State inheritance tax return (short form) other forms. Capital taxes short form for personal applicants name of the person who has died date when the person died* *use this form only if the person inheritance tax died on or after 6 april 2003 but before 6 april 2004 introduction

Chapter 2 Rules And Facts On Low-carbon Technology Diffusion In Wto Law And Trade Policy Reform For Low-carbon Technology Diffusion

Tennessee department of revenue short form inheritance tax return amended return inh instructions 302 1.

Tennessee inheritance tax return short form. The short form variant may be used if the gross estate is less than the single exemption allowed. Please check this page regularly, as we will post the updated form as soon as it is released by the kentucky department of revenue. With this new amendment, estates where the deceased died on january 1, 2014 or after, no short form inheritance tax return is required as long as the gross value of the estate is $1,000,000.00 or less (and the court provides a waiver in the order).

Make sure the information you add to the tennessee inheritance tax short form extension is updated and accurate. Tennessee short form inheritance return (form inh 302) the personal representative or person in possession of the property of a deceased person in tennessee must file an inheritance tax return within 9 months of the death. Add the date to the form using the date function.

Most estates are eligible to file a short form tn inheritance tax return (inh 302) as long as the gross value of the estate (before any deductions or claims against it) does not exceed the tennessee inheritance tax annual exemption level ($1.25. Inheriteance tax return {inh 302} this is a tennessee form that can be used for probate within local county, williamson, chancery court. In 2015, the allowable exemption is $5,000,000.

Turn on the wizard mode in the top toolbar to obtain extra suggestions. A long form inheritance tax return will take longer. Print tennessee department of revenue short form inheritance tax return inh reset amended return instructions 1.

However, if the estate is undergoing probate, a short form inheritance tax return (inh 302) is required. In that case, the representative will need to file a short form inheritance tax return in order to obtain a closing certificate. This means that we don't yet have the updated form for the current tax year.

Outstanding orders to close will not be signed by the judge unless an inheritance tax closing letter has been properly filed. Form sls 452 tennessee consumer use tax form inh 302 state inheritance tax return (short form) form application for inheritance tax waiver affidavit of complaint (criminal) form 1 request for divorce form instructions for sls 450 state and local sales and use tax return form bus 415 classification 1a county business tax return Also, estates of nonresidents holding property in tennessee must file an inheritance tax return (inh 301).

State inheritance tax return (long form) please note that schedules a through o, listed under other forms must be attached to the completed long form. Print tennessee department of revenue short form inheritance tax return inh 302 reset amended return instructions 1. Until this estate tax is phased out, the minimum tax rate for estates larger than the exemption amount is 5.5% and the maximum remains 9.5%.

Select the orange get form button to begin filling out. General filing requirement the tennessee inheritance tax is a tax upon the privilege of receiving property by transfer because of a decedent s death. In 2013, the allowable exemption is $1,250,000;

Click the sign icon and make a signature. The inheritance tax return is not required if the gross estate of a resident decedent is less than the single exemption allowed by t.c.a. In 2014, the allowable exemption is $2,000,000;

The tennessee inheritance tax exemption is steadily increasing to $2 million in 2014 to $5 million in 2015, and in 2016 there'll be no inheritance tax. Inheritance tax return (short form) (form 92a205) this return may be used for an estate (kentucky resident or nonresident) when : If the value of the gross estate is below the exemption allowed for the year of death, an inheritance tax return is not required.

You can find three available choices; The tennessee inheritance tax is a tax upon the privilege of receiving property by transfer because of a decedent's death. Instructions for state inheritance tax return;

But please do not use this number just to order form iht200. If yes, give name of representative the inheritance tax return is not required if the gross estate of a resident decedent is less than the single exemption allowed by t.c.a. The statute of limitations for assessment is three years from december 31 of the year in which the return is filed.

Subscribe today and save up to 80% on this form. In the case of resident decedent’s dying between 2006 and 2012, the allowable exemption is $1,000,000; If a short form inheritance tax return is filed, it takes approximately four to six weeks to process.

If yes, give name of representative the inheritance tax return is not required if the gross estate of a resident decedent is less than the single exemption allowed by t.c.a.

