Viewing all rates location rate county; Ad with secure payments and simple shipping you can convert more users & earn more!.

Hayward California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The gross receipts tax is much like a value added tax, only for businesses rather than individuals.

Hayward ca sales tax rate 2019. For tax rates in other cities, see california sales taxes by city and county. Four states impose gross receipt taxes, nevada, ohio, texas, and washington. The hayward, california sales tax rate of 10.75% applies to the following seven zip codes:

The tax amount paid for 441 banbury street, hayward is $9,167. The us average is 6.0%. With local taxes, the total sales tax rate is between 7.250% and 10.750%.

Ad with secure payments and simple shipping you can convert more users & earn more!. That's because on wednesday, sales tax goes up to ten percent. You can print a 9.75% sales tax table here.

Stop by hayward showcase today and browse our more affordably priced and perfect quality used cars, trucks and suv's in hayward, ca. Build the online store that you've always dreamed of. Combined with the state sales tax, the highest sales tax rate in california is 10.75% in the cities of hayward, san leandro, alameda, union city and newark (and one other cities).

The median property value in hayward, ca was $581,200 in 2019, which is 2.42 times larger than the national average of $240,500. From the peaks of the eastern hills to the city's pristine shoreline, 150,000 people call hayward home and nearly 65,000 pursue their education in the heart of. 94540, 94541, 94542, 94543, 94544, 94545 and 94557.

County 7.25% city of oroville 8.25%. This is the total of state, county and city sales tax rates. City of angels camp 7.75%.

The assessed market value for the current tax year is $763,208. The minimum combined 2021 sales tax rate for alameda, california is. The alameda sales tax rate is %.

The hayward, california, general sales tax rate is 6%. Between 2018 and 2019 the median property value increased from $519,600 to $581,200, a 11.9% increase. The homeownership rate in hayward, ca is 52.8%, which is lower than the national average of 64.1%.

The county sales tax rate is %. City of san leandro 10.75%. 101 rows the 94545, hayward, california, general sales tax rate is 9.75%.

What is the assessed value of 441 banbury street, hayward? City of union city 10.75%. The sales tax rate is always 9.75% the sales tax rate is always 9.75% every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the california cities rate (0.5%), and in.

The 9.75% sales tax rate in hayward consists of 6.00% california state sales tax, 0.25% alameda county sales tax, 0.50% hayward tax and 3.00% special tax. Total tax rate property tax; California has recent rate changes(thu jul 01 2021).

What is the sales tax rate in alameda, california? Future job growth over the next ten years is predicted to be 36.1%, which is higher than the us average of 33.5%. Build the online store that you've always dreamed of.

Hayward has an unemployment rate of 7.9%. California (ca) sales tax rates by city (a) the state sales tax rate in californiais 7.250%. City of capitola is 9.00%.

Boost your business with wix! The california sales tax rate is currently %. Boost your business with wix!

There are approximately 134,360 people living in the hayward area. Hayward has seen the job market increase by 1.4% over the last year.

State And Local Sales Tax Rates In 2017 Tax Foundation

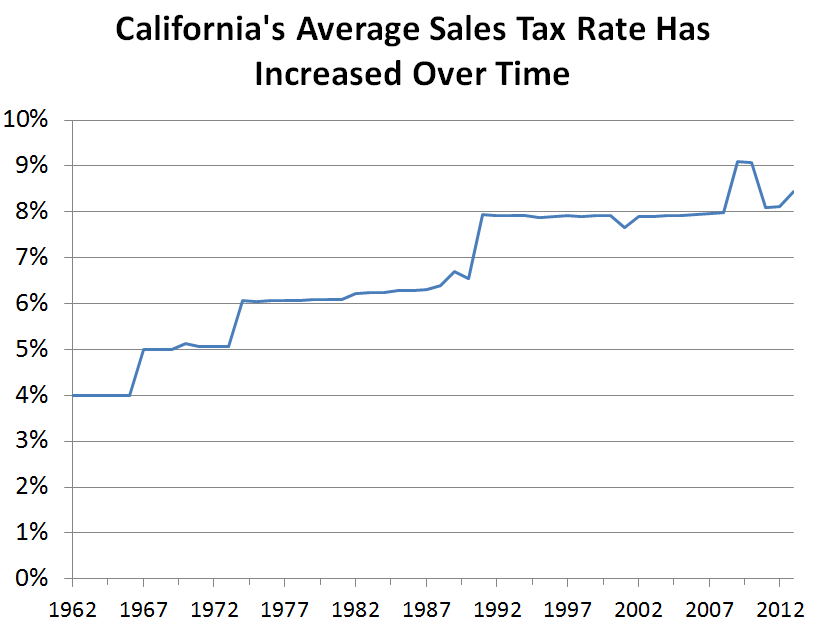

Understanding Californias Sales Tax

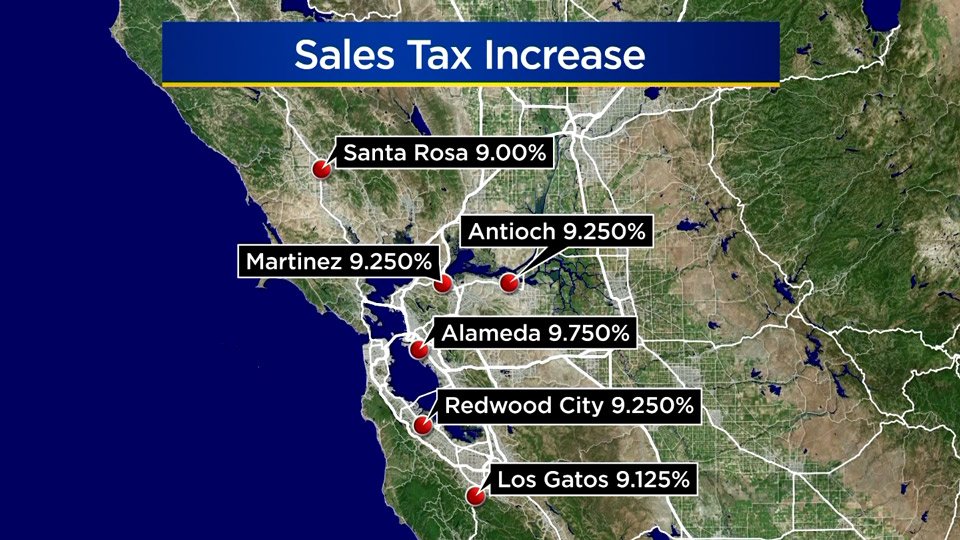

Sales Gas Taxes Increasing In The Bay Area And California

California Sales Tax Rates By City County 2021

New Sales And Use Tax Rates In Hayward East Bay Effective April 1 Castro Valley Ca Patch

New Sales And Use Tax Rates Take Effect In Some East Bay Cities This Week San Ramon Ca Patch

Sales Taxes In The United States - Wikiwand

Los Angeles Countys Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizens Voice

Hayward California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fillable Online Boe Ca California City And County Sales And Use Tax Rates Tax Rates Effective 1-1-13 To 3-31-13 - Boe Ca Fax Email Print - Pdffiller

Drdteccom

Albanycaorg

California City And County Sales And Use Tax Rates - Cities Counties And Tax Rates - California Department Of Tax And Fee Administration

Hayward California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How To Calculate California Sales Tax 11 Steps With Pictures

Californias Sales Tax Rate Has Grown Over Time Econtax Blog

Vietnam Special Sales Tax Rates 2020 Statista

Sales Tax Rates Rise Monday Out-of-state Online Sellers Included Cbs San Francisco

Acgovorg