Ii the australian approach to ‘tax avoidance and tax evasion’ it is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. Tax avoidance and tax evasion at one time the distinction between tax avoidance and tax evasion was relatively clear.

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

It may also structure arrangements to:

Tax avoidance vs tax evasion australia. For a person to be found guilty of tax evasion, the prosecution must prove beyond a reasonable doubt that the accused: Avoiding tax and other obligations entirely. Access financial crime compliance information to mitigate risk & prevent tax evasion.

The basic difference is that avoidance is legal and evasion is not. I develop a unifying conceptual framework of corporate tax planning. Punishment under australian law can be severe for tax fraud.

As a result, individuals or businesses get into trouble with the internal revenue service (irs) when they attempt to engage in deliberate tax evasion strategies or activities. Deliberate fraud or false statements, on the other hand, can lead to charges of tax evasion. Contact us to learn more.

But it’s not quite as simple as that. Chapter 8 tax avoidance and tax evasion introduction tax avoidance and tax evasion can next section explains the motivation to products illegally traded across decrease the economic welfare for tax avoidance and tax evasion, borders. Tax evasion is when a person evades or attempts to evade tax by a deliberate act or omission (s 61).

The distinction between tax avoidance and tax evasion has been well established in the australian taxation system. In short, one is legal (tax avoidance) and the other illegal (tax evasion). In tax evasion, you hide or lie about your income and assets altogether.

Incorrectly classify revenue as capital; The most serious tax fraud offence under the taxation administration act (vic) is tax evasion. Therefore, tax avoidance means to reduce taxes by legal means, whereas tax.

Contact us to learn more. The main offences for prosecuting tax evasion are contained in sections 134.1(1), 134.2(1), 135.2(1), and 135.4(3) and (4) of the act. However, the ato closely examines schemes and arrangements that might comply with the technical requirements of tax law but have a dominant purpose of avoiding tax.

Illegally release super funds early Illicit trade is defined in by making tobacco products more and categorizes these motives based article 1 of the. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion

