Provincial, federal and harmonized taxes are automatically calculated for the province selected. This is greater than revenue from ontario’s corporation tax, health premium, and education property tax combined.

Canada Sales Tax Calculator On The App Store

Ad earn more money by creating a professional ecommerce website.

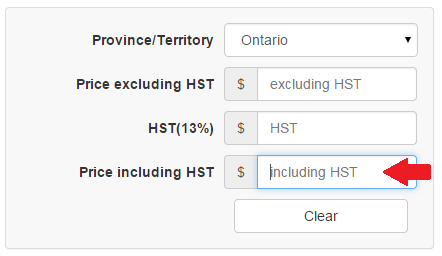

Reverse sales tax calculator ontario. Here is how the total is calculated before sales tax: All harmonized sales tax calculators on this site can be used as well as reverse hst calculator. Reverse sales tax calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage.

This will combine the gst and pst, and you can enter the amount to then reverse it out. Start yours with a template!. The harmonized sales tax, or hst, is a sales tax that is applied to most goods and services in a number of canadian provinces:

Amount without sales tax * gst rate = gst amount. New brunswick, newfoundland and labrador, nova scotia, ontario, and prince edward island.it ranges from 13% in ontario to 15% in other provinces and is composed of a provincial tax and a federal tax. Revenues from sales taxes such as the hst and rst are expected to total $28.1 billion, or 26.5% of all of ontario’s taxation revenue, during the 2019 fiscal year.

Ad understand your sales tax issues with real, personalized help from a pro. Sales taxes make up a significant portion of ontario’s budget. It ranges from 13% in ontario to 15% in other provinces and is composed of a provincial tax and a federal tax.

Op with sales tax = [op × (tax rate in decimal form + 1)] Ad understand your sales tax issues with real, personalized help from a pro. Start yours with a template!.

An error margin of $ 0.01 may appear in reverse calculator of canada hst, gst and pst sales tax. The provincial sales tax (pst) applies only to three provinces in canada. You have a total price with hst included and want to find out a price without harmonized sales tax ?

Sales tax calculator 2021 for ontario. Amount + hst/gst ( variable) = total amount. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax.

The reverse sales tax formula below shows you how to calculate reverse sales tax. Use leading seo & marketing tools to promote your store. Use leading seo & marketing tools to promote your store.

Understanding the reverse goods and services tax (gst) now that you have a good grasp of the goods and services tax (gst), we can now see what exactly is the reverse goods and services tax (gst). It is very easy to use it. Enter the sales tax and the final price, and the reverse tax calculator will calculate the tax amount and.

Ad earn more money by creating a professional ecommerce website. Ontario revenues from sales taxes. In normal circumstances, a supplier of services or goods is.

Let more people find you online. Property tax calculator ontario property tax (68 cities) brampton hamilton kitchener london markham mississauga ottawa toronto vaughan windsor show more bc property taxes (48 cities) abbotsford burnaby coquitlam kelowna richmond surrey vancouver Ontariotaxcalculator is a simple, efficient and easy to use tool in ontario to calculate sales tax hst.

Instead of using the reverse sales tax calculator, you can compute this manually. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Enter that total price into “price including hst” input box at the bottom of calculator and you will get excluding hst value and hst value.

Calculates the canada reverse sales taxes hst, gst and pst. Due to rounding of the amount without sales tax, it is possible that the method of reverse calculation charges does not give ($ 0.01 to close) the total of sales tax used in every businesses. To find the original price of an item, you need this formula:

There are times when you may want to find out the original price of the items you’ve purchased before tax. If you want a reverse gst pst calculator bc only, just set the calculator above for british columbia, and it will back out the 12% combined tax rate for the amount you enter in. Also is a tool for reverse sales tax calculation.

Exemptions to the hst there are two types of exemptions for hst: Let more people find you online.

