The increase to the standard deduction under tcja resulted in more taxpayers claiming the standard deduction rather than itemizing. They also both get an additional standard deduction of $1,350 for being over age 65.

Whats The Deal With The State And Local Tax Deduction - Publications - National Taxpayers Union

Under current policy, the salt deduction cap is not adjusted for inflation.

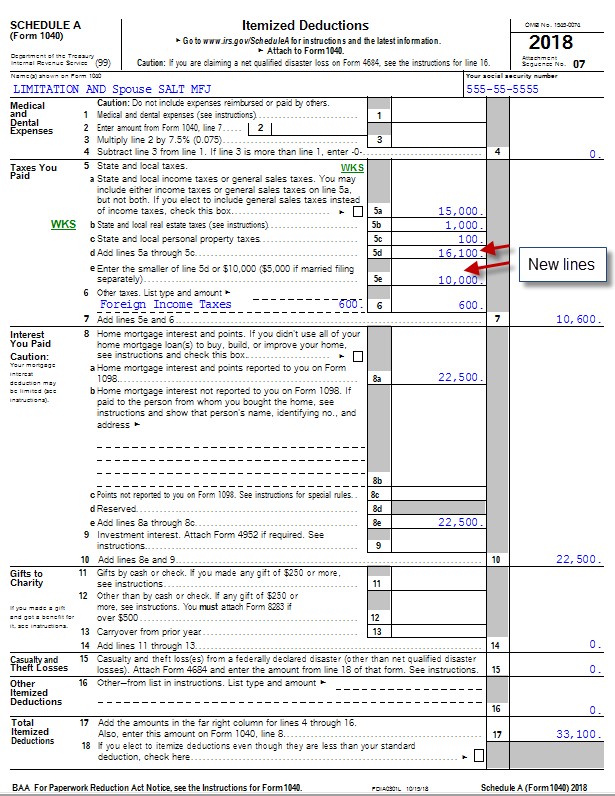

Salt tax cap married filing jointly. It is $10,000 for all other filing statuses. The cap reverts back to $10,000 for 2031, the final year it would be in effect. While the standard deduction for married couples filing jointly is twice the standard deduction of single taxpayers, the tjca limited the itemized deduction for state and local taxes (salt) to $10,000 for both single taxpayers and those filing married jointly.

In late december 2019, the u.s. By limiting the salt deduction available to certain taxpayers, the salt cap decreases the tax savings associated with the deduction relative to prior law, thereby increasing. The salt cap is set at $10,000 for single taxpayers or married couples filing jointly and $5,000 for married taxpayers filing separately.

New tax law for 2018. Under tcja, the salt deduction was capped at $10,000 for single filers and married couples filing jointly. The limit is $5,000 if married filing.

22, 2017, established a new limit on the amount of state and local taxes (salt) that can be deducted on a federal income tax return. The itep plan tpc analyzed would allow an unlimited salt deduction for households with agi under $400,000 ($200,000 for married couples filing separately). This cap remains unchanged for your 2020 and 2021 taxes.

The proposal also addresses an unfair marriage penalty where two single filers could each claim a $10,000 salt deduction, but once they marry and file jointly they're still limited to $10,000 (or. For example, if you are a person with a single filing status, taking the largest possible amount for your salt deduction at $10,000, the total amount of the rest of your itemized deductions would need to be more than $2,550 to exceed your standard deduction amount of $12,550 so that you can itemize and deduct salt. As a side note, it is a $10,000 limit for the combined total of salt and real estate taxes.