2

2

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2

2

Suggested State Legislation 1995 Volume 54 By The Council Of State Governments - Issuu

2

2

2

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pdf High Performing Institutions And Economic Development A Case Study Of Uganda

Delaware Taxes De State Income Tax Calculator Community Tax

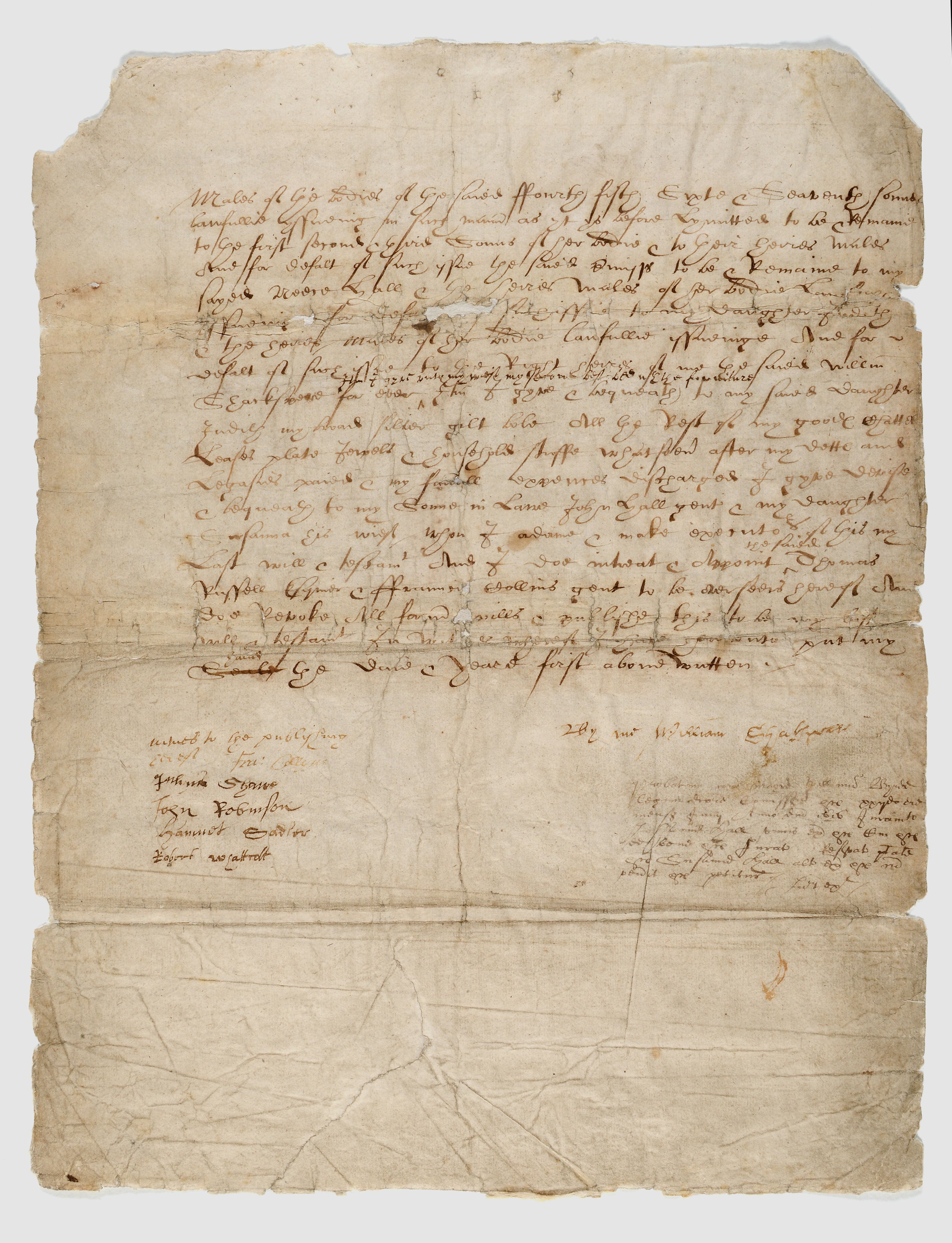

Holographic Will - Wikipedia

2

2

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Delaware Taxes De State Income Tax Calculator Community Tax

2