What types of real property have been granted an exemption from georgia’s property tax? What is the intangible tax?

2

(1) the property is committed to and held in good faith for an exempt use;

Georgia property tax exemption nonprofit. The following list sets forth the property tax exemptions that are most likely to be used by georgia nonprofit organizations. No age or income limit. We start by examining justifications and existing eligibility criteria for the property tax exemption, followed by studies of the magnitude of the revenue loss from the exemption.

(d) property which is held by a georgia nonprofit corporation whose income is exempt from federal income tax pursuant to section 115 of the internal revenue code of 1986 and held exclusively for the benefit of a county, municipality, or school district shall be considered to be public property within the meaning of this paragraph. Domestic animals in an amount not to exceed $300 in actual value ; There are limited tax exemptions from georgia sales and use tax for qualifying nonprofits.

According to alabama code, real or personal property used exclusively for nonprofit hospital purposes is exempt from property taxation. The georgia code grants several exemptions from property tax. Today, georgia nonprofits owning property and earning revenue through rentals or other income producing activities can relax for a moment.

Se, unit 1001, atlanta ga 30316 Usually there is no ga sales tax exemption to churches, religious, charitable, civic, and other nonprofit organizations. (2) acquisition of the property is reasonable and proporionate to the future needs of.

(1)(a) public property (1)(d) property held by a georgia nonprofit corporation whose income is exempt from federal income tax and held exclusively for the benefit of a county, municipality, or school district (2) all places of burial (2)(a) all places of religious worship Includes $10,000 off the assessed value on county, $4,000 off school, and $7,000 off recreation. (d) property which is held by a georgia nonprofit corporation whose income is exempt from federal income tax pursuant to section 115 of the internal revenue code of 1986 and held exclusively for the benefit of a county, municipality, or school district shall be considered to be public property within the meaning of this paragraph.

Regarding this, are churches tax exempt in georgia? If development authority supported by millage from local government gag It also includes use requirements or other conditions a nonprofit must comply with to be eligible for the exemption.

This paper reviews the existing literature on the property tax exemption for nonprofit organizations and identifies gaps to be addressed in future research. Are there any exceptions for ga sales tax exemption? Items of personal property used in the home if not held for sale, rental, or other commercial use ;

Property tax exemption briefing for nonprofits this briefing for nonprofits provides an overview of the nuçi case and provides a framework for moving forward on the issue of property tax exemption. In order to qualify for one of the exemptions, the property must not be used for the purpose of producing private or corporate. Who is eligible for sales tax exemption in georgia?

In general, georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations. These organizations are required to pay the tax on all purchases of tangible personal property. Your nonprofit in georgia will have to pay taxes on all tangible personal property purchased.

Usually there is no ga sales tax exemption to churches, religious, charitable, civic, and other nonprofit organizations. Real or personal or both). Georgia exempts a property owner from paying property tax on:

For all property owners who occupy the property as of january 1 of the application year. Your nonprofit in georgia will have to pay taxes on all tangible personal property purchased. Qualifying nonprofits and exempt property (i.e.

Main office 881 memorial dr. All tools and implements of trade of manual laborers in an amount not to exceed $2,500 in actual value ; Income tax entities that are exempt from federal income tax under section 501(c), (d) or (e) are exempt from state income tax.

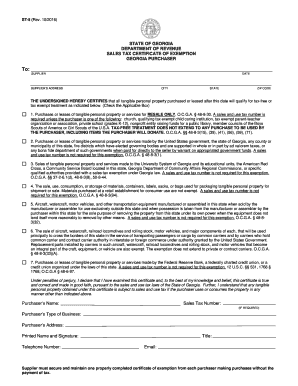

2016-2021 Form Ga Dor St-5 Fill Online Printable Fillable Blank - Pdffiller

2

2

How To Register A Foreign Non Profit In Georgia

Form St-ch-1 Fillable Application For Certificate Of Exemption For Nonprofit Child-caring Institution Child-placing Agency And Maternity Home Rev 0704

2

Exemption Summary Richmond County Tax Commissioners Ga

Ga Certificate Of Exemption Of Local Hotelmotel Excise Tax 2013-2021 - Fill Out Tax Template Online Us Legal Forms

The Economic Impact Of Georgias Nonprofit Sector The Georgia Center For Nonprofits

2016-2021 Form Ga Dor St-5 Fill Online Printable Fillable Blank - Pdffiller

2

2

2

Form St-5 Fillable St-5 Certificate Of Exemption Rev 1112

2

2

2

2

2