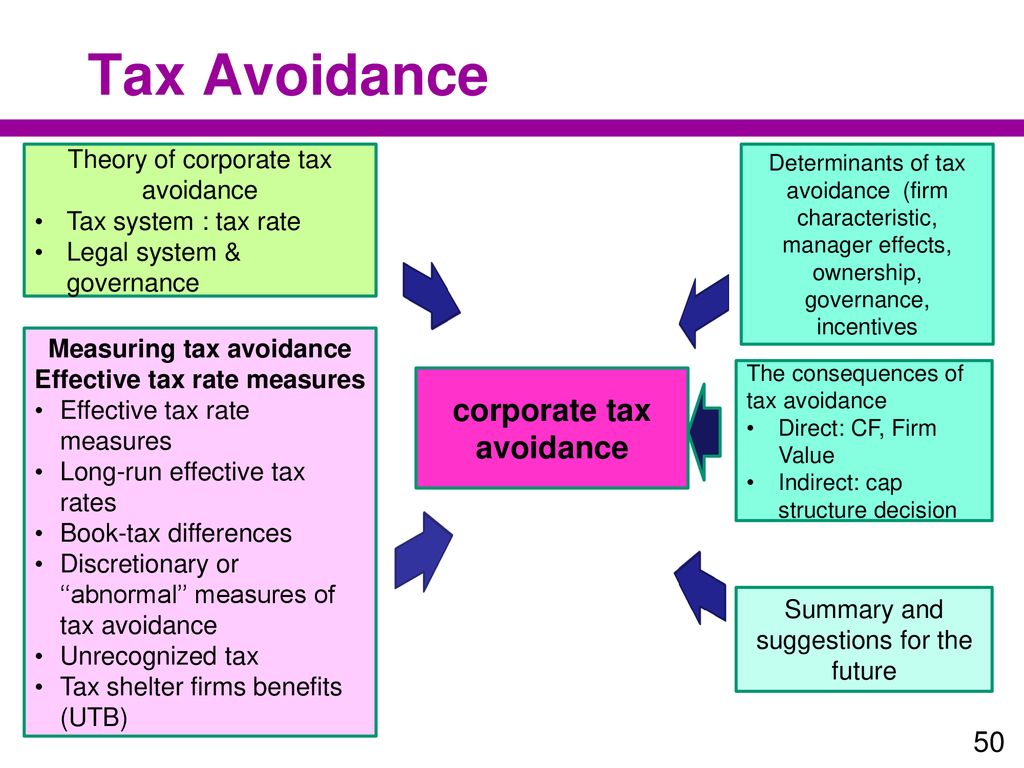

In australia, a finding of tax fraud or tax evasion by the australian taxation office (ato) can have significant consequences for a taxpayer. However, for some time the australian government has ignored the difference between the two concepts when it comes to australians using tax havens and being investigated as part of 'project wickenby'.1the australian government is deliberately labelling all attempts to minimise. The framework accommodates constructs frequently studied in empirical tax accounting research, i.e.

There is a fine line between tax avoidance and tax evasion. If the ato has made a finding of tax fraud or tax evasion in your case, you should contact king lawyers immediately and get legal advice on your legal rights and obligations. Ad protect your organization from tax avoidance and tax evasion.

A tax avoidance scheme may include complex transactions or distort the way funds are used in order to avoid tax or other obligations. The major difference between tax avoidance and tax evasion is that the former is legal while the latter is illegal (murray, 2017). “ [t]he last 40 years in australia has seen a blurring of the three categories (between tax planning, tax avoidance and tax evasion), in particular, the distinction between [what constitutes] tax avoidance and tax evasion” (xynas, 2011).

The distinction between them is typically described by lawyers as the difference between tax avoidance and tax evasion. There are many legitimate ways in which tax can be. The difference between tax avoidance and tax evasion boils down to the element of concealing.

Access financial crime compliance information to mitigate risk & prevent tax evasion. Alongside economic globalization, the recent decades have witnessed the rise of transfer. Tax planning is a legitimate practice aimed to minimise tax liabilities through activities that are allowed under the law;

Whereas, tax evasion is unlawful. In tax avoidance, you structure your affairs to pay the least possible amount of tax due. While you get reduced taxes with tax avoidance, tax evasion can result in fines, penalties, imprisonment, or even higher audit risk.

Tax avoidance, tax aggressiveness, tax sheltering, and tax evasion, by relating them to the seminal notion of effective tax planning presented in scholes and wolfson [1992]. Ad protect your organization from tax avoidance and tax evasion.

Most Likely Core Elements Of The Associations On Tax Avoidance Tax Download Table

The Pandora Papers Show The Line Between Tax Avoidance And Tax Evasion Has Become So Blurred We Need To Act Against Both

Ini Beda Tax Planning Tax Avoidance Dan Tax Evasion

2

Pdf Tax Avoidance Tax Evasion And Tax Flight Do Legal Differences Matter

Tax Avoidance Png Images Pngwing

Riset In Taxation - Ppt Download

Explainer The Difference Between Tax Avoidance And Evasion

Legislating Against Tax Avoidance Ibfd

Penelitian Pajak Agenda Jenis Penelitian Pajak Teori Contoh

Requalification Of Tax Avoidance Into Tax Evasion

Corporate Tax Avoidance A Literature Review And Research Agenda - Wang - 2020 - Journal Of Economic Surveys - Wiley Online Library

Apa Itu Tax Avoidance Dan Karakteristiknya - Ayo Pajak

Tax Avoidance Png Images Pngwing

Tax Evasion And Tax Avoidance Explainedpdf - Tax Avoidance And Tax Evasion Explained And - Studocu

Ini Beda Tax Planning - Artikel 7 Pdf

Investopedia Video Tax Avoidance Vs Tax Evasion Investing Millionaire Mindset Wealth Building

Explainer Whats The Difference Between Tax Avoidance And Evasion

Penelitian Pajak Agenda Jenis Penelitian Pajak Teori Contoh