Local tax rates in colorado range from 0% to 8.3%, making the sales tax range in colorado 2.9% to 11.2%. The colorado (co) state sales tax rate is currently 2.9%.

Colorado Sales Tax Calculator Reverse Sales Dremployee

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

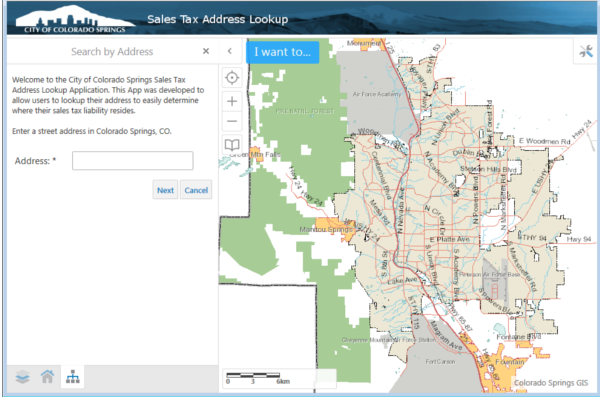

Colorado springs sales tax calculator. This system will greatly improve our business’s experience by allowing businesses to file and pay taxes at any time via an internet connected device, view their account history on demand, and delegate access to tax. Depending on the zipcode, the sales tax rate of colorado springs may vary from 2.9% to 7.63%. The current total local sales tax rate in colorado springs, co is 8.200%.

Please call the office to determine the cash deposit amount before mailing. Welcome to the city of colorado springs sales tax filing and payment portal powered by. Depending on the zipcode, the sales tax rate of colorado springs may vary from 2.9% to 8.25% every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (1.23%), the colorado springs tax rate (0% to 3.12%), and in some case, special rate.

Instructions for city of colorado springs sales and/or use tax return; Colorado has a 2.9% statewide sales tax rate , but also has 223 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.374% on top. This is the total of state, county and city sales tax rates.

For tax rates in other cities, see colorado sales taxes by city and county. I plan on having a garage sale. This is because many cities and counties have their own sales taxes in addition to the state.

The colorado springs, colorado, general sales tax rate is 2.9%. Colorado sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. A tax of 10 mills on a property with an assessed value of $10,000 is equal to $100 ($10,000 x 0.1).

The colorado sales tax rate is currently %. The colorado springs sales tax rate is %. All *pprta is due if the address is located in el paso county, cities of colorado springs, manitou springs, ramah, and green mountain falls.

On november 3, 2015, colorado springs voters approved a sales and use tax rate increase of 0.62% to fund road repair, maintenance and improvements. The colorado sales tax rate is 2.9%, the sales tax rates in cities may differ from 3.25% to 10.4%. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate.

The county sales tax rate is 1.23%. *pprta tax is not due if the address is located within the town limits of. However, as anyone who has spent time in denver, boulder or colorado springs can tell you, actual sales tax rates are much higher in most cities.

The 8.2% sales tax rate in colorado springs consists of 2.9% colorado state sales tax, 1.23% el paso county sales tax, 3.07% colorado springs tax and 1% special tax. You can print a 8.2% sales tax table here. 101 rows how 2021 sales taxes are calculated for zip code 80909.

January 1, 2016 through december 31, 2020, will be subject to the previous tax rate of 3.12%. 101 rows how 2021 sales taxes are calculated for zip code 80911. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

On july 12, 2021, the city of colorado springs sales tax office will be transitioning to a new online licensing and tax filing system, powered by munirevs. City sales tax collected within this date range will report at 3.12%. The december 2020 total local sales tax rate was 8.250%.

The statewide sales tax in colorado is just 2.9%, lowest among states with a sales tax. Companies doing business in colorado need to register with the colorado department of revenue. The 0.62% road repair, maintenance, and improvements tax will expire five years from the date of implementation and will apply to all transactions that are currently taxable under the city sale sand use tax code.

The minimum combined 2021 sales tax rate for colorado springs, colorado is. The colorado springs, colorado, general sales tax rate is 2.9%. Method to calculate colorado springs sales tax in 2021.

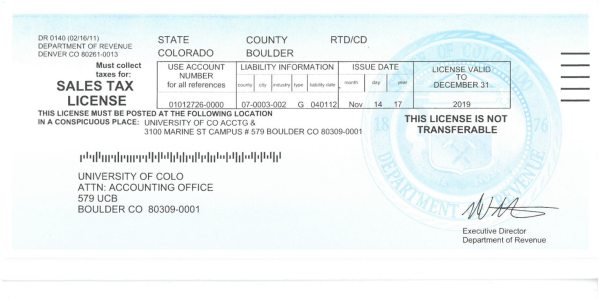

3.07% sales and use tax return; Colorado has 560 cities, counties, and special districts that collect a local sales tax in addition to the colorado state sales tax.click any locality for a full breakdown of local property taxes, or visit our colorado sales tax calculator to lookup local rates by zip code. The license fee is $20.00.

What is the sales tax rate in colorado springs, colorado? The colorado springs sales tax rate is 3.07% effective january 1, 2021, the city of colorado springs sales and use tax rate has decreased from 3.12% to 3.07% for all transactions occurring on or after that date. 101 rows how 2021 sales taxes are calculated for zip code 80951.

If you need access to a database of all colorado local sales tax rates, visit the sales tax data page. So if you pay $1,500 in taxes annually and your home’s market value is $100,000, your effective tax rate is 1.5%. The base state sales tax rate in colorado is 2.9%.

Every 2015 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (0% to 1.23%), the colorado springs tax rate (0% to 2.5%), and in some case. Find your colorado combined state and local tax rate. Overview of colorado taxes colorado is home to rocky mountain national park, upscale ski resorts and a flat income tax rate of 4.63%.

An effective tax rate is the amount you actually pay annually divided by the value of your property. 3.07% sales and use tax return in spanish; The county sales tax rate is %.

Depending on local municipalities, the total tax rate can be as high as 11.2%. The average sales tax rate in colorado is 6.078%.

/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

Sales Tax Faq Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Address Lookup Application Colorado Springs

How Colorado Taxes Work - Auto Dealers - Dealrtax

Sales Tax Calculator

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Colorado Sales Tax Calculator

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Colorado Income Tax Calculator - Smartasset

How Colorado Taxes Work - Auto Dealers - Dealrtax

Sales Tax Campus Controllers Office University Of Colorado Boulder

Colorado Sales Tax Calculator And Local Rates 2021 - Wise

Sales Tax Calculator - An Online Calculate To Calculate Sales Tax

Sales Taxes In The United States - Wikipedia

Sales Tax Information Colorado Springs

Wyoming Sales Tax - Small Business Guide Truic

Sales Tax Information Colorado Springs

Colorado Sales Tax Calculator And Local Rates 2021 - Wise