If the home is valued at less than $70,000, please see financial. Universal service fund and weatherization

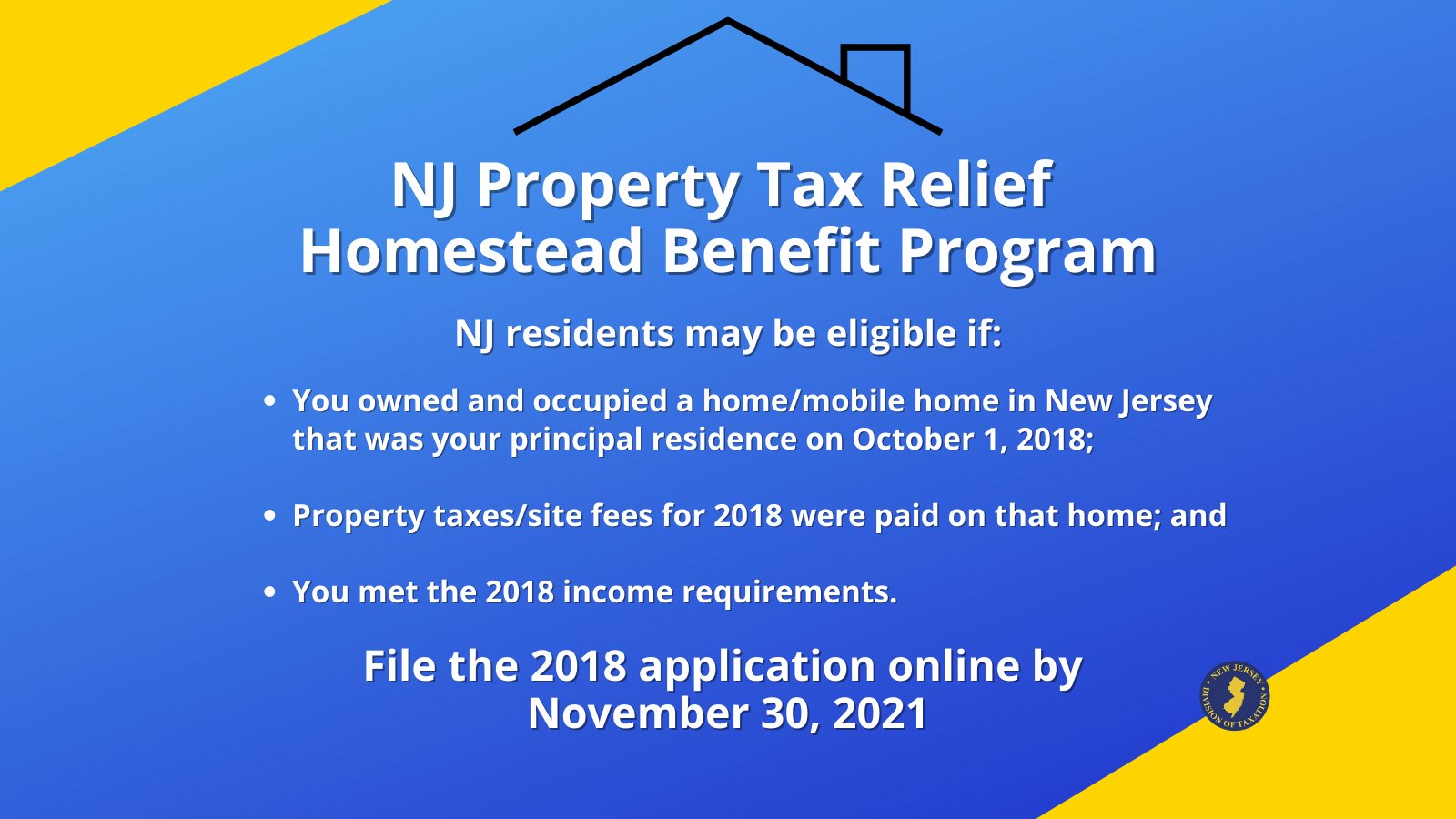

Nj Property Tax Relief Program Updates Access Wealth

The state has two programs that are supposed to help seniors with the costs:

Property tax assistance program nj. Edison senior services provide a wide variety of services to senior residents of edison township. Heating assistance rebates will be issued starting on october 18, 2021. Donotpay provides information on available property tax assistance for seniors in the following text and some of.

