If you can answer yes to any of the following questions, your vehicle is considered by state law to have a business use and does not qualify for personal property tax relief. Ad a tax advisor will answer you now!

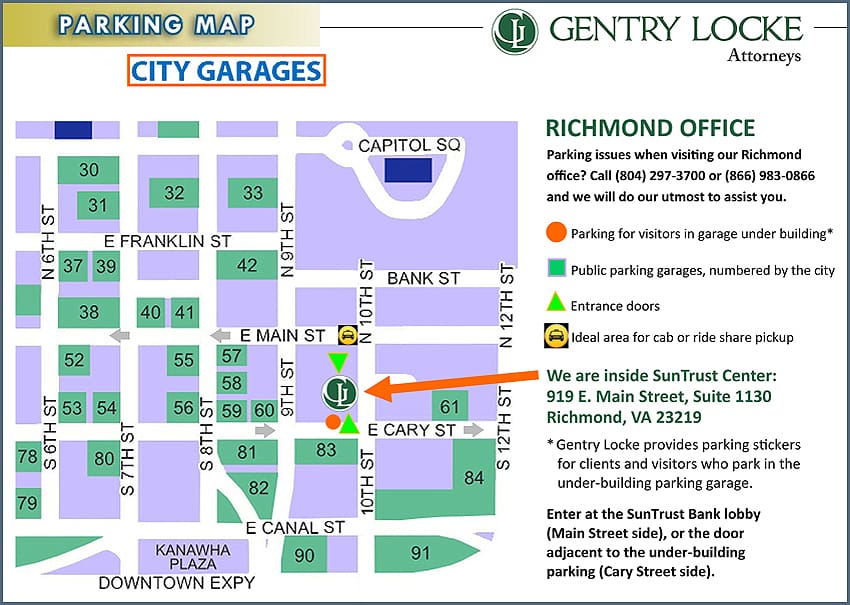

Visiting Our Richmond Office - Gentry Locke Attorneys

The personal property tax is calculated by multiplying the assessed value by the tax rate.

Personal property tax car richmond va. Team papergov • 11 months ago. $25.00 for a vehicle over 4,000 pounds and over; Personal property taxes are billed annually with a due date of december 5 th.

The median property tax in virginia is $1,862.00 per year for a home worth the median value of $252,600.00. Annual tax amount = $354.35. Virginia is ranked number twenty one out of the fifty states, in order of the average amount of property taxes collected.

Questions answered every 9 seconds. The governing body of any county, city or town may provide by ordinance for the levy and collection of personal property tax on motor vehicles, trailers, semitrailers, and boats which have acquired a situs within such locality after the tax day for the balance of the tax year. There is a $1.50 transaction fee for each payment made online.

It is an ad valorem tax, meaning the tax amount is set according to the value of the property. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. Please input the value of the vehicle, the number of months that you owned it during the tax year and click the calculate button to compute the tax.

I was sent a bill for personal taxes in richmond and chesterfield i moved to chesterfield in 2018. Questions answered every 9 seconds. $0.001 per $100.00 of assessed value;

Ad a tax advisor will answer you now! The personal property rates are: Personal property tax relief (pptr) calculator.

Use this calculator to compute your 2021 personal property tax bill for a qualified vehicle. Tax relief programs are available in city of richmond, which may lower the property's tax bill. If a vehicle is subject to the taxes in alexandria for a full calendar year , the tax amount is determined by multiplying the tax rate by the assessed value.

The county receives 1.0% of the 6.0% collected on each purchase.the state of virginia disburses these receipts. January les must be presented each year to verify tax relief. Is more than 50% of the vehicle's annual mileage used as a business.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. If you purchased a vehicle (car, truck, motorcycle, motor home, or low speed vehicle) anytime during the tax year you will receive a prorated bill within 60 days, from the purchase date to the end of the tax year. Counties in virginia collect an average of 0.74% of a property's assesed fair market value as property tax per year.

