Dedicated to helping individuals become successful entrepreneurs to better their lives and community. It has served new zealand well.

2020 Tax Software Survey - Journal Of Accountancy

We aim to help you grow as a tax professional, credit specialist and client.

Minority tax pros cost. 5) tax free distributions of roth contributions and earnings. Mbe suppliers can offer cost saving strategies due to diversity spend requirements and taking advantage of numerous federal and state tax incentives, tax. These factors have been colloquially called the “minority tax” or “cultural tax”.

On black and minority ethnic women in the uk this is a summary of a cumulative impact assessment of the changes to taxes, benefits and public spending since 2010 on black and minority ethnic (bme) women. In addition, you need more hourly training as opposed to the mtp plan where you can get certified in 5 hours. The minority tax certificate was a program designed to provide broadcasters with an economic incentive to sell their stations to minority owners.

There are no signup or upfront costs. We maintained cleanliness of the office and kept files organized. #workfromhome #entrepreneurship #beyourownboss #minorityownedbusiness #minoritytaxpros #incomeopportunities.

According to a survey by guidant financial, 45 percent of. For more information, we encourage you to contact the regional affiliate nearest to your company. Taxes may not be the most exciting financial topic, but they're definitely important.

Extending the tax base could stop at any of these asset classes but in our view the incremental approach of extending the tax base carefully over time is preferred. Online services for tax pros and clients cons charge over $1500 in fees $549 prep fee $285 bank fee $899 add ons pro credit,car,legal services that do not exist at all the companies are fraudulent and websites do not work at all! The report is part of an ongoing project by the women’s budget group.

Decrease minority participation on committees: This section briefly outlines some of those benefits. Company owners may contribute, as roth/post tax contributions, up to $18,000 annually to.

The best and fastest tax service serving all of las vegas area. For the purposes of this article, we will focus on those who are underrepresented minorities in medicine (urmm), including blacks, latinos,. Pros and cons of a sugar tax.

The minority tax has been defined as the tax of extra responsibilities placed on minority faculty in the name of efforts to achieve diversity [2,3]—but this unfair tax is, in reality, complex. Current minority tax tax reform strategy pro con; I looked into starting your own tax business without their help and you would have to come out of your pocket with the $399 fee up front instead of mtp letting you pay that on the backend.

• cuts to corporation tax will cost £13bn by 2020. A tax collector may not be a friend to all but someone has to do the job. As the old adage goes, taxes are a fact of life.

Minority tax pros association | 232 followers on linkedin. By joining the organization you will have access to a large client base, the best resources, training, marketing, support and software. Minority tax pros has been serving the community for 14 years with certified tax professionals preparing taxes for the minority community.

We are looking for motivated people who are ready to better their life. During tax season it gets very crazy, we have limited accountants to do the tax returns and each return takes about an hour more or less. A sugar tax is a tax on sugary drinks, also called a sugar sweetened beverage tax (ssbt).

These types of businesses comprise a far greater share of the market than you’d think! Besides the economic benefits, there are several intangible benefits to working with a mbe. Estate tax is collected by the federal government, while inheritance tax is state imposed.

Public health advocates say an ssbt in australia and new zealand could help reduce consumption of ssbs and thereby reduce obesity and other associated diseases. The united kingdom has recently joined france, hungary, chile and. At this point we believe that the costs of extending the tax base clearly exceed the benefits.

The minority tax pros association is dedicated to helping individuals become successful entrepreneurs to better their lives and community.

Financial Freedom Blog - Where Sharing Of Financial Knowledge Happens Budgeting Money Budgeting Finances Money Management

