In missouri, the county tax collector will sell tax lien certificates to winning bidders at the saline county tax lien certificates sale. The online payment transaction receipt is not sufficient for license plate renewal, if you need tags immediately do not pay online.

Saline County Tax Collector Record Search - Arcountydatacom - Arcountydatacom

The total amount will be adjusted to allow for the electronic processing of the transaction through the state's egovernment service provider, click here for fee information.

Saline county tax collector mo. Third party advertisements support hosting, listing verification, updates, and site maintenance. During the meeting of the saline county commission on thursday, october 28, collector cindi sims said the tax bills were approved on wednesday, october 27. Disputed taxes the collector of saline county, as well as the collectors of all affected political subdivisions therein, shall continue to hold the disputed taxes pending the possible filing of an application for review, unless said taxes have been disbursed pursuant to a court order under the provisions of section 139.031.8 rsmo.

If you have questions or need your bill information please contact the collector office at 660.886.5104. Saline county tax collector's office contact information. This fee is not charged nor collected by the county but by the payment processor.

The information is provided by saline county and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or. Welcome to the saline county missouri payment website for real estate and personal property taxes. The collector prepares an annual settlement of the collection of all property taxes.

Sims says the real estate and personal property bills total more than $24 million. If you would like to pay using the automated phone. We also have the 2015 plat books on sale for $5.00 each.

14, the missouri state tax commission completed the residential sales study in my office and found that saline county was out of compliance,” goodman continued. Welcome to saline county, arkansas, home to nationally recognized schools, championship sports, first class parks and libraries in a suburban/rural setting with a marvelous variety of shopping and dining amenities for your family to enjoy. Real estate taxes fund local services such as public education, police protection and medical services.

Collector tammy steele, collector brenda frahm, deputy collector po box 65 lancaster, mo 63548 office: The collector also collects merchant license fees, liquor license fees and utility and railroad taxes. The collector is charged with the duties of collecting the taxes due, as shown on the county's tax.

Conveniently located in central arkansas along interstate 30, saline county is fifteen minutes from the little. Saline county does not receive any portion of. Tax collector is not affiliated with any government agency.

Address, phone number, and fax number for saline county tax collector's office, a treasurer & tax collector office, at east arrow street, marshall mo. The collector’s responsibilities apply to the collection and distribution of all real and personal property taxes, the collection of both current and delinquent surtax, railroad and utility taxes, payment in lieu of tax (pilt) and the private railcar tax. In order to receive a receipt today you must come into the office.

The information contained in this website is for general information purposes only. “our residential sales studies are completed by the state tax commission every two years. The primary function of the county collector is the collection of personal and real estate taxes for the various taxing entities of the county.

According to state law missouri tax lien certificates can earn as much as 10% per annum (8% on subsequent taxes) on the amount winning bidders pay to purchase missouri tax lien certificates. Welcome to the saline county collector epayment service this site was created to give taxpayers the opportunity to pay their personal and real estate taxes online. A county merchant’s license is required by.

The collection of real estate taxes for properties located in marshall missouri is a major priority for the saline county missouri tax collector. We current have both with and without the e911 addresses. Po box 459 eminence, mo 65466.

Information found on tax collector is strictly for informational purposes and does not construe legal or financial advice.

Saline County Courthouse Kmmo - Marshall Mo

Ecode360com

Saline County Mo

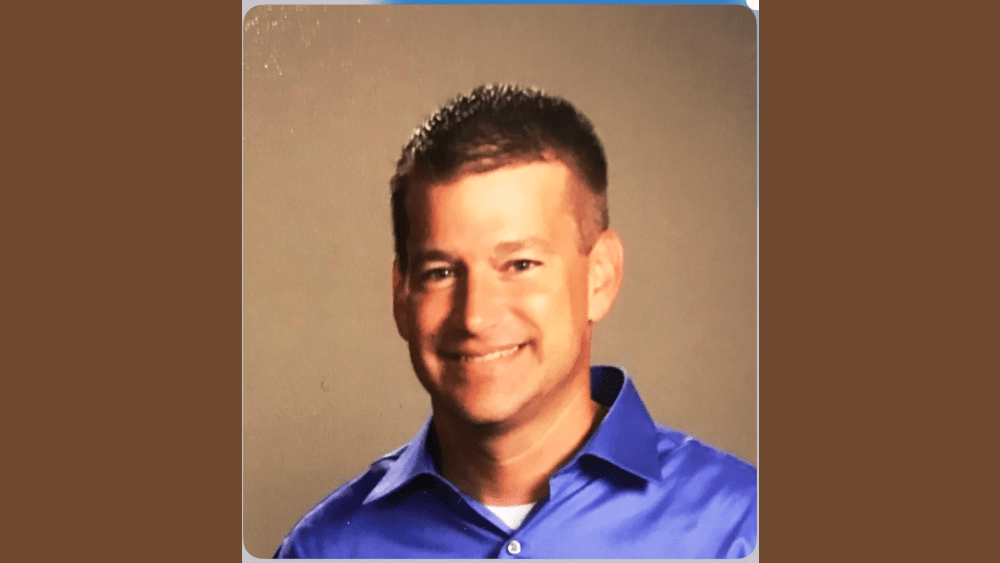

Cindi Sims Saline County Collector Of Revenue

Cindi Sims Saline County Collector Of Revenue

![]()

Home - Saline County Tax Collector

Saline County Treasurer Reviews Monthly Tax Report During Commission Meeting Kmmo - Marshall Mo

Cindi Sims Saline County Collector Of Revenue

Cindi Sims Saline County Collector Of Revenue

Quorum Court Deliberates Shortly And Chooses A Replacement To Complete Tax Collectors Term - Mysaline

Collector Salinecountymo

Saline County Treasurer Gives Sales Tax Report Kmmo - Marshall Mo

Cindi Sims Saline County Collector Of Revenue

Saline County Mo

Saline County Treasurer

Saline County Property Tax A Secure Online Service Of Arkansasgov

Cindi Sims Saline County Collector Of Revenue

Collector Salinecountymo

Saline County Collector Cindi Sims Kmmo - Marshall Mo