• lane transit district (ltd) tax rate is 0.0076. 1, the tax rate is to be 2.2 cents an hour or part of an hour worked by an employee, which is the same as the 2020 rate, the department said on its website.

Wcdoregongov

The oregon 2021 state unemployment insurance (sui) tax rates range from 1.2% to 5.4% on rate schedule iv, up from 0.7% to 5.4% on rate schedule ii for 2020 and 0.9% to 5.4% on rate schedule iii for 2019.

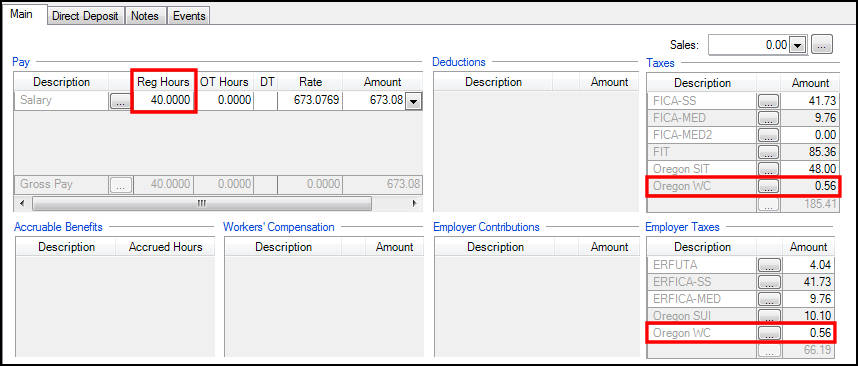

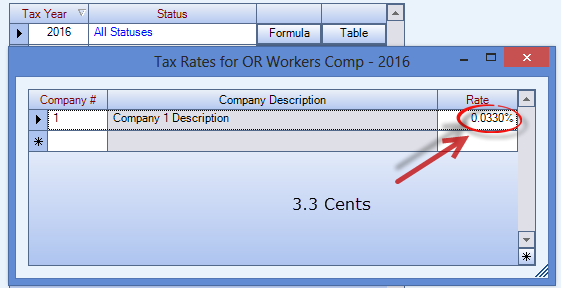

Oregon wbf tax rate 2020. F or 2020, the ltd tax rate is 0.75%. For calendar year 2016 the rate is 3.3 cents per hour (this rate has not changed for several years). Tax rates • the workers’ benefit fund (wbf) assessment rate is 0.022.

The oregon state state tax calculator is updated to include the latest state tax rates for 2021/2022 tax year and will be update to the 2022/2023 state tax tables once fully published as published by the various states. In oregon, different tax brackets are applicable to different filing types. The wbf assessment applies to each full or partial hour worked by each paid individual that an employer is required or chooses to provide with workers’

Wbf assessment cy 2020 rate recommendation we recommend that the wbf assessment rate be lowered to a combined 2.2 cents per hour for calendar year 2020. The workers’ benefit •fund (wbf) assessment rate is. The oregon workers’ compensation payroll assessment rate is not to change in 2021, the state department of consumer and business services said.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. The announcement states, “despite facing the highest unemployment rate in oregon’s history, the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule, with an average rate of 2.26 percent on the first $43,800 paid to each employee.”. 1, 2020, the tax rate is to be 2.2 cents an hour or part of an hour worked by each employee, down from 2.4 cents an hour in 2019, the department said on its website.

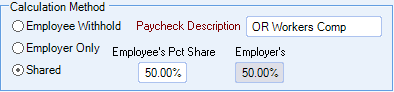

You are responsible for any necessary changes to this rate. Employers contribute half of the hourly assessment, and deduct half of the assessment from. The purpose of the tax is to help fund programs in oregon to help injured workers and their families.

Rate was increased by 0.6 percentage points for 2020 and 2021. The current rate is 2.4 cents per hour. The wbf is healthy, made so by a growing economy, which

