4.5% of the next €50,672; The profits will be subject to normal income tax rules i.e.

Debt Arrangement Scheme Uk Wwwdebtarrangeme Debt Arrangement Scheme Scotland - Mortgage Repayment Calcula Mortgage Repayment Calculator Debt Problem Repayment

If the stock acquired through the exercise of the stock is disposed after 24 months (or 36 in the case of startup companies) from the grant of such stock options, then upon disposal, any benefit (difference between their market value upon exercise and their exercise value) is subject to personal income tax at a flat rate of 15 percent (or 5 percent for startup companies).

Stock option tax calculator ireland. The grant of an iso or other statutory stock option does not produce any immediate income subject to regular income taxes. This paper profit is immediately liable for income tax and must be paid over to the revenue within 30 days of exercising the option. • marginal tax rates (currently up to 52%) apply on the exercise of share options.

How to calculate the tax on share options? Income tax file and pay date: And 8% of any remaining balance.

However, you have fewer obligations with regard to irs and sec compliance and reporting. Emily made an exercised share profit of €20,000. See example below on how to calculate share profit.

Let us introduce emily who exercised her share options. Assuming the 40% tax rate applies the tax on the share options is €8,000. When you exercise a qualifying share option under the keep programme, any gain will not be subject to income tax, prsi or usc.

Stock dividends taken in lieu of cash are taxed on the shareholder based on an amount equivalent to the amount that would have been received if the option to take stock dividends had not been exercised. By filing a 83(b) election, you can pay tax on the 409a valuation of company shares today versus their 409a valuation in the future, which will likely be higher. The name refers to a provision under section 83(b) of the u.s.

How to calculate your rtso1 share option tax. There are a number of issues with the current taxation of stock options: Personal cgt exemption of €1,270;

Where an employee/director obtains a right to acquire shares under a revenue approved scheme, no income tax, usc or prsi will be chargeable on grant of the option. You sell them in december 2020 for €8,000. The income tax (it) and universal social charge (usc) due on the exercise of a share option is known as relevant tax on share options (rtso).

If eligibility and holding period requirements are met, the bargain element is taxed as a capital gain to the employee. If the recipient is an irish resident company and it receives the stock dividend from a quoted (listed) irish company, then there will be no tax. Prsi, paye and usc will apply at the relevant rates (up to 52% tax).

Prsi is due on what is referred to as “reckonable income” and includes trading, professional and investment income. The employee includes the benefit either in the year she exercised the employee stock option or, if she acquired ccpc shares, in the year that she sells the shares. 2% of the next €7,862 @ 2%;

She advises clients on the tax, regulatory and design aspects of No income tax arises on exercise of the option. The amount charged to usc and prsi is the income tax free option gain on date of exercise.

A share option to which section 128 tca 1997 applies. This form will report important dates and values needed to determine the correct amount of capital and ordinary income (if applicable) to be reported on your return. Tax rules for statutory stock options.

The gain will be subject to capital gains tax when you dispose of the shares. You must pay it and usc at the higher rate. Using the espp tax and return calculator.

Rsus chargeable to income tax under schedule e are within the scope of the paye system. Qualified espps, known as qualified section 423 plans (to match the tax code), have to follow irs rules to receive favored treatment. Specialises in the tax, regulatory and compliance issues around rewarding and incentivising employees.

You must also pay pay related social insurance (prsi) using the rate of the prsi class applied to you for. Cost of shares;10,000 shares @€1 = €10,000 The following formula will be applied to determine the taxable benefit in kind (figures 2021):

Kpmg alison hughes is a senior manager in kpmg’s people services team. Net chargeable gain = €1,730 Now, if you made $50,000 from stock options trading during the year, you’d be taxed at 35% on all gains, meaning you’d keep ~$32,500 after taxes.

They do not take into account your full tax situation and should not be relied upon or considered advice of any kind.) Calculation of capital gains tax on shares in ireland. The relevant tax on share options is paid at 52%.

Tax code that allows you to elect being taxed on your equity compensation today versus when it vests. In contrast, incentive stock options, or isos, are qualified to receive favorable income tax treatment. Therefore, employees have to use their salary and/or other income or where possible sell sufficient shares in order to fund the taxes arising on exercise;

A list of pwc contacts is provided within each tax area and at the back of this The income tax charge on the shares (or the cash amount of such shares) arises either: This incentive is available for qualifying share options granted between 1 january 2018 and 31 december 2023.

(after brokers fees deducted) chargeable gain = €3,000; Standard rates for usc for 2019 are 0.5% of the first €12,012; Usc and prsi is charged on exercise of the option.

The most significant implication for employees is a $25,000 benefit. From 2011 onwards prsi (4%) and the usc (8%) charges also apply. This is calculated as follows:

(note, all examples are overly simplified for illustrative purposes: How to calculate and pay relevant tax on share options rate of tax. • selling stock options to fund the 52% income tax arising on exercise,.

A) on the date of vesting (rather than grant date) of the rsu; It provides a summary of irish tax rates as well as an outline of the main areas of irish taxation. Usc and prsi are also chargeable on rsus.

You purchased shares in january 2010 at a cost of €5,000 including stamp duty and trading fees; Usc is tax payable on an individual’s total income.

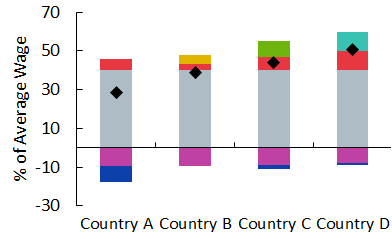

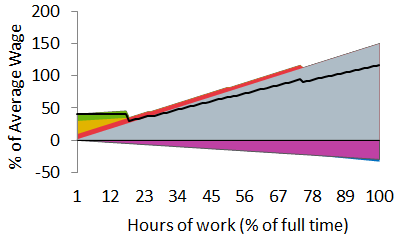

Tax-benefit Web Calculator - Oecd

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Capital Gains Tax On Shares In Ireland - Money Guide Ireland

Personal Loans Online Personal Loans Online Finance Guide Types Of Credit Cards

Colony Villa Floorplan 1163 Sq Ft The Villages Floor Plans New House Plans House Floor Plans

Uk Postcode Sales Map Sales Tracking Map Printable Digital Etsy In 2021 Map Etsy Printables Printables

Tax-benefit Web Calculator - Oecd

Pin On Economy Markets And Miscellaneous Points Of Interest

Pin On Life Hacks

How To Live On One Income Tax Debt Tax Deductions Income Tax Return

For More Details Or Booking Please Visit At Httpmortgage-providerscomau Loans For Bad Credit Mortgage Loans Home Equity Loan

Mortgage Quotes For The Day Mortgage Mortgage Loans Mortgage Lenders

Mortgage Bank Loans In Ireland Mortgage Lenders Mortgage Loans Adjustable Rate Mortgage

Tax-benefit Web Calculator - Oecd

Cover Of Excel For Accountants Accounting Basics Accounting Student Accounting

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Mobility Basics - What Are Tax Equalisation And Tax Protection - Eca International

Premiere Suite - Bali Nusa Dua Hotel

Six Tax Time Tips For Small Business Tax Time Business Small Business