Mccann, esq., and philip s. The list below summarizes a few of the main advantages.

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

While private reits certainly aren’t great investment choices for everyone, as we’ll get into in the next section, there are several reasons why they could be attractive to investors:

Private reit tax advantages. One of the most important considerations for choosing to invest capital in commercial real estate is with the goal of minimizing risk while optimizing investment returns. What tax or other advantages make reits unique investments? The income generated by reits is not taxed on the corporate level, and is instead taxed only on the individual shareholder level.

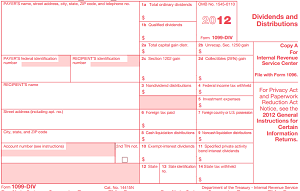

Instead, the income is “passed through” the reit and taxed at the investor level. Thanks to the tax bill that signed into law in 2017, reits now boast a new and lucrative tax benefit: The reit shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

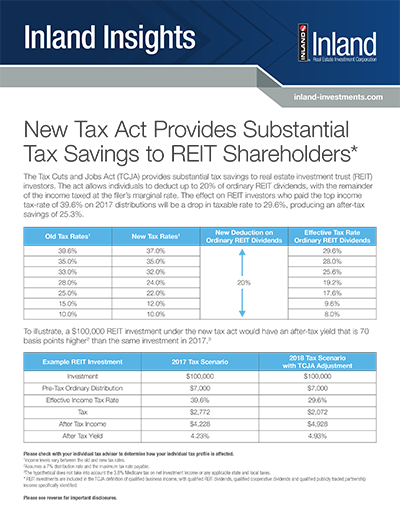

Reit investors can deduct up to 20% of ordinary dividends before income tax is assessed. Dividends are distributed by real estate investment trusts, as. 1 limited partnerships and limited liability companies are generally the preferred vehicles for private investment in real estate, due to their flexibility, low cost and tax efficiency.

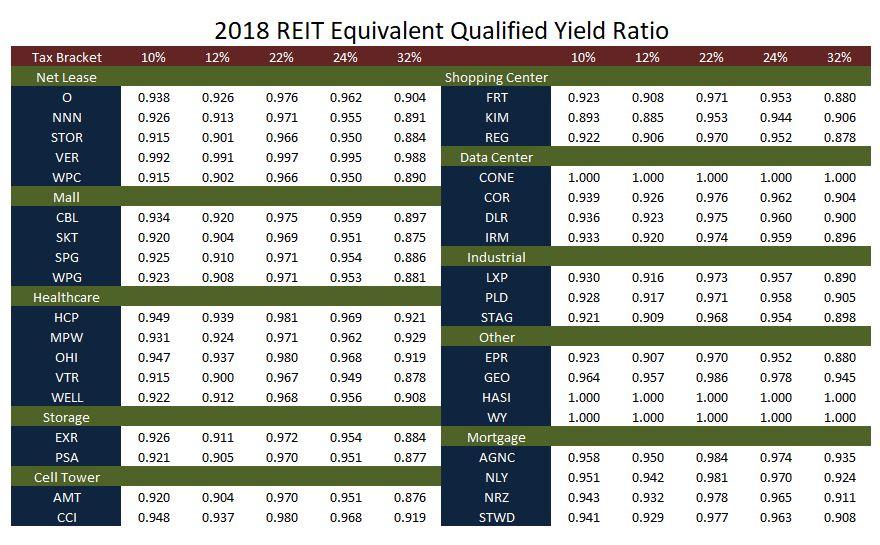

In addition, reit investors benefit from a 20% rate reduction to individual tax rates on the ordinary income portion of distributions.3 individual income tax rates (top 3 tax brackets) federal tax rate 32% 35% 37% reit rate reduction 20% 20% 20% effective federal tax It receives the same tax treatment as those publicly traded, but that is. Both a reit and a dst offer some type of tax benefits, but they are very different.