Sales Tax Canada Calculator On The App Store

Reverse Hst Calculator - Hstcalculatorca

Reverse Sales Tax Calculator - 100 Free - Calculatorsio

Updated Canada Sales Tax Calculator Pc Iphone Ipad App Mod Download 2021

Pst Calculator - Calculatorscanadaca

Canadian Sales Tax Calculator - Windows 10 Download

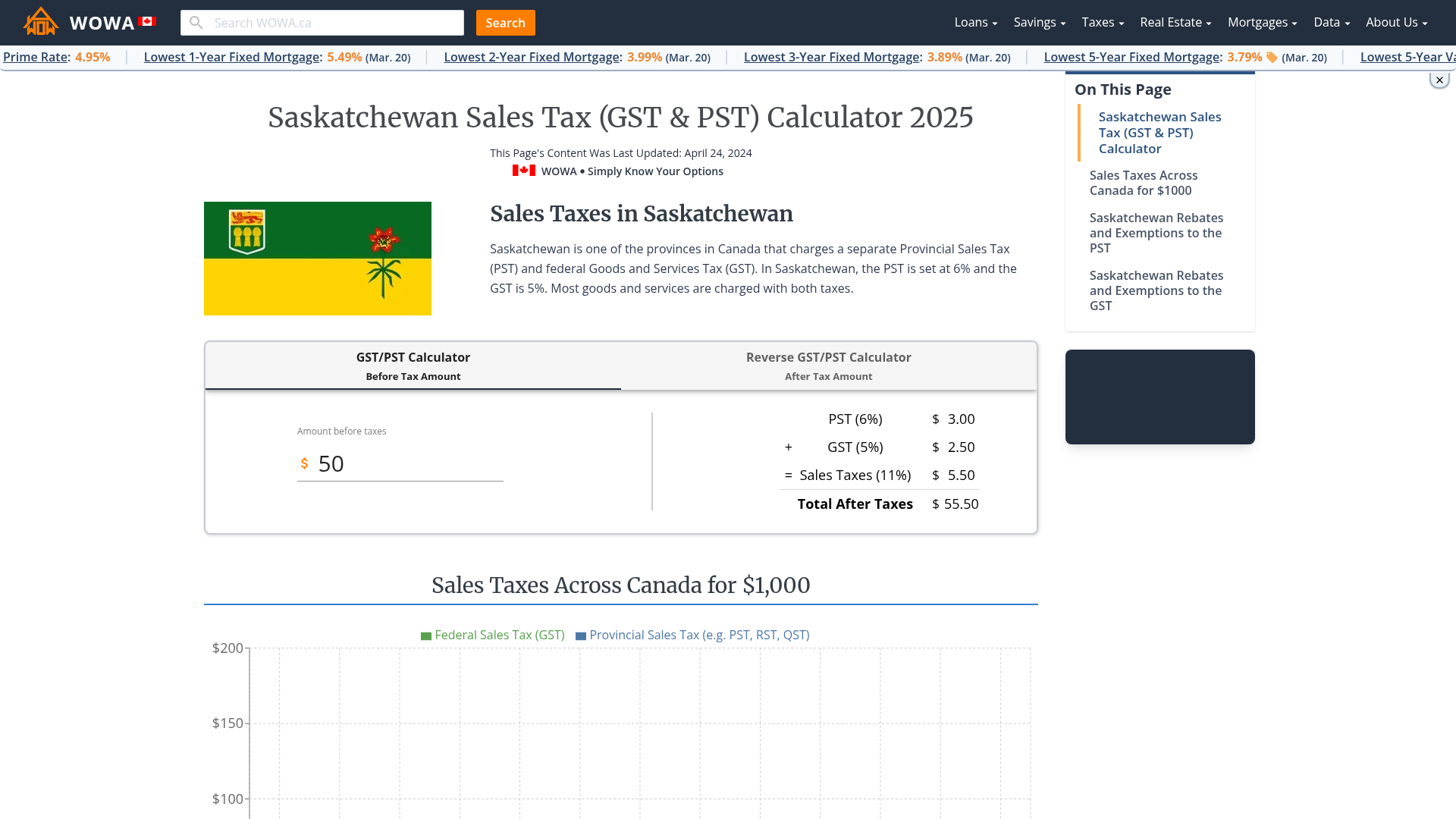

Saskatchewan Gst Calculator - Gstcalculatorca

Reverse Sales Tax Cwl

Reverse Sales Tax Calculator - 100 Free - Calculatorsio

Ontario Sales Tax Hst Calculator 2021 Wowaca

Canada Sales Tax Calculator By Tardent Apps Inc

Canada Sales Tax Calculator By Tardent Apps Inc

Sales Tax Decalculator - Formula To Get Pre-tax Price From Total Price

Reverse Gst Hst Pst Qst Calculator 2021 All Provinces In Canada

Updated Canada Sales Tax Calculator Pc Iphone Ipad App Mod Download 2021

How To Calculate Sales Tax Backwards From Total

New York Sales Tax Calculator Reverse Sales Dremployee

Saskatchewan Sales Tax Gst Pst Calculator 2021 Wowaca

Canada Sales Tax Calculator On The App Store