The senior freeze (property tax reimbursement) program reimburses eligible new jersey residents who are senior citizens or disabled persons for property tax increases on their principal residence (home). Home energy and home energy assistance program; Seniors can receive assistance in the following:

The new jersey housing and mortgage finance agency (njhmfa) is dedicated to increasing the availability of and accessibility to safe, decent and affordable housing to families in new jersey. The state of new jersey offers tax relief in various forms to certain property owners. Senior citizen and disabled persons property tax reimbursement program.

Last year, new jersey's average bill was $8,953. We in new jersey have one of the highest property taxes in the nation. The new jersey housing and mortgage finance agency provides a variety of programs to assist prospective homebuyers and homeowners.

The pilot program allows municipalities to exempt developers from full property taxes for a set period of time when making improvements to existing buildings or creating new projects in areas in need of redevelopment, aiming to encourage commercial, residential, and industrial development. For more information on the senior freeze program, including eligibility requirements and how to apply, visit the nj treasury department's senior freeze program page. Guide to car safety for seniors.

The property must have a current market value of $70,000 or more. The property tax reimbursement plan, also called the “senior freeze,” and the homestead benefit program. If you are a qualified veteran, widow of a veteran, senior citizen, disabled person, or surviving spouse, you may be eligible for deductions which reduce your property tax liability by $250.

If you qualify for this year’s property tax rebate for seniors program, you also qualify for this year’s heating assistance rebate program. Take the senior resident wellness pledge. Counselors will provide assistance to help homeowners avoid potential foreclosure.

The program’s purpose is to make funds available for eligible applicants who are interested in purchasing a home but need financial help to pay the upfront costs associated with a mortgage. Njeda small business emergency assistance grant program. The rules were tightened up in 2013, making it tougher to qualify for the program — including.

Eligibility criteria are set at the state or local level and may differ. In addition, the new jersey housing and mortgage finance agency offers homeowners free counseling through its foreclosure mediation assistance program (fmap). If you are a senior, you can qualify for property tax assistance programs in most states, counties, or towns.

Counseling is free, available now, and can be provided remotely. Forms are sent out by the state in late february/early march. The program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence.

Helping seniors drive safer & longer. The most common programs are as follows: Rsf properties does business across the united states, and there must be a wide margin between what is owed and the home's value.

Complete this questionnaire to see if you may be eligible for a 2017 senior freeze. Gross sales of products from the land must average at least $1,000 per year for the first 5 acres. In some cases this may mean working with.

Senior freeze (property tax reimbursement) program. Energy star certification has been a continuing threshold requirement in the qap, helping to create buildings that. Since 2003, njhmfa has championed energy efficiency and green building practices for low income housing tax credit program projects in new jersey.

Freehold Township Sample Tax Bill And Explanation

Bidens Proposal Doesnt Address Property Tax Breaks But The Final Bill Will Nj Lawmakers Say - Njcom