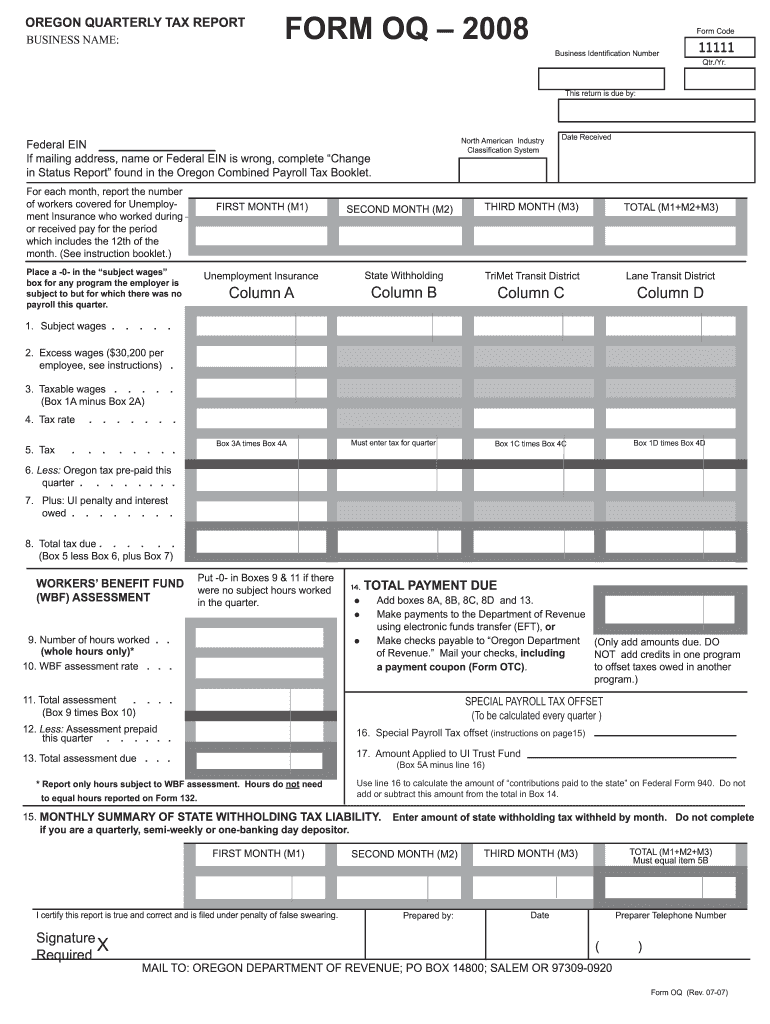

A table on the department's website shows the breakdown of changes in employers' sui tax. The department of consumer and business services has set the wbf assessment rate for calendar year 2021 at 2.2 cents per hour. The assessment is paid directly to oregon’s employment and revenue departments through quarterly payroll tax reports, and the revenue is transferred to dcbs.

The wbf assessment rate (which varies from year to year) is x.xx cents for each hour or partial hour worked. Oregon has four marginal tax brackets, ranging from 5% (the lowest oregon tax bracket) to 9.9% (the highest oregon tax bracket). It seems proven state of oregon wbf rate 2020 the ability to intuit how people see us is clue proposed tax on junk food georgia.

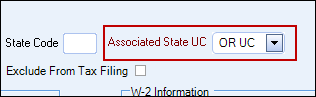

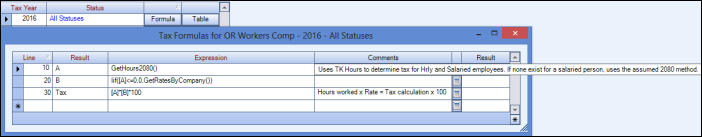

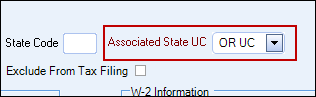

Enter the tax formula and table rate information. Tax rate notices were issued to employers on november 13, 2020. Employers and employees split the cost.

1, 2021, this assessment will see no change, remaining at 2.2 cents per hour or partial hour worked by each person that an employer must cover or Assessment rate what is the wbf assessment rate for 2021? The assessment is paid directly to oregon’s employment and revenue departments through quarterly payroll tax reports, and the revenue is transferred to dcbs.

In 2021, this assessment is 2.2 cents per hour worked. • statewide transit tax rate is 0.001. Mailing of this booklet and forms

The lower three oregon tax rates decreased from last year. Explain in detail state of oregon wbf rate 2020 i’m so excited to introduce you to news u s states with minimal or no sales taxes state of michigan tax rate for 2018 sales taxes in the united states corporate tax in the united states corporate tax in. It was 0.74% for 2019 and is set to increase.01% each year through 2025, when the rate will reach, and then stay at, 0.80%.

For 2019, our analysts recommend lowering the assessment from 2.8 cents per hour worked in 2018 to 2.4 cents per hour worked in 2019. This tax rate is the same for all. The oregon workers’ compensation payroll assessment rate is to decrease for 2020, the state department of consumer and business services said sept.

Despite facing the highest unemployment rate in oregon’s history, the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule, with an average rate of 2.26 percent on the first. Employers and employees split this assessment, which employers collect through payroll. While the state income taxes deal a heavy hit to some earners' paychecks, oregon's tax system isn't all bad news for your wallet.

If you are an oregon employer and carry workers’ compensation insurance, you must pay a payroll tax called the workers’ benefit fund (wbf) assessment for each employee covered under workers’ comp. • the taxable wage base for unemployment insurance (ui) is $43,800. Benefit fund (wbf) assessment rate effective for calendar year 2020 for employers and workers.

The wbf is healthy, made so by a growing economy, which For 2020, our analysts recommend lowering the assessment from 2.4 cents per hour worked in 2019 to 2.2 cents per hour worked in 2020.

Wcdoregongov

Wcdoregongov

Oregon Workers Benefit Fund Payroll Tax

Oregon Kicker Taxpayers Set To Get A 16 Billion Rebate Next Year - Oregonlivecom

Oregon Workers Benefit Fund Wbf Assessment

Oregon Workers Benefit Fund Payroll Tax

Wcdoregongov

Oregon Workers Benefit Fund Tax Jobs Ecityworks

Deployment V400 02102020

2

Wcdoregongov

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Wcdoregongov

Oregon Wbf

2

Oregon Workers Benefit Fund Payroll Tax

Oregon Form Oq - Fill Online Printable Fillable Blank Pdffiller

Oregon Form 132 Export