One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law. This tax change is targeted to fund a $1.8 trillion american families plan.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

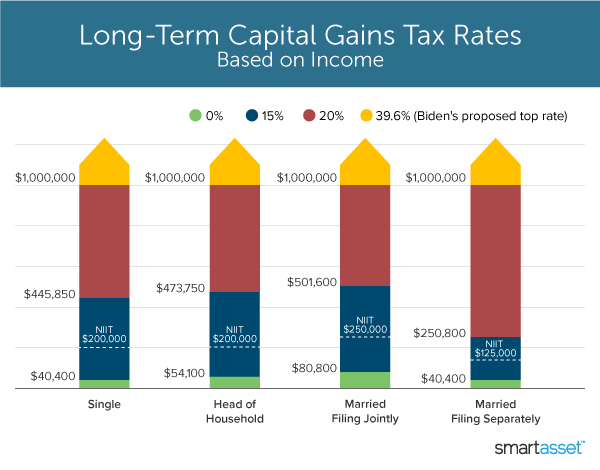

Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more.

Capital gains tax changes 2021. At this point, many ideas are being considered as legislators look for ways to raise revenue to help pay for the build back better plan. Investors anticipated tax changes when joe biden became president of the united states. The current capital gain tax rate for wealthy investors is 20%.

This guide is not available in print or as a downloadable pdf. Additionally, a section 1250 gain, the portion of a gain on a sale that was previously depreciated, is. The house ways and means committee released their tax proposal on september 13, 2021.

Capital gains tax changes that self assessment customers need to know. Still another would make the change to capital gains tax retroactive, with a start date of april 2021. Over the last year, there has been considerable speculation (like most other things these days) about the federal government increasing the inclusion rate of capital gains tax in canada.

13 will be taxed at top rate of 20%; Another would raise the capital gains tax rate to 39.6% for taxpayers. See more tax changes and key amounts for the 2021 tax year;

Gains realized after that date would be taxed at a. What changed with capital gains tax? The tax proposal nearly doubles this tax to 43.4% on gains for taxpayers with over $1 million in annual income.

There are links to worksheets in this guide to help you do this. Hmrc customers have until 31 january 2021 to declare any profit made from selling a uk residential property, which was not. On april 28, 2021, joe biden proposed to nearly double the capital gains tax for wealthy people to around 39.6%.

Once again, no change to cgt rates was announced which actually came as no surprise. Guide to capital gains tax 2021 about this guide. A summary can be found here and the full text here.

Although the concept of capital gains tax is not new to canadians, there have been. Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the. Possible changes coming to tax on capital gains in canada.

Under the current proposal, “gains realized prior to sept. The proposal would increase the maximum stated capital gain rate from 20% to 25%. Potential changes to the capital gains tax rate.

The biggest question asked of private client advisors over the past couple of years is when do we expect capital gains tax (cgt) to increase. The proposals would also end capital gains treatment for income based on a carried interest. Currently, taxpayers pay an income tax rate ranging from zero to 20% when realizing capital gains on assets held for more than 12 months.

What You Need To Know About Capital Gains Tax

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

The Tax Impact Of The Long-term Capital Gains Bump Zone

The Tax Impact Of The Long-term Capital Gains Bump Zone

What You Need To Know About Capital Gains Tax

The Tax Impact Of The Long-term Capital Gains Bump Zone

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Capital Gains Taxes With A Six-figure Income

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Rethinking How We Score Capital Gains Tax Reform Bfi

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

The Tax Impact Of The Long-term Capital Gains Bump Zone

Whats In Bidens Capital Gains Tax Plan - Smartasset