Disabled Veterans Property Tax Exemptions By State

Nj Div Of Taxation Nj_taxation Twitter

Deducting Property Taxes Hr Block

Nj Property Tax Relief Program Updates Access Wealth

Tax Assessment Summit Nj

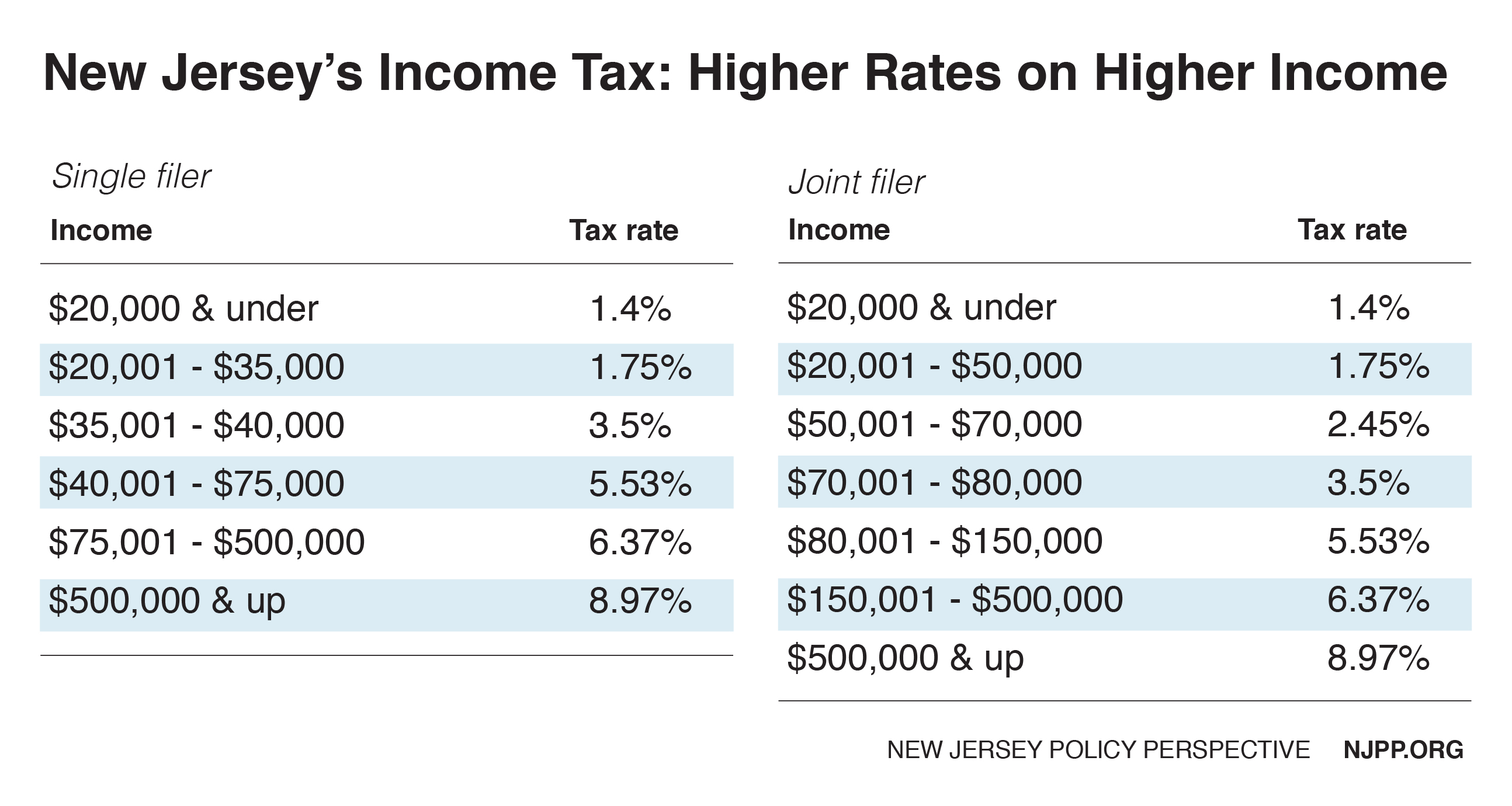

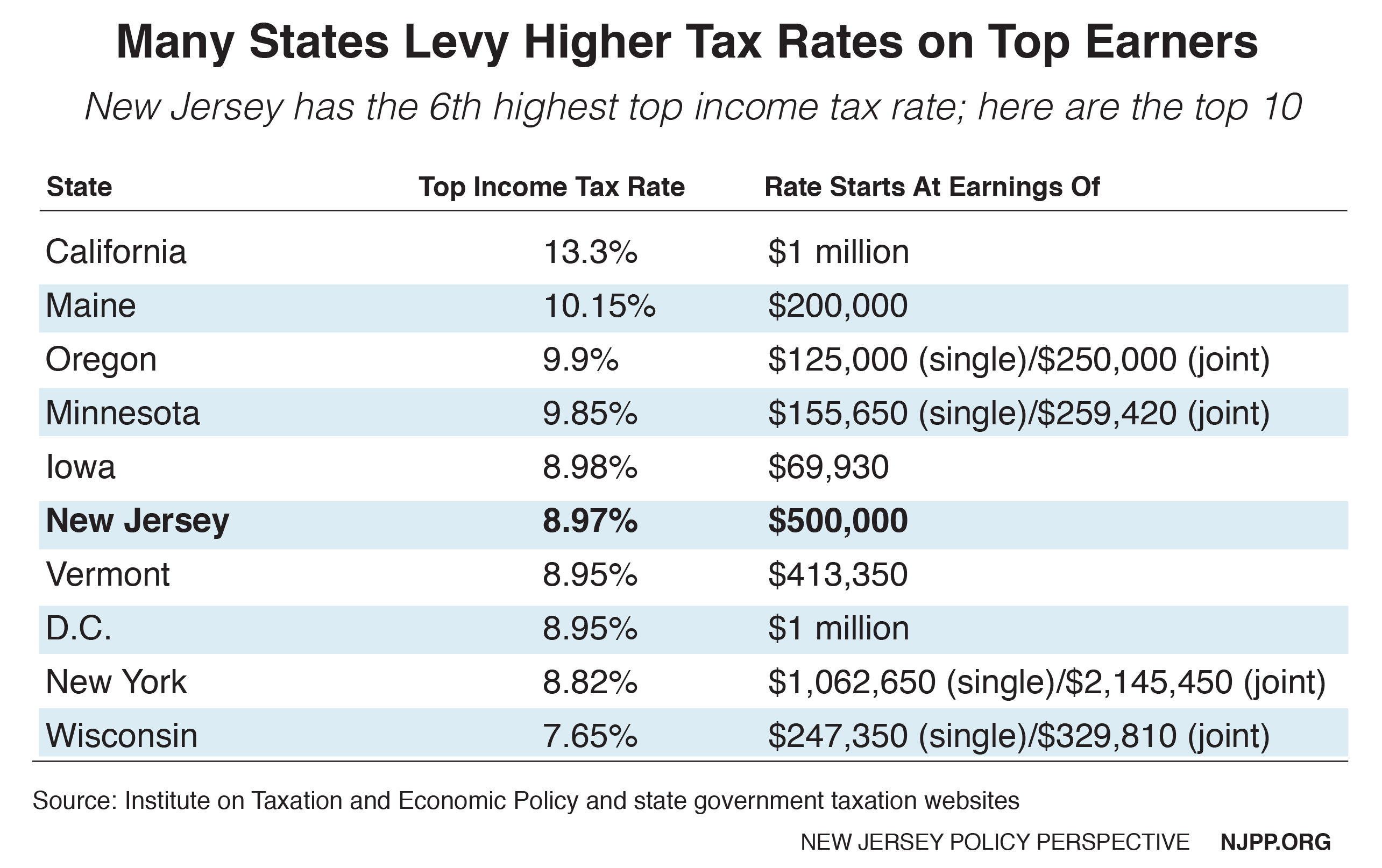

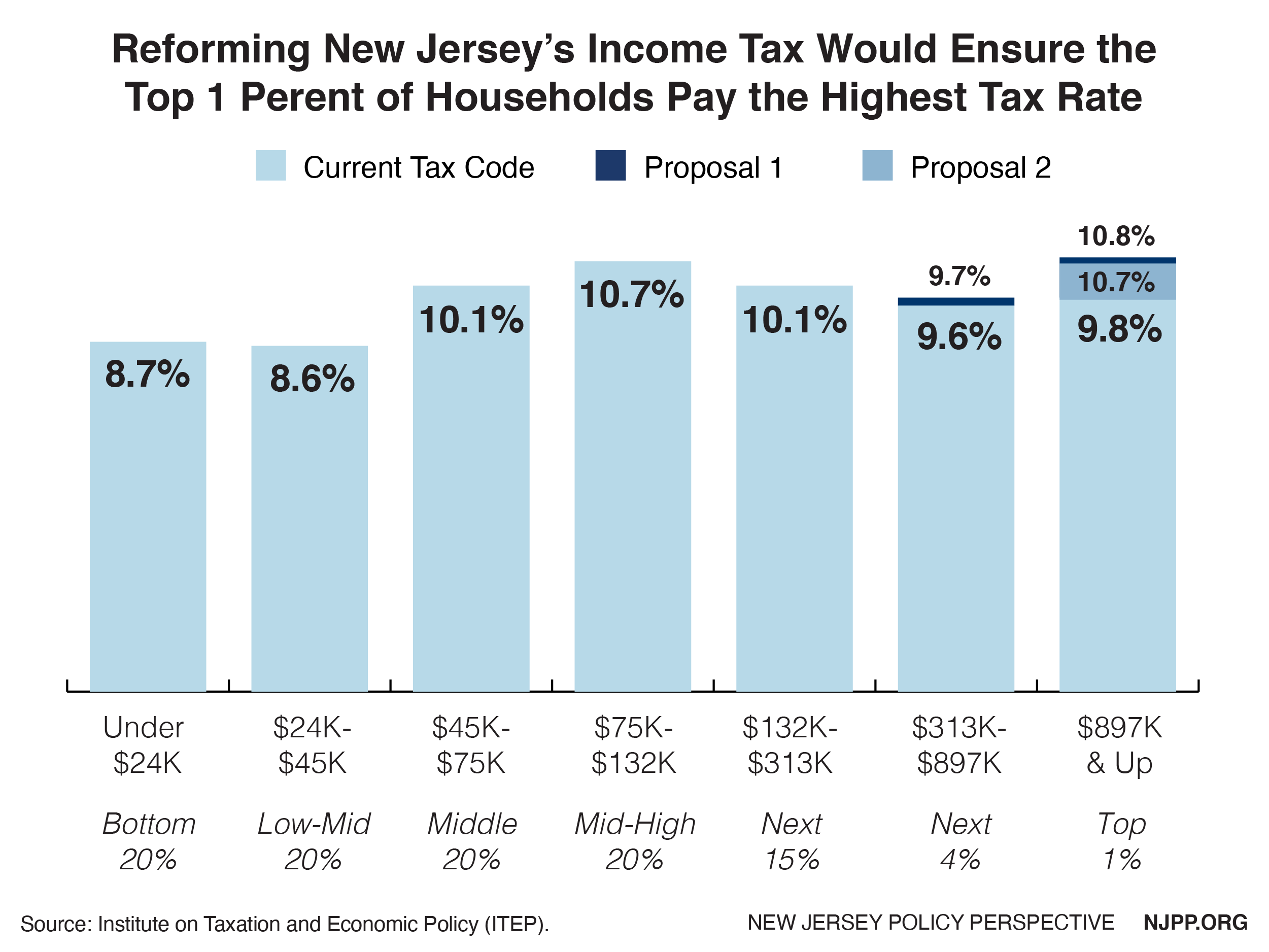

Reforming New Jerseys Income Tax Would Help Build Shared Prosperity - New Jersey Policy Perspective

Congress May Restore Your Property Tax Break But Just For A Little While Nj Congressman Says - Njcom

How To Appeal Property Taxes And Win Over The Appraiser We Did - Njcom

Reforming New Jerseys Income Tax Would Help Build Shared Prosperity - New Jersey Policy Perspective

Tax Assessor - Chester Township Nj

Changing Senior Freeze Program So Those Who Move Arent Penalized - Whyy

Road To Recovery Reforming New Jerseys Income Tax Code - New Jersey Policy Perspective

/cloudfront-us-east-1.images.arcpublishing.com/pmn/T7BKLA5ULVFWPFN4PIW5LBNSXU.jpg)

These Nj Democrats Have Their Own Demands For Their Partys Big Bill And Yes Its About Property Taxes

The Official Website Of The Borough Of Roselle Nj - Tax Collector

The Official Website Of City Of Union City Nj - Tax Department

Freehold Township Sample Tax Bill And Explanation

Where Do New Jerseys Property Tax Bills Hit The Hardest New Jersey Future