Under irs rules, a reit is not taxed at the entity level as long as they follow a certain set of rules, including paying out 90% of their taxable income as dividends. Private equity vs reits investments. State income tax considerations for reit investors.

Potential tax benefits of private reits for hedge funds and private equity funds by james d. One significant advantage of investing in a private reit is its correlation has been historically low to the markets—the price of private reit units is solely based on the actual appraised value of the real estate holdings, which generally translates to a lack of fluctuation in response to public market volatility. In this article, we'll take a look at the key tax advantages of real estate investment trust investing and why these reit tax benefits can be so important.

Distributions are tax deferred until redemption, at which time they give rise to capital gain. Most reits trade on major stock exchanges and offer a number of benefits to investors. Reits function like a blocker corporation in a real estate investment fund, so setting up the reit as the investment entity reduces the number of entities needed in the structure.

Reits distribute dividend payments to the investors that constitute capital gains, ordinary income, or returns on capital. In its simplest tax form, a reit functions like a hybrid of the two and provides the best of both worlds. Therefore, state income tax benefits also impact the standard of living in a state positively.

Entities qualifying for reit status under the tax code receive preferential tax treatment: Two of the most popular investment choices are through a private equity real estate (pe) firm or a real estate investment trust (reit). Ordinary dividends from a reit are not subject to foreign withholding.

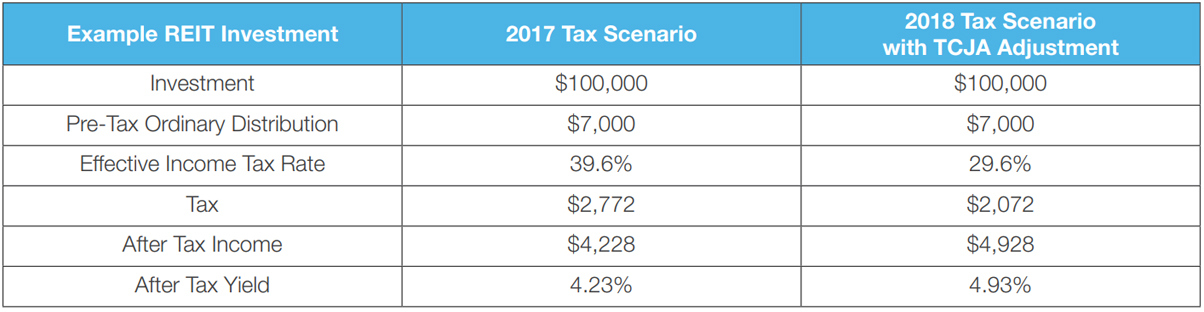

But they also come with a higher risk profile than their publicly traded counterparts. This inevitably leads to a better potential for higher returns — private reits are able to consistently pay out greater dividends than public reits. If you’re in the top bracket, the tax bill on your dividends could go from 37% to 29.6%.

There are several legal, tax and structural advantages for canadians investing into a private u.s mortgage real estate investment trust. As a result of the tax reform bill signed into law in 2017, reits now have a new and lucrative tax deduction:

A Short Lesson On Reit Taxation - Intelligent Income By Simply Safe Dividends

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

A Short Lesson On Reit Taxation - Intelligent Income By Simply Safe Dividends

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Understanding The Reit Taxation Rules Novel Investor

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

How Tax Efficient Are Your Reits Seeking Alpha

Top Reit Investments Finance Investing Finance Investing

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit

India - Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Why Asset Location Matters - Fidelity Personal Financial Planning Investing Real Estate Investment Trust

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Sec 199a And Subchapter M Rics Vs Reits

Real Estate Investment Trusts Reits 1 What Is

Guide To Reits Reit Tax Advantages More - Wall Street Prep

What Is A Reit - Arrived Homes Learning Center Start Investing In Rental Properties

Guide To Reits Reit Tax Advantages More - Wall Street Prep

Reits Vs Property Which Is A Better Way To Invest