We have almost everything on ebay. Currently, combined sales tax rates in wyoming range from 4% to 6%, depending on the location of the sale.

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

The sales tax will be collected at the county clerks office when you go to get plates.

Does wyoming have sales tax on cars. Sales tax applies where the purchase of the vehicle occurred in wyoming. Sales tax applies where the purchase of the vehicle occurred in wyoming. But did you check ebay?

Does the sales tax amount differ from state to state? Below is a list that shows which states require insurance companies to pay sales tax above and beyond the vehicle's actual cash value. It just can't be done.

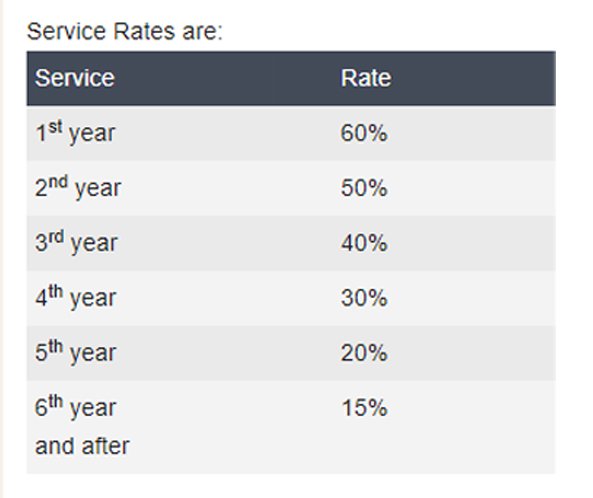

Certain services your business may provide A sales or use tax is due prior to first registration of a vehicle. However, some areas can have a higher rate, depending on the local county tax of the area the vehicle is purchased in.

The states with the lowest combined state and local sales tax rates are hawaii , wyoming , wisconsin , and maine. The state of wyoming does not usually collect sales taxes on the vast majority of services performed. When buying a vehicle, you'll generally need to factor in the following costs/fees in addition to the purchase price and tax:

In addition, local and optional taxes can be assessed if approved by a vote of the citizens. Sales tax is due in 65 days. The use tax is the same rate as the tax rate of the county where the purchaser resides.

What is wyoming's sales and use tax? States with high tax rates tend to be above 10% of the price of the vehicle. Wyoming law requires that a bill of sale must be presented to pay sales tax when a vehicle is purchased from a dealer.

The amount of sales tax you’ll pay will be determined by 3 factors; For residential and commercial property, the tax collected is 9.5 percent of the value of the property. Fortunately, there are several states with low car sales tax rates, at or below 4%:

But did you check ebay? Use tax applies there the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming. Use tax applies where the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming.

This means that a carpenter repairing a roof would be required to collect sales tax, while an accountant would not. Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc. The county treasurer collects a sales or use tax on all vehicle purchases.

Are services subject to sales tax in wyoming? Ad looking for vehicle sales tax? The minimum sales tax varies from state to state.

Depending on local municipalities, the total tax rate can be as high as 6%. States requiring sales tax be paid for total loss settlements. This is the state requirement, but a local mill levy rate (mlr) is added based on each area's rates for residential and commercial property.

The wy sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. Check out vehicle sales tax on ebay. The county treasurer collects a sales or use tax on all vehicle purchases.

Check out vehicle sales tax on ebay. The states with the highest car sales tax rates are: Sales tax applies where the purchase of the vehicle occurred in wyoming.

For industrial lands, this percentage goes up to 11.5 percent. The wyoming (wy) state sales tax rate is currently 4%. Sales and use tax the county treasurer collects a sales or use tax on all vehicle purchases.

You’ll typically need to collect wyoming sales tax on: The amount of sales tax due depends on: Montana, alaska, delaware, oregon, and new hampshire.

We have almost everything on ebay. Use tax applies where the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming. In addition to taxes, car purchases in wyoming may be.

See the publications section for more information. Wyoming's sales tax rates for commonly exempted items are. State wide sales tax is 4%.

Use tax applies where the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming. States with some of the highest sales tax on cars include oklahoma (11.5%), louisiana (11.45%), and arkansas (11.25%). A first party claim is a claim filed against your own carrier, regardless of fault.

Prescription drugs and groceries are exempt from sales tax. Wyoming does not use a formal bill of sale, and some counties provide one while others rely on the transaction parties to provide one. A third party claim is a claim filed against another carrier (at fault carrier).

The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. Wyoming collects a 4% state sales tax rate on the purchase of all vehicles. Sales tax applies where the purchase of the vehicle occurred in wyoming.

Ad looking for vehicle sales tax? The tax fee is based on your county's tax rate. An example of taxed services would be one which sells, repairs, alters, or improves tangible physical property.

Factory cost (not blue book) of the vehicle purchased (msrp), whether you traded. If you have lost your title or it has been mutilated, you will need to apply for a duplicate before you sell the vehicle. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0% and 2%.

What states have the highest sales tax on new cars? When a vehicle is purchased from an individual, no bill of sale is required. Only five states do not have statewide sales taxes:

Updated 17 States Now Charge Fees For Electric Vehicles Gas Tax Electricity States

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Wyoming Affidavit Of Distribution For Motor Vehicle Form Resume Download Resume Computerized Accounting

Sales Tax On Cars And Vehicles In Wyoming

With The New Month Comes A New Season And New Specials Httpwwwvwofoaklandcomspecials Lease Deals Volkswagen New Month

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

Vintage Mcdonald Collectible Cars 2 Hamburglar 1 Big Mac Etsy Big Mac Car Collection Mcdonald

Wyoming Sales Tax - Taxjar

96 Chevy Lumina Ls - 2000 Collegeville Cars For Sale Family Car Chevy

Top 10 States With The Lowest Taxes Wyoming Wyoming Tourism Spearfish

How To Write A Bill Check More At Httpsnationalgriefawarenessdaycom4317how-to-write-a-bill

Shipping From Arkansas To California California Arkansas Vehicle Shipping

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Pin On Hot Deals

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Trickrides Ratrods Trickit Carlifestyle Rat Rod Cartoon Antiques

Pin On 2012-06 Sanfords Pub Grub Casper Wyoming

Pin By Lemoncheckscom On Lemoncheckscom Mazda 2 Mazda Hatchback

Auktionsrueckblick 2011 - Die Teuersten Oldtimer Des Jahres Ferrari Old Sports Cars Ferrari Car