Minority Tax Pros - Home Facebook

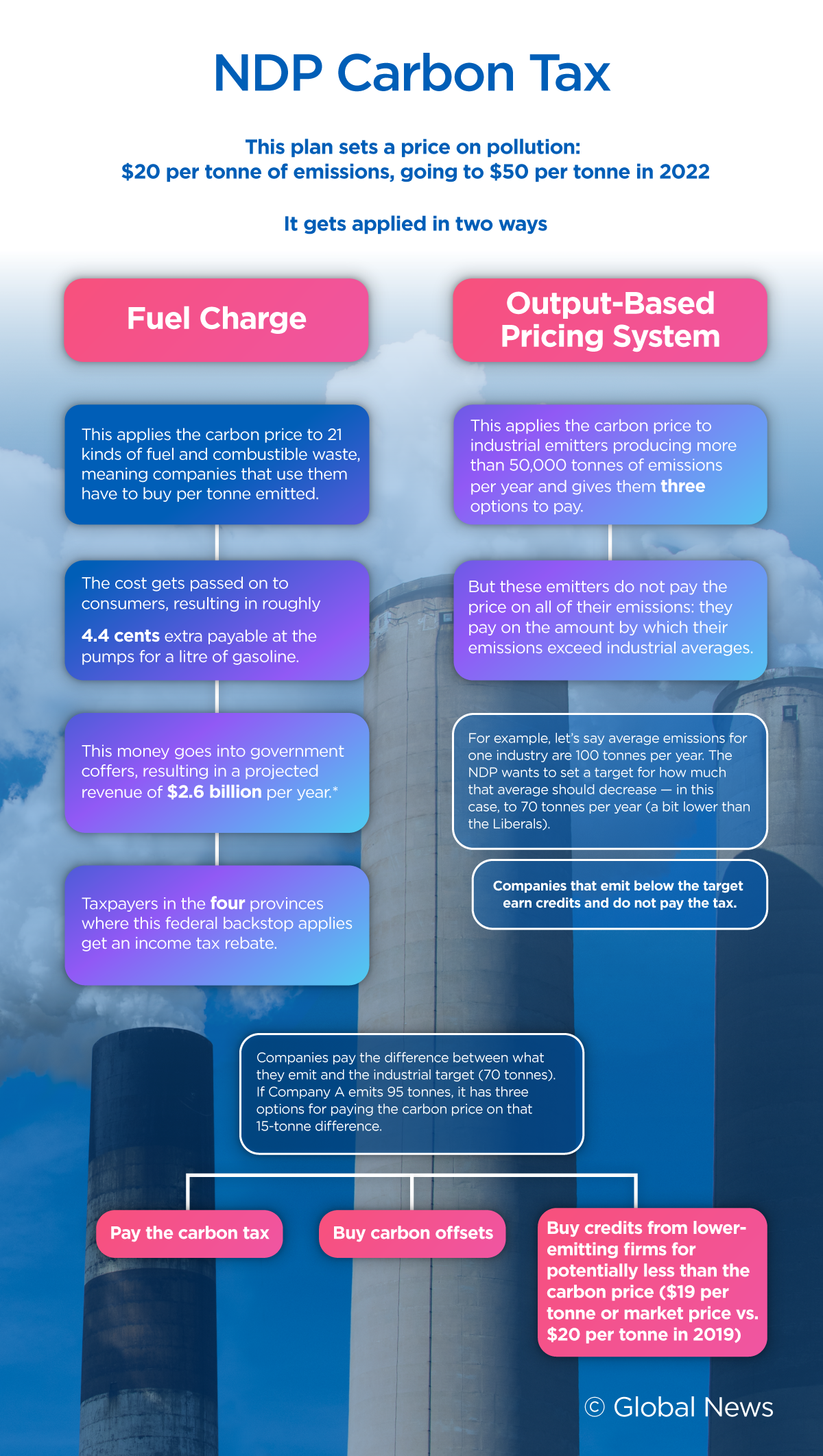

Heres Where The Federal Parties Stand On The Carbon Tax - National Globalnewsca

Amazoncom The Black Tax The Cost Of Being Black In America Ebook Rochester Shawn D Books

Minority Tax Pros - Home Facebook

Minority Tax Pros Association Linkedin

Understanding The Pl Statement Tax And Other Items Value Research

2020 Tax Software Survey - Journal Of Accountancy

How To File Previous Year Taxes Online Priortax Filing Taxes Previous Year Tax

2020 Tax Software Survey - Journal Of Accountancy

Minority Tax Pros Association Linkedin

Minority Tax Pros - Home Facebook

Minority Tax Pros Association Linkedin

Minority Tax Pros Association Linkedin

2

Minority Tax Pros - Home Facebook

Minority Tax Pros Association Linkedin

Arts Crafts Income Statement Profit And Loss Statement Cost Of Goods Sold

Minority Tax Pros Association Linkedin