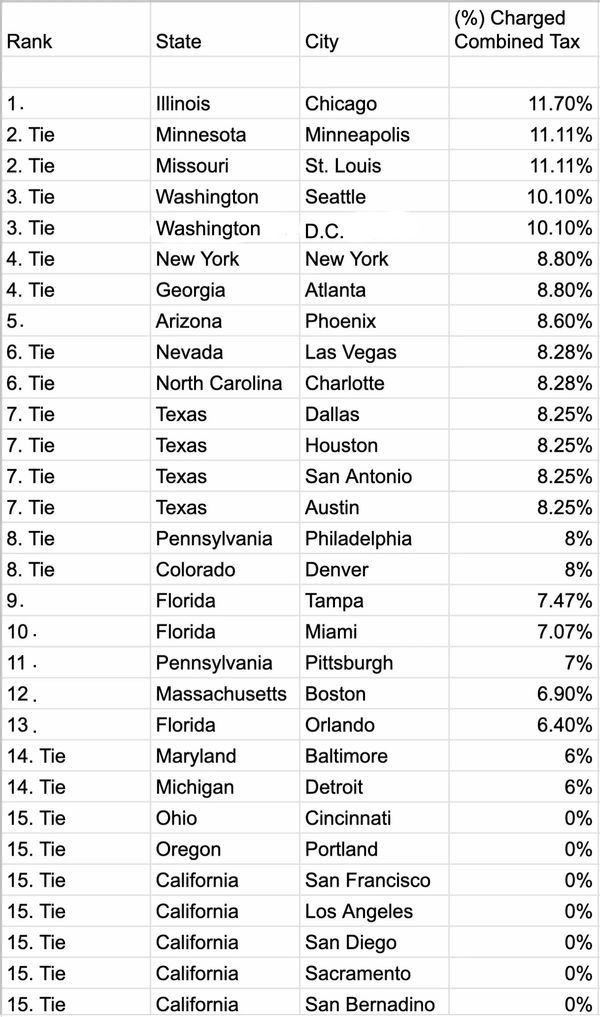

The san antonio, texas sales tax is 8.25% , consisting of 6.25% texas state sales tax and 2.00% san antonio local sales taxes.the local sales tax consists of a 1.25% city sales tax and a 0.75% special district sales tax (used to fund transportation districts, local attractions, etc). 2021 low income housing tax credit/chodo apartment capitalization rates according to house bill 3546:

Medina County Texas Dont Fence Me In Site Selection Magazine

San antonio is providing the following statement on this cover page of its fy 2021 proposed budget:

San antonio tax rate 2021. 0.500% san antonio mta (metropolitan transit authority); But he said there was room in the budget for a reduction from 30.1 cents to. The city also collects 1.75% for bexar county.

The city of san antonio tax rate is nine percent (.09). The december 2020 total local sales tax rate was also 8.250%. 'not later than january 31st of each year, the appraisal district shall give public notice in the manner determined by the district, including posting on the district's website if applicable, of the capitalization rate to be used in that year to appraise property receiving an exemption under this section'.

A block of rooms has been secured at the drury inn & suites at a rate of $110 + tax per night. Local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. During 2022, this tax will go up from 2021's $142,800 to $147,000 in 2022.

This budget will raise more total property taxes than last year’s budget by $26,748,510 or 4.4%, and of that amount, $11,487,636 is tax revenue to be raised from new property added to the tax roll this year. China grove, which has a combined total rate of 1.72 percent, has the lowest property tax rate in the san antonio area and poteet, with a combined total rate of 3.22 percent, has the highest rate in the area. The revenue must be reported to the state each month.

Drury inn & suites san antonio near la cantera parkway. Tax rates the official tax rate each tax year local government officials, such as city council members, school board members, and commissioner's court, examine the taxing units' needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. The san antonio sales tax rate is %.

All companies that have employees earning more than that threshold will have to pay the additional amount in 2022. You can find more tax rates and allowances for san antonio and texas in the 2022 texas tax tables. The six percent state hotel tax applies to any room or space in a hotel, including meeting and banquet rooms.

San antonio sales tax rates for 2022. Road and flood control fund. The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division.

The county sales tax rate is %. The state hotel occupancy tax rate is six percent (.06) of the cost of a room. Texas sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

County manager david smith had recommended that commissioners leave the tax rate unchanged. There is no applicable county tax. The 8.25% sales tax rate in san antonio consists of 6.25% texas state sales tax, 1.25% san antonio tax and 0.75% special tax.

0.125% dedicated to the city of san antonio ready to work program; Meanwhile, the labor force participation rate, or the number of adults who work at jobs compared to the overall population, remains at 61.6% in october, unchanged from. 2020 actual tax rates / 2021 actual tax rates (as of 10/12/2021) tax rates bexar county city of san antonio incorporated cities school districts

This is the total of state, county and city sales tax rates. 2021 official tax rates & exemptions. Homeowners would see an annual increase in property taxes of about $108 per $100,000 taxable value or about $242 for a home valued at $250,000.

1.000% city of san antonio; By 2025, the district would raise its tax rate by $0.1075 per $100 taxable value, increasing the current tax rate of $1.088 to $1.1955. Find your texas combined state and local tax rate.

The minimum combined 2021 sales tax rate for san antonio, texas is. San antonio cities/towns property tax rates the following table provides 2017 the most common total combined property tax rates for 46 san antonio area cities and towns. The base state sales tax rate in texas is 6.25%.

0.250% san antonio atd (advanced transportation district); San antonio in texas has a tax rate of 8.25% for 2022, this includes the texas sales tax rate of 6.25% and local sales tax rates in san antonio totaling 2%. The texas sales tax rate is currently %.

You can book your room by using the link below or. San antonio’s current sales tax rate is 8.250% and is distributed as follows: The county’s real property tax rate has held steady at $1.15 per $100 of assessed value since fiscal 2019 — though it will decline to $1.14 in 2022.

San antonio, tx sales tax rate the current total local sales tax rate in san antonio, tx is 8.250%.

San Antonio-new Braunfels Median Income Rises To 74100 Heres Why It Matters - San Antonio Heron

Road Closures On Broadway In San Antonio Will Continue Through 2024

Tac - School Property Taxes By County

World Languages - Saisd

Tax Calendar Bexar County Tx - Official Website

Tac - School Property Taxes By County

Cost Of Living In San Antonio Tx 2021

The Eddington Groupinc - Home Facebook

Workforce Alamo Solutions Ceo Says San Antonios Unemployment Rate Near Pre-pandemic Level

6bhczkyytu5yam

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Saloncom

San Antonio Suburb Approves Tax District Mixed Use Districts Suburbs

2

Tac - School Property Taxes By County

2021 International Petrochemical Conference American Fuel Petrochemical Manufacturers

Cost Of Living In San Antonio Tx 2021

San Antonio Isd

Texas Income Tax Calculator - Smartasset

City Of Poth Texas