt deduction was almost eliminated. This limit is scheduled to remain through 2025 and has significant tax consequences, especially to individuals in states with applicable income taxes. Prior to the tax cuts and jobs act, the salt deduction was unlimited.

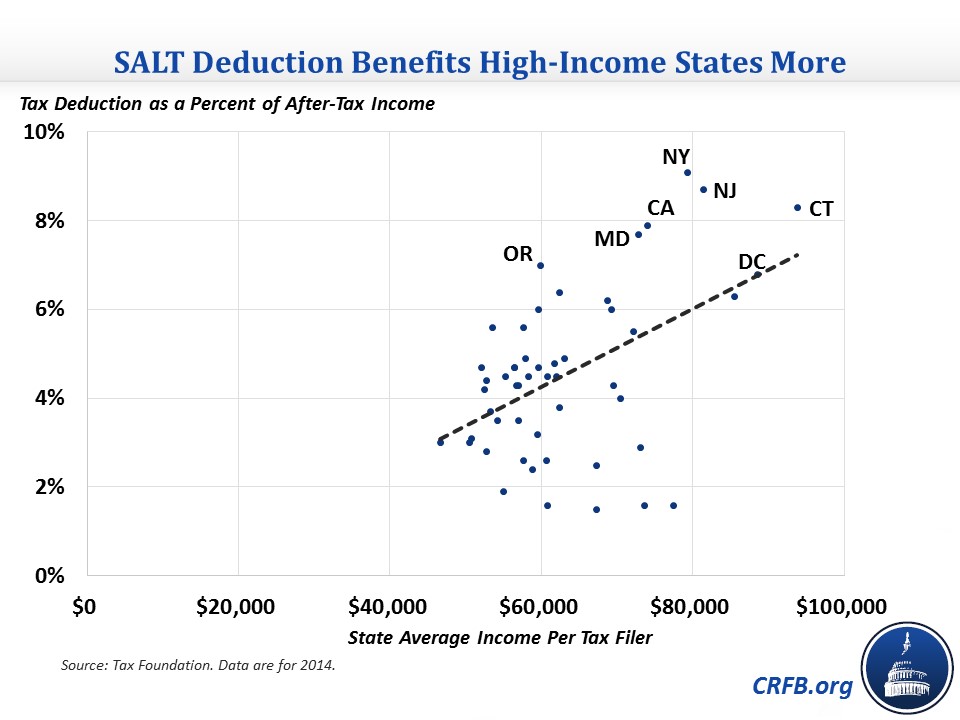

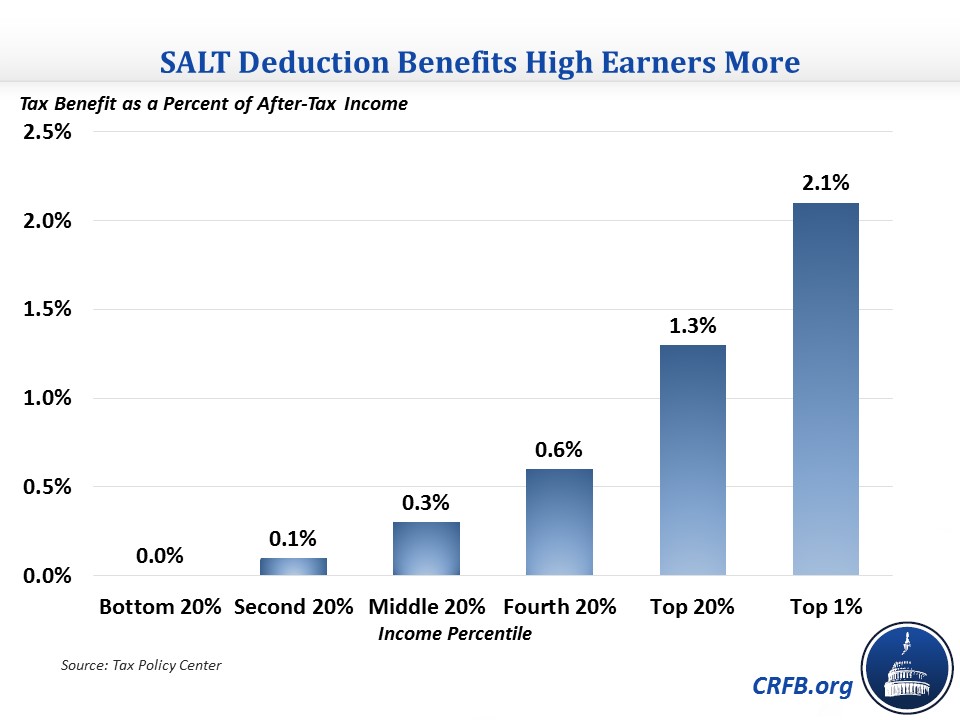

The salt deduction is only. For 2020, taxpayers can’t deduct more than $10,000 or $5,000 if they’re married and filing separately. The salt tax deduction is a handout to the rich.

The tax cuts and jobs act of 2017 (“tcja”) introduced a general $10,000 limit on the amount of state and local taxes (“salt”) a taxpayer can deduct for federal income tax purposes. By adam sweet, j.d., ll.m. 52 rows you cannot deduct both income and sales taxes.

The tax plan signed by president trump in 2017, called the tax cuts and jobs act, instituted a cap on the salt deduction. What does this mean for you and how will it affect your tax return for 2018, 2019, 2020, 2021, and beyond? The sales tax limit for tax year 2020 is $10,000 — or $5,000 if you’re married and filing separately.

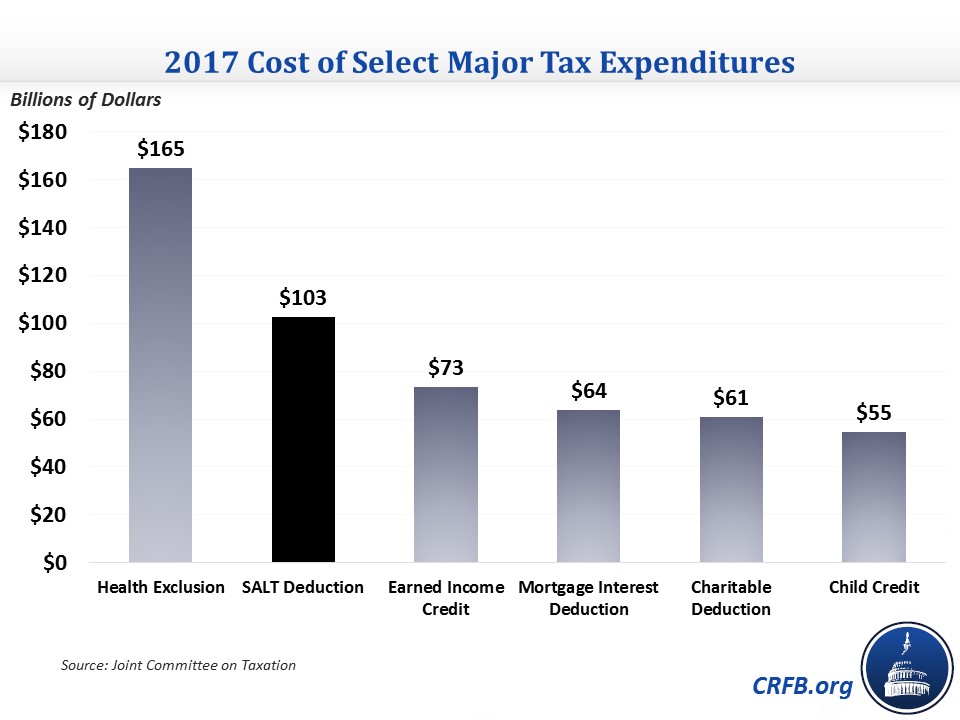

How much is the sales tax deduction for tax year 2020? Prior to the limit’s enactment, the cost in lost revenue for the federal government for the salt deduction was estimated at $78 billion and $82 billion in fiscal years (fys) 2019 and 2020. As a result, state and local income taxes, whether mandatory or elective, will be deductible at the level of the pte and not passed through to individual partners or shareholders of the pte who are subject to the state and local tax (salt) deduction limitation that applies to individuals who itemize deductions for federal income tax purposes.

The proposed regulations will also permit taxpayers described in section 3.02 of this notice to apply the rules described in this notice to specified income tax payments made in a taxable year of the partnership or s corporation ending after december 31, 2017, and made before november 9, 2020, provided that the specified income tax payment is. 5377), which calls for the removal of the salt deduction cap for the 2020 and 2021 tax years. 22, 2017, established a new limit on the amount of state and local taxes (salt) that can be deducted on a federal income tax return.

The tax cuts and jobs act of 2017 (tcja) limits an individual’s deduction for state and local taxes (salt) paid to $10,000 ($5,000 in the case of a married individual filing a separate return). The salt deduction has these limits: When you file your taxes, you can either write off sales tax or state and local income tax — but the irs won’t let you do both.

The salt deduction (which stands for state and local taxes) was perhaps the most controversial part of the changes to the. 9, the irs may have endorsed a workaround to the $10,000 cap on state and local taxes when it comes to state and local taxes paid by passthrough entities. Starting with the 2018 tax year, the maximum salt deduction available was $10,000.

In late december 2019, the u.s. This cap only applied to salt deductions paid by individuals, not by corporations. For spouses that file separate tax returns, the salt deduction is limited to $5,000 per person.

Your reference to $10,000 is the limit on deducting state and local taxes (salt), which is typically the sum of state income taxes plus real estate taxes,. The federal tax reform law passed on dec. After legislators realized the impact of this, it was decided to simply reduce the salt deduction to $10,000.

Beginning in 2018, the itemized deduction for state and local taxes paid will be capped at $10,000 per return for single filers, head of household filers, and married taxpayers filing jointly. Tax changes shake up salt deductions oct.

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

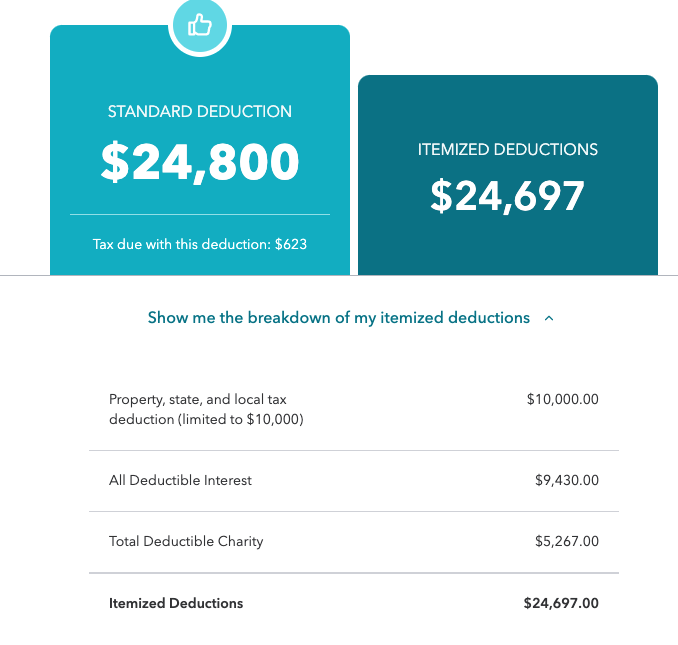

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Medical Expense Deduction Which Expenses Are Deductible Medical Financial Advice Tax Help

The Tax Break-down The State And Local Tax Deduction Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Or Standard Deduction Houselogic

Itemized Deduction Who Benefits From Itemized Deductions

Beating The Standard Deduction With Strategic Giving

Tax Deduction Definition Taxedu Tax Foundation

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Your 2020 Guide To Tax Deductions The Motley Fool

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Senate Calls For Revamped Salt Tax Break Skip September State Estimated Tax Payment To Save Big

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Tax Deductions Lower Taxes Increase Your Refund With Your 2021 Tax Return In 2022

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Deduction Work-arounds Receive Irs Blessing Look For More States To Enact Them - Marks Paneth

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget