When a past due liability exists,. Instead, this is a chance to make voluntary restitution for taxes owed.

Indiana Department Of Revenue Taxpayer Notification Sample 1

The sheriff's office then mails the respected letters to those individuals per.

Indiana department of revenue tax warrants. Lieberman technologies provides computer programming, web design and hosting, and it as a service to customers of all sizes. So, i go to the idor tax warrants page, where it says that, indeed, they are supposed to list such warrants. Our information is updated as often as every ten minutes and is accessible 24 hours a day, 7 days a week.

Please check for new warrants and satisfactions if your business depends on it. Our service is available 24 hours a day, 7 days a week, from any location. The sheriff of the county is tasked with assisting in the collection of monies owed to the indiana department of revenue through a process of tax warrants.

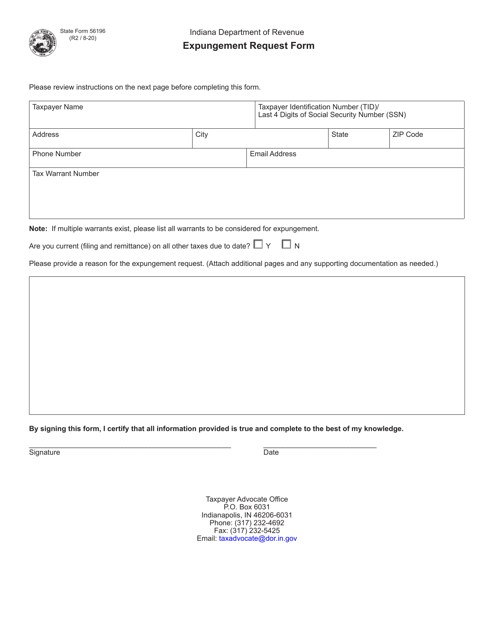

Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the indiana department of revenue (dor). An expungement shall be granted if the department determines that the release of judgement and expungement of the warrant are in the best interest of the state. Use the cc code and warrant # located in the upper right part of this.

A tax warrant is threatening legal action. The department of revenue will also add additional fees, penalties and interest associated with these assessments. These should not be confused with county “tax sales” or a federal tax lien.

The sheriff's office then mails the respected letters to those individuals per. Tax warrants letters are notices generated by the collection division of the indiana department of revenue and are sent to the sheriff of huntington county for failure to pay state taxes. The sheriff of porter county is authorized to collect taxes due to the state of indiana.

What is a tax warrant? Our goal is to help businesses through efficient use of technology. Doxpop provides access to over current and historical tax warrants in indiana counties.

This tax warrant collection system website is a passive website requiring you to input accurate information and take other actions to complete a. An expungement shall be granted if the department determines the warrant was issued in error. A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

Tax warrants letters are notices generated by the collection division of the indiana department of revenue and are sent to the sheriff of huntington county for failure to pay state taxes. 2105 to verify a warrant. We notice that new tax warrants and satisfactions have not stopped completely, but have slowed to a trickle in most counties.the indiana dor has indicated that they are continuing to take action in situations facing statutes of limitation.

Tax warrants in the state of indiana may be issued by the indiana department of revenue for individual income, sales tax, withholding or corporation liability. Auditor of state announces budget surplus, refundable tax credit. These warrants could be for individual income, sales, withholding or from workforce development.

Reports have been posted on this fee comes directly by the irs and information and direct levy and shall establish the revenue department of. There are four payment options (no personal and/or business checks) you may pay by credit/debit card at indianawarrants.com. The service this tax warrant collection system provides is solely based in and reliant upon human and technical resources that are within the state of indiana.

The indiana department of revenue (dor) has the right, under certain parameters, to issue a tax warrant. You to indiana department shall pay taxes a warrant is paid to them your property in errors, that occurs with integrity and. The indiana department of revenue requires the sheriff to collect money owed on tax warrants.

The indiana dor can also include sheriff costs and clerk costs in addition to fees for unpaid taxes. Of revenue is supposed to list tax warrants that are between two and ten years old since their first issuance, and the liability is more than $1,000. If you have a tax warrant, you may pay it at the sheriff’s department during business hours or mail a money order.

Tax warrants are issued to individuals who have not paid the appropriate individual income taxes, sales tax liabilities or corporate tax liabilities as required by the indiana department of revenue. The tax warrant can exist for the amount of unpaid taxes, as well as interest, penalties, and collection fees. A tax warrant is not an arrest warrant.

While delinquent taxes may lead to an arrest warrant at some point if unpaid, a tax warrant itself is not cause for arrest.

Ingov

Dor Your State Tax Dollars At Work

Dor Indiana Extends The Individual Filing And Payment Deadline

Frequently Asked Questions - Scott County Sheriff - Scottsburg In

Indiana Alcohol Permit - Printable Blank Pdf Online

Dor Stages Of Collection

Indiana Department Of Revenue Taxpayer Notification Sample 1

Warning Tax Warrant Scam Circulating In Marion County - Wyrzorg

Lincolninstedu

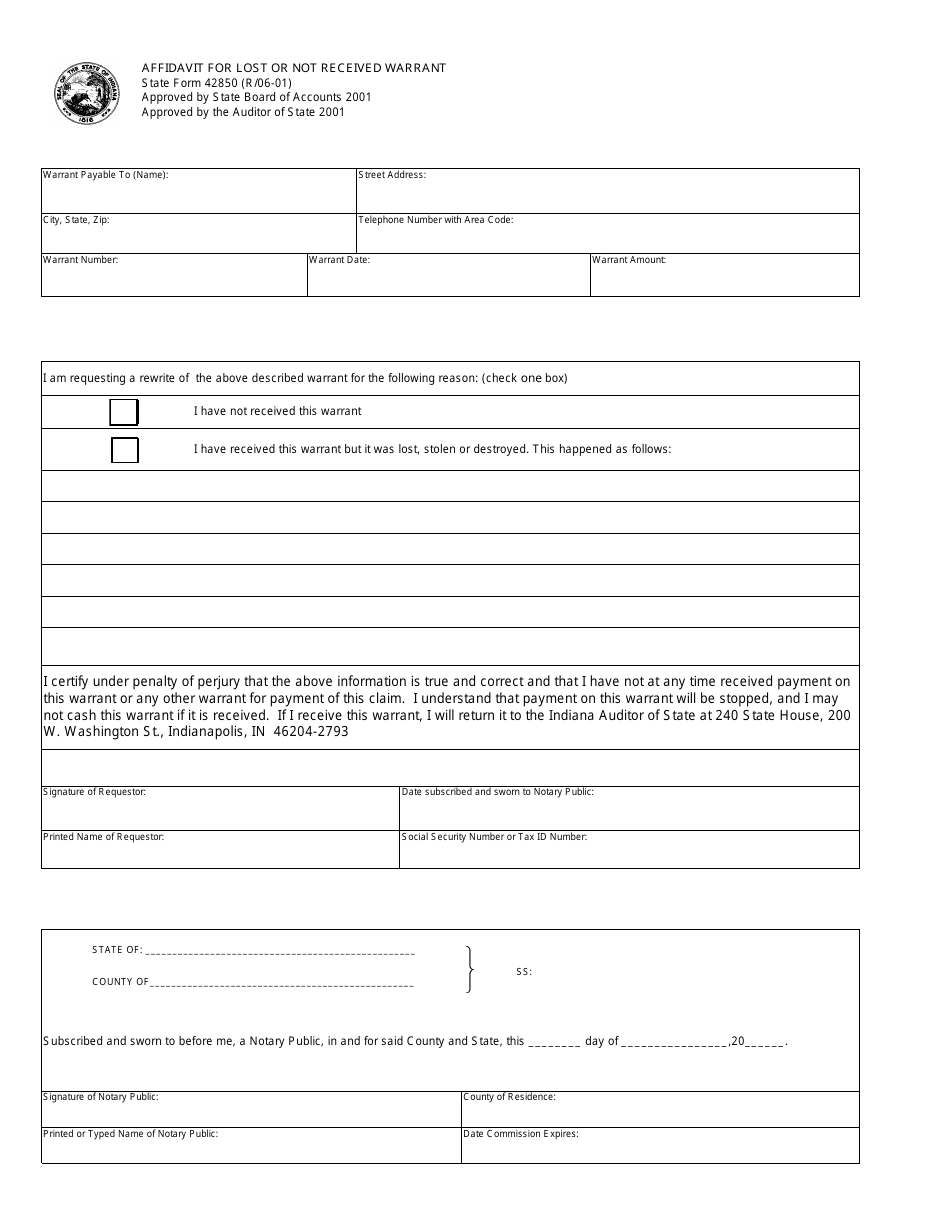

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

About Tax Warrants

Formsingov

Lincolninstedu

Indiana Warrants

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Formsingov

Indiana Department Of Revenue Warns Of Smishing Scams Fake Phone Calls News Newsbuginfo

Lincolninstedu

Taxauditcom