Virginia tax code requires that all properties currently must be assessed for taxation at 100% of market value. All cities and counties in virginia administer a tax on personal property, such as automobiles, as an important and stable revenue source for municipal services ranging from police and fire protection to street maintenance and solid waste collection.the personal property tax is assessed on all vehicles (cars, buses, mobile homes, trailers, motor homes,. Interest is assessed as of january 1 st at a rate of 10% per year.

When a person initially acquires an automobile or truck and/or moves that vehicle into henrico county, that person must file a personal property return. $20.00 for a vehicle under 4,000 pounds; Active duty military and spouses with states of record other than virginia are eligible for personal property tax relief.

Personal property taxes are billed once a year with a december 5 th due date. The 10% late payment penalty is applied december 6 th. Also, for credit card payments there is a 2.5% convenience fee in addition to the total tax and transaction fees charged.

The personal property tax rate is determined annually by the city council and recorded in. Proration of personal property tax. Reduce the tax by the relief amount:

Tax relief view the vehicle qualification for personal property tax relief notice for details about tax relief. 49% (for 2020) x $694.80 = $340.45. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

In city of richmond the reassessment process takes place every two years. The current rate is $3.50 per $100 of assessed value. Contact the chesterfield county commissioner of the revenue to register your vehicle for personal property tax purposes.

This does not include the registration fee currently set at $40.00 per vehicle.

704 N 33rd St Richmond Va 23223 - Realtorcom

148 Honey Locust Richmond Va 23238 - Realtorcom

1015 W Franklin St Richmond Va 23220 Realtorcom

Formerly Redlined Areas Of Richmond Are Going Green - Chesapeake Bay Foundation

Try The 4-both Method To De-clutter Your Living Room Place 4 Boxes On The Ground Let One Box Be Your Trash Investment Firms Investing Real Estate Investing

Mehangai Ki Maar Essay In 2021 Essay Writing Tips Conference Planning Essay

101 N 29th St Richmond Va 23223 Realtorcom

1839 Monument Ave Richmond Va 23220 - Realtorcom

List Of Auto Insurance Companies General Auto Insurance

Home Down Payments In 2021 Home Buying Homeowners Insurance First Time Home Buyers

5511 Cary Street Rd Richmond Va 23226 Mls 2129552 Zillow

Drury Plaza Hotel Richmond Richmond Va 2021 Updated Prices Deals

1711 Grove Ave Richmond Va 23220 - Realtorcom

Sppup1jikcqccm

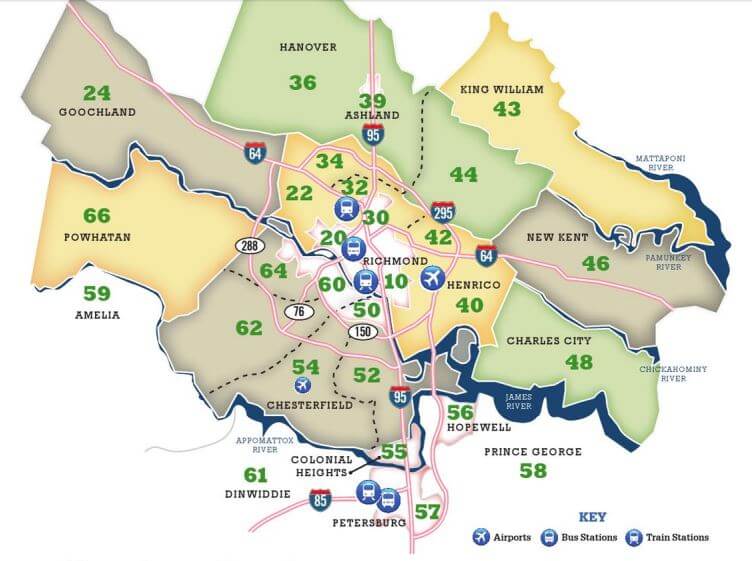

Guide-to-richmond-area-mls-real-estate-zones Mr Williamsburg

1203 Wallace St Richmond Va 23220 - Realtorcom

Public Housing In Richmond Virginia Richmond Cycling Corps

Kmu6ol-grwaxhm

Pin On Vintage Tobacco Tins