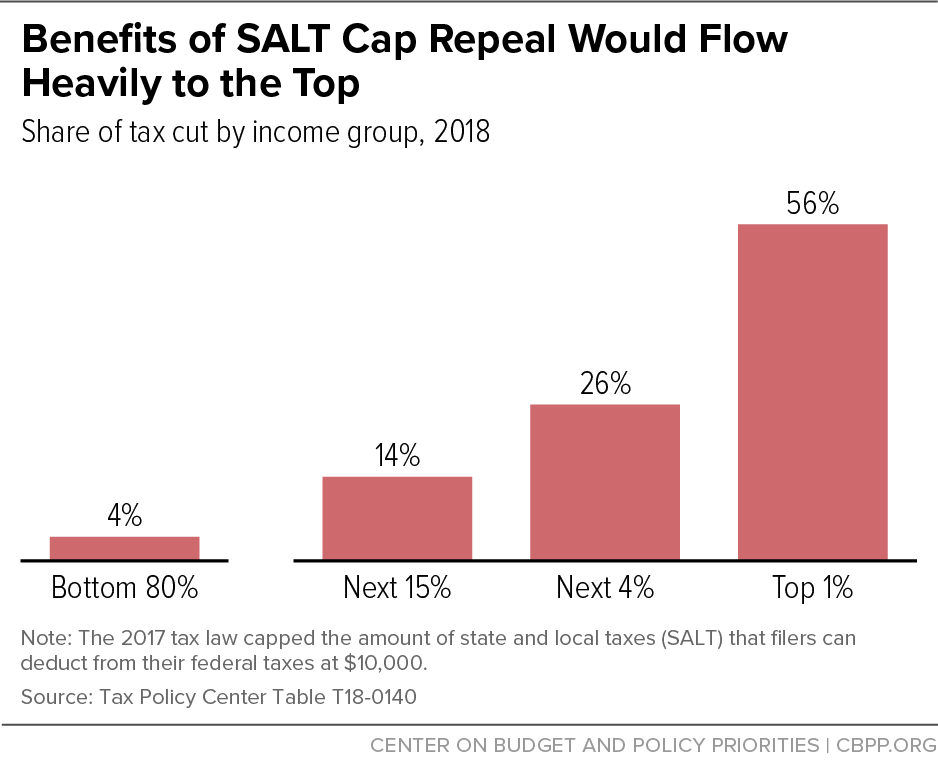

Tax experts say removing the cap would largely benefit wealthier americans, but the people. The proposal also addresses an unfair marriage penalty where two single filers could each claim a $10,000 salt deduction, but once they marry and file jointly they're still limited to $10,000 (or $5,000 if married filing separately). Married filing jointly $24,000 (+ $1300 each spouse 65 or older) head of household $18,000.

Second, it would adjust the cap for inflation each year. For 2021, they get the normal standard deduction of $25,100 for a married couple filing jointly. State and local taxes include income or general sales taxes, real estate taxes, and personal property taxes.

It also aims to double the salt deduction to $20,000 for married couples filing jointly in 2019. For married couples filing separately, it's a $5,000 cap. As of 2019, the maximum salt deduction is $10,000.

Is it $5000 for married filing separately. This policy would reduce federal revenues by a lesser amount than a straight repeal of the cap. This limit applies to single filers, joint filers, and heads of household.

Previously, they could deduct the full amount. The proposal would make two changes to current policy’s salt deduction cap. And there is a max 10,000 limit (5,000 mfs) of property tax and state taxes salt.

House of representatives passed the restoring tax fairness for states and localities act (h.r. As well as the cap on state and local taxes have had a major impact. However, for tax years 2018 through 2025, the tcja capped the salt deduction at $10,000 for single taxpayers and couples filing jointly — limiting its value for tax filers.

It is $5,000 for married taxpayers filing separately. First, it would raise the cap from $10,000 ($10,000 for married couples filing jointly) to $15,000 ($30,000 married couples filing jointly). However, becourtney said, the $10,000 salt deduction limit is only applicable to taxpayers with a single, married joint or head of household filing status.

2022 tax brackets for single filers, married couples filing jointly, and heads of households; 5377), which calls for the removal of the salt deduction cap for the 2020 and 2021 tax years. A final proposal would raise the salt cap from $10,000 to $15,000 for single filers and $30,000 for married couples.

Is this the same number for single, married filing jointly, and married filing singly? If you are filing married filing joint, your total itemized deductions would need to be. Those caps would also be adjusted for inflation annually.

The federal tax reform law passed on dec. Beginning in 2018, the itemized deduction for state and local taxes paid will be capped at $10,000 per return for single filers, head of household filers, and married taxpayers filing jointly. The tcja established a temporary salt cap for tax years 2018 through 2025.

The deduction has a cap of $5,000 if your filing status is married filing separately. Rate for unmarried individuals for married individuals filing joint returns for heads of households; The tax law fixed some of the ways the tax code penalizes married couples, but the salt cap remains an outlier.

Opinion The Tart Truth Underlying Salt Repeal Arguments - The Washington Post

The Salt Cap Overview And Analysis - Everycrsreportcom

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Irs Endorses Business Entity Tax Salt Cap Workaround - Mclaughlinquinn Llc - Rhode Island Boston Law Firm - Tax Planning Resolution Irs Bankruptcy Business

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Deduction Hr Block

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

For Most New York Income Tax Filers Salt Deduction Still Isnt Missed - Empire Center For Public Policy

How Taxpayers Can Deal With New Caps On State Local Deductions - The Columbian

The Marriage Tax Penalty Post-tcja

Salt Tax Deduction 2020 Changes What Changed Millionacres

The Status Of The Marriage Penalty An Update From The Tax Cuts And Jobs Act - The Cpa Journal

For Most New York Income Tax Filers Salt Deduction Still Isnt Missed - Empire Center For Public Policy

California Democrats Have Chance To Restore Salt Deductions - Los Angeles Times

What Is The Salt Deduction Hr Block

How Tax Reform Affects You Reviewing The 2017 Tax Cuts Jobs Act